THOUSAND OAKS, CALIF. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged the sale of a two-property, 399-unit portfolio in Thousand Oaks. FPA Multifamily purchased the assets from Decron Properties for $171.3 million. IPA’s Kevin Green, Joseph Grabiec and Gregory Harris represented the seller and procured the buyer. The properties included in the portfolio are Los Robles Apartments and The Retreat at Thousand Oaks. Los Robles Apartments is a 32-building property that offers studio, one- and two-bedroom apartments. Units average 882 square feet in size. Amenities …

Channing Hamilton

WARNER ROBINS, GA. — Berkadia has arranged a $36.8 million loan for Pointe Grand Warner Robins, a 288-unit property in Warner Robins. Located at 1601 Leverette Road, Pointe Grand Warner Robins consists of ten residential buildings and a clubhouse. Each residential building rises three stories. Units come in two-bedroom layouts and are 1,170 square feet in size. Amenities include a pool, fitness center and business center. Berkadia’s Proprietary Lending Group provided the loan, which features a two-year, competitive floating-rate with extensions and full-term interest only. Michael Weinberg and Wesley Moczul …

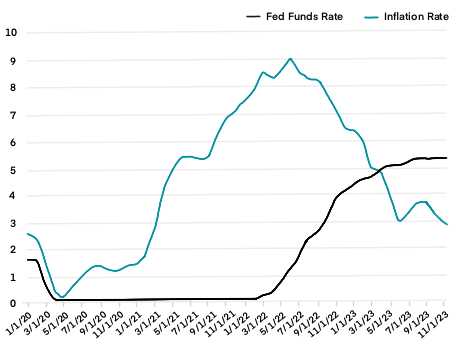

ATLANTA — Depending on the era in which you came of age and the general experiences you’ve had in life, the notion that “things can always get worse” can be easy to endorse. As it pertains to commercial lending and borrowing, the consensus narratives that have prevailed ever since the Federal Reserve began jacking up interest rates in early 2022 has largely followed the same script: “Hunker down.” “Survive till ’25.” “Delay and defer.” In other words, do whatever you have to do to avoid the sting of the 11 …

NEW YORK CITY — Dwight Mortgage Trust, the affiliate REIT of Dwight Capital, has provided $100 million in bridge financing for a property located at 224 W. 124th St. in New York City’s West Harlem neighborhood. The borrower and developer, Carthage Real Estate Advisors, will use the proceeds to refinance existing construction debt and fund lease-up of the property and other capital expenditures. The 19-story building was completed earlier this year and comprises 168 units. The community offers one-, two- and three-bedroom apartments, as well as townhomes and penthouse suites. …

CHICAGO — An analysis from Origin Investments (Origin) predicts a tumultuous 2024, with concerns of a recession and elevated interest rates likely to continue. Despite this, the Chicago-based real estate fund manager expects next year to bring unique opportunities for multifamily investors to secure protected positions in the capital structure and enhance investment returns. “The volume of variable-rate bank loans — made when the Secured Overnight Financing Rate was 0 percent and the 10-year Treasury note yield was below two percent — coming due in 2024 will create a generational …

NEW YORK CITY — Marcus & Millichap has arranged the $48 million sale of Fannwood Estates, a 312-unit community in the New York City borough of Queens. Shaun Riney, Seth Glasser, Joe Koicim, Louis Zarif and Sean Fopeano of Marcus & Millichap represented the seller and procured the buyer in the transaction. Both parties were private investors that requested anonymity. Fannwood Estates rises six stories within the borough’s Rego Park neighborhood. The rent-stabilized building occupies a full city block.

SANTA ANA, CALIF. — Caribou Industries has pulled $5.6 million in building permits and executed a disposition and development agreement with the City of Santa Ana to build 3rd & Broadway Promenade, a mixed-use development in downtown Santa Ana. Caribou Industries plans to begin construction in the second quarter of 2024. Gensler is serving as architect. Plans for 3rd & Broadway Promenade call for a 16-story high-rise community, which will offer studio, one- and two-bedroom units and 198 secured homeowner garages. The project will also include a 10-story hotel, an event …

MOUNT VERNON, N.Y. — JLL Capital Markets has arranged a 93 million loan to refinance 42 West Broad Street, a high-rise community in Mount Vernon. The borrower was a joint venture between Alexander Development Group, The Bluestone Organization and institutional investors advised by JP Morgan Asset Management. Kellogg Gaines and Geoff Goldstein led the JLL Debt Advisory team. Canadian institutional lender Otera Capital provided the loan. Situated in Mount Vernon’s Fleetwood neighborhood, 42 West Broad Street comprises 249 units across 16 stories. Units come in studio, one-, two- and three-bedroom …

WEST WINDSOR, N.J. — JLL Capital Markets has arranged permanent financing for Woodmont Way at West Windsor, a garden-style community in West Windsor, 12 miles northeast of Trenton, New Jersey. The borrower, Woodmont Properties, will use the funds to refinance the property. Thomas Didio, Thomas Didio Jr., Salvatore Buzzerio and Benjamin Morgenthal led the JLL Capital Markets Debt Advisory team, which represented Woodmont Properties in the transaction. Woodmont Way at West Windsor was built in 2022. The property comprises 443 units across 13 buildings. Units come in one-, two- and three-bedroom …

ATLANTA — Cushman & Wakefield has arranged the sale of Alexan Summerhill, a recently built 315-unit community in Atlanta’s Summerhill neighborhood. Weinstein Properties purchased the asset from the developers, Trammell Crow Residential and PGIM Real Estate, for an undisclosed price. Robert Stickel, Alex Brown, Ashlyn Warren, Michael Kay and Sim Patrick of Cushman & Wakefield represented the sellers in the transaction. Alexan Summerhill was built in 2022 as part of an ongoing 72-acre transformational mixed-use redevelopment plan. The community will feature direct access to the adaptive reuse retail spaces on …