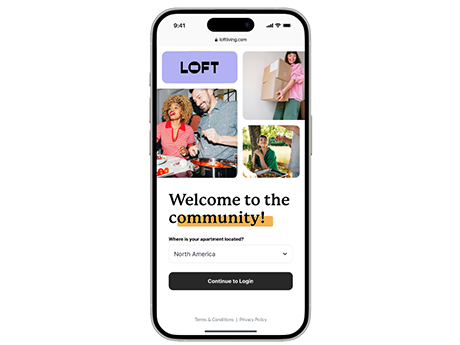

RealPage has a new app for residents called LOFT that’s designed to take the sting out of several operational pain points. The app comes on the heels of a survey of residents and property managers. The Richardson, Texas-based commercial real estate tech and data company queried more than 75 owners and operators to uncover which service objectives property managers were struggling to meet.

The survey show that an overwhelming 97 percent of residents indicated they would be more likely to renew their lease if working with their property manager were as easy as interacting with Amazon. A majority, 97 percent, also said they’d be more likely to choose a rental community that offered a service to simplify moving, such as help with setting up internet and utilities, finding a local mover and setting up payments. And 93 percent of renters surveyed said they were interested in breaking rent payments intotwo rather than paying in full at the beginning of each month.

On the property management side, the research helped establish the purpose of the app. It was developed to solve three key challenges: acquiring and retaining residents; driving operational efficiency via renter fraud reduction and cost savings; and developing new revenue streams.

LOFT is intended to be a one-stop shop. Once downloaded, renters can fill out an application, sign a lease, register pets, buy renters insurance, hire a mover, order internet and utilities, pay their rent and earn points and rewards through a loyalty program. Features include fraud-detection technology and an AI assistant to handle leasing chats.

Since August, more than 30 companies — representing over 200,000 units —participated in the app’s beta test. The pilot group consists of current users of OneSite, RealPage’s property management software. As of December, the app was in use at properties comprising a total of 1 million units.

App Rewards Behaviors, Builds Credit

The payment function of the app allows residents to pay their rent traditionally, directly from their bank in one lump sum. LOFT also features a partnership with Flex, a company that acts similarly to a credit card and enables renters to split up monthly rent into two payments. Flex can also function like a credit card, where Flex pays the landlord directly, and the resident makes payments back to Flex. Flex does not charge interest, but it does require residents to pay a $14.99 monthly fee.

LOFT’s loyalty program allows users who pay rent on time to earn points, which can be redeemed for items, funded by RealPage, that include Amazon gift cards. Property managers also can create their own incentives and offer points for actions that include, a review or referring a friend to the property. Points could also be applied to rent discounts.

Although figures and data are not yet available, RealPage says property managers also can use LOFT to create ancillary income. For example, if enough residents set up internet services with a provider listed in the app, RealPage can share revenue with the property owner.

Streamlining Helps Renters, Managers Alike

Companies using LOFT in the pilot program revealed a few outcomes at RealPage’s annual RealWorld conference this year. Kellie Bossert, vice president of asset management with Pegasus Residential, reported that the company has received about 50 percent more renters insurance policies prior to move-in than the company received before launching LOFT.

Renters insurance is not required by law, but most landlords won’t lease to a tenant without it. In 2022, SafeHome.org, a safety research firm, reported that 75 percent of residents who have renters insurance were required to obtain the policy by their property owner.

Costs for LOFT are not publicly available. The app is free for renters. Property managers pay a software-as-a-service fee.

According to Rob Franklin, senior vice president of resident solutions for RealPage, LOFT is a first of its kind in the industry. Unlike the current process of working with a power company to set up electricity followed by an internet provider to set up Wi-Fi, LOFT offers an all-in-one solution for residents.

“Residents begin their search online to find a community that matches where they want to live and how much they want to pay,” says Franklin says. “Then, they apply, go through identity verification, sign a lease and move in. It is a very disjointed experience for the resident. There isn’t one single beginning-to-end technology to help guide them.”

Historically, this disjointed process has exacerbated problems for property staff, says Franklin. Front-office teams field tenant questions all day, such as “How do I register my pet or my car?” or “How do I get my renters insurance over to you?”

“These questions are overwhelming to property managers, who are seeing rising costs to run their buildings and facing challenges to hire and retain staff,” says Franklin. “Additionally, there is a lot of app fatigue. Property managers are tired of having to jump to different applications to perform various functions, and residents are tired of doing the same thing on the front end.”

— Lynn Peisner