Multifamily operators face a number of challenging factors in today’s market. The spike in the cost of debt along with higher expenses across the board — from property insurance and taxes to construction and labor — as well as adverse effects left over from eviction moratoriums are eating away at net operating income (NOI) across the country. During the third quarter of 2023, multifamily expenses grew 7.2 percent, more than double the rate of inflation, according to Freddie Mac’s 2024 multifamily forecast. Additionally, rent control efforts in some jurisdictions are …

Features

Along with Dallas and Houston, San Antonio is one of three powerhouse multifamily markets that make up the Texas Triangle. Multifamily & Affordable Housing Business asked Mike Miller, managing director for Berkadia San Antonio, for his take on the metro area’s investment and development trends. MAHB: On the map, how does Berkadia define the San Antonio multifamily market? Miller: Our team defines and services San Antonio proper as well as Boerne and New Braunfels, additionally, we cover the remainder of South Texas. MAHB: Berkadia’s latest report card has deliveries as 7,895 units …

Developers have responded to Miami’s influx of well-heeled renters with a heavy Class A development pipeline and rents that rival some of the nation’s most expensive places to live. The city is also under the gun to create more housing for its low- and middle-income residents. Multifamily & Affordable Housing Business talked with real estate economist Carl Whitaker of RealPage’s data analytics division about rents, development and the Miami market’s unique ability to retain renters. MAHB: Could you share with us the most recent data on average effective rents, occupancies, deliveries and …

Multifamily & Affordable Housing Business sat down with Roberto Pesant, senior managing director of investment sales with Berkadia’s Miami office, to discuss the demand for luxury communities in Miami — from both renters and investors. MAHB: The latest Berkadia report forecasts that average effective rent will be $2,569 by the fourth quarter of this year. Is the market overbuilt toward Class A/luxury properties, and if so, who’s renting these pricey units? Roberto Pesant: Demand for the urban, luxury product is coming from a number of sources. Some part of it comes …

Heightened Demand for Affordable Rental Housing Sets Tone for 2024 Investment Opportunities

Multifamily & Affordable Housing Business sat down with Marge Novak, senior vice president and head of Capital Markets at Berkadia, for a question-and-answer discussion about the current state of the affordable housing market and the challenges likely to influence 2024. Multifamily & Affordable Housing Business: How is the affordable housing market faring in the current economic conditions? Novak: With increased inflation and interest rates, home prices hit all-time highs, making them less affordable than at the height of the 2006 housing bubble. While buyers waited for prices to fall, sellers …

Concerns of oversupply have risen regarding several Texas markets, including Dallas and Austin. Where does San Antonio stand in terms of supply and demand, and where in the city is there still room for new opportunities? Multifamily & Affordable Housing Business (MAHB) recently interviewed David Lynd, CEO of Lynd Cos., about the state of the market. Multifamily & Affordable Housing Business: How many units do you currently own nationwide? How many in San Antonio? Lynd: We own about 3,000 units in San Antonio and 6,000 nationwide. We also do third-party …

ATLANTA — Shortened attention spans and the desire for instant gratification are a couple of the changing consumer behaviors that impact the multifamily operations industry. Karen Key, a president with Houston-based Asset Living, said that 75 percent of consumers expect a response time in less than 24 hours from a business. Twenty percent expect a response time within minutes. “If you’re missing that mark and someone else is responding to them, whether it’s a client, prospect or resident, you’ve lost them. They’re gone.” Key’s remarks came during the operations panel …

— By Mark Peters, president and general manager at Zego — Property managers are always looking for ways to improve resident satisfaction. But that’s not so easy in today’s competitive rental market, where renters reportedly have higher standards of value and service than they once did. Resident satisfaction directly affects a property’s financial performance. A recent study from financial advisory firm Deloitte found that great customer experiences grow revenue. Companies can earn up to 140 percent more from customers who have had positive experiences with their business. These individuals are also likely to remain customers …

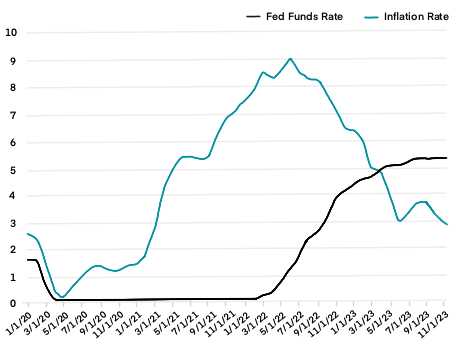

ATLANTA — Depending on the era in which you came of age and the general experiences you’ve had in life, the notion that “things can always get worse” can be easy to endorse. As it pertains to commercial lending and borrowing, the consensus narratives that have prevailed ever since the Federal Reserve began jacking up interest rates in early 2022 has largely followed the same script: “Hunker down.” “Survive till ’25.” “Delay and defer.” In other words, do whatever you have to do to avoid the sting of the 11 …

CHICAGO — An analysis from Origin Investments (Origin) predicts a tumultuous 2024, with concerns of a recession and elevated interest rates likely to continue. Despite this, the Chicago-based real estate fund manager expects next year to bring unique opportunities for multifamily investors to secure protected positions in the capital structure and enhance investment returns. “The volume of variable-rate bank loans — made when the Secured Overnight Financing Rate was 0 percent and the 10-year Treasury note yield was below two percent — coming due in 2024 will create a generational …