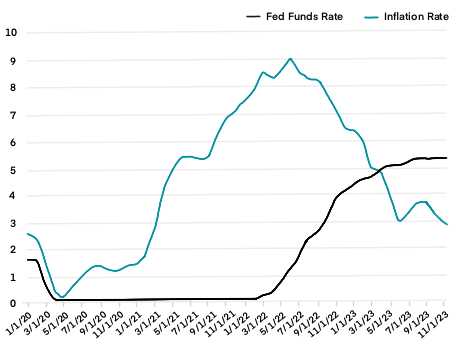

CHICAGO — An analysis from Origin Investments (Origin) predicts a tumultuous 2024, with concerns of a recession and elevated interest rates likely to continue. Despite this, the Chicago-based real estate fund manager expects next year to bring unique opportunities for multifamily investors to secure protected positions in the capital structure and enhance investment returns. “The volume of variable-rate bank loans — made when the Secured Overnight Financing Rate was 0 percent and the 10-year Treasury note yield was below two percent — coming due in 2024 will create a generational …

Features

WASHINGTON, D.C. — Senate Finance Committee Chair Ronald Wyden (D-Ore.), Sen. Daniel Sullivan (R-Alaska) and U.S. Representatives James Panetta (D-Calif.) and Michael Carey (R-Ohio) have introduced the Workforce Housing Tax Credit Act into the U.S. House and Senate. The bipartisan proposal would establish a Workforce Housing Tax Credit (WHTC) that would complement the Low-Income Housing Tax Credit (LIHTC). The Workforce Housing Tax Credit Act would establish a public-private partnership that allows state housing agencies to issue credit allocations to developers through a competitive process. These credit allocations would then subsequently …

ATLANTA — Multifamily developers are bracing for the uncertainty of 2024 as their projects are delivering into a landscape where new supply is outpacing demand by a significant margin. In the third quarter, a total of 114,000 new multifamily units were delivered compared to 82,100 absorbed, according to research from CBRE. The absorption figure is technically rebounding as it represents the highest quarterly figure since early 2022, but there is still a sizeable delta compared to supply growth. The trailing four-quarter total for multifamily deliveries stands at 376,500 units, which …

ATLANTA — Investors in the multifamily sector are having trouble getting deals done in 2023, and 2024 isn’t looking to start out much better. The culprit is the bid-ask spread — the gap between what sellers believe their property is worth and what buyers are willing to pay. That’s according to a panel of multifamily investors, several of whom described transacting in the present environment to be a “slog.” The panel, titled “Investment Outlook: When will the Bid-Ask Gap Narrow, the Market Stabilize and Transactions Resume in Earnest?,” was held …

SAN FRANCISCO — The net operating income (NOI) of properties financed by low-income housing tax credit (LIHTC) equity increased by 7.4 percent in 2022, according to a report from Novogradac, a San Francisco-based accounting firm focused on real estate and community development. The NOI at these properties surpassed the inflation rate, which was 6.8 percent from December 2021 to December 2022, as the nation emerged from the worst of the COVID-19 pandemic. The 2023 LIHTC and Operating Expenses Report — published by Novogradac — tracked data from more than 186,000 affordable housing …

CHICAGO — Chicago-based Origin Investments forecasts that year-over-year national Class-A apartment rent growth will normalize by January 2025 and range from 2 to 3 percent, in keeping with historical rent growth averages. However, Origin also cautions that “unquantifiable risks” loom large over the market and could have broad implications for multifamily properties. The findings are from the company’s Multilytics Rent Growth Forecast Report. “The return to normalization has been expected because the rent growth levels of 2021 and 2022 were unsustainable. We are now paying for the distortions of the …

WASHINGTON, D.C. — The Biden-Harris Administration has released a new guidebook, developed in partnership with the U.S. Department of Housing and Urban Development (HUD) and other federal agencies. The goal of the guidebook is to help housing providers identify federal resources to finance the conversion of commercial properties to residential and mixed-use developments. In addition to the guidebook, HUD will release an updated notice on how its Community Development Block Grant (CDBG) funding — $10 billion of which has been allocated during the current administration — can be used to boost …

Asset Living Emphasizes Occupancy, Efficiency as Market Conditions Soften

Sensing a shift in the wind, multifamily property manager Asset Living is preparing for a bumpier leasing environment amid rising supply, slowing rent growth and overall economic uncertainty. While an adjustment, it shouldn’t come as a complete shock, says Robert Hicks, an Asset Living division president in charge of the conventional multifamily business in the western United States. Over the past handful of years, the sector has enjoyed some of the highest occupancies he has seen in his 25-year career in the industry, he points out. At the same time, …

Tech-Driven Renters Insurance Model Ramps Up Efficiency, Reduces Risk

The failure of residents to meet coverage requirements or letting policies lapse can cost owners and operators significantly, according to TheGuarantors, a fintech company serving the multifamily industry. For some operators, this can mean up to hundreds of thousands of dollars in liability costs. It can be months before operators become aware that residents have changed or canceled their policy. Property technology (proptech) innovations have helped digitize every facet of the leasing, management, maintenance, rent collection and revenue management processes. However, most proptech improvements have traditionally been renter focused, rather …

Fine-Tune Borrowing Strategies to Activate Multifamily Projects

Multifamily developers and owners seeking debt financing face a gauntlet of headwinds, but deal flows confirm that good deals are still landing loans. That’s according to Janette O’Brien, head of production for multifamily lending at KeyBank. As one of the nation’s largest bank-based financial services companies, KeyBank has a full pipeline of multifamily loans in process. That puts O’Brien’s finger on the pulse of what differentiates viable deals in today’s volatile market. Multifamily & Affordable Housing Business asked O’Brien about current borrower challenges, as well as the strategies that are helping some …

![20-REBO[5]](https://multifamilyaffordablehousing.com/wp-content/uploads/2023/11/20-REBO5.jpg)