The Nevada multifamily market, which is primarily made up of Reno and Las Vegas, faced significant challenges in 2023, particularly due to rising interest rates and a slowdown in sales volume. Rents declined by approximately 8 percent since their peak in the fourth quarter of 2021. Despite these setbacks, investors remain attracted to multifamily properties in Nevada, buoyed by the state’s favorable economic indicators and potential for long-term returns. However, supply constraints and rising construction costs pose ongoing challenges that could impact future market growth. Nonetheless, the Nevada multifamily market …

Market Reports

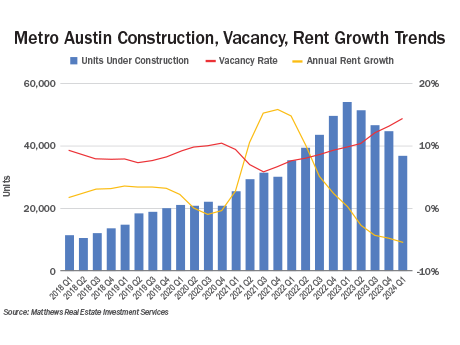

Austin has distinguished itself as one of the youngest markets in the nation, with a large portion of its population falling within the working-age bracket. Notably, individuals ages 25 to 34 comprise the largest segment of residents, making rental housing pivotal to support this demographic. Population growth was exacerbated during the COVID pandemic and in the years immediately following. Within a short timeframe, Austin experienced a substantial influx of residents, driven partly by the relocation of numerous well-known companies, such as Oracle, Google and Tesla. These organizations moved out of …

Contrary to popular belief, not everyone seeking a better lifestyle moves to Atlanta or Houston. If you live in the Midwest, Columbus has become a prime destination, especially for young people. The metro has a reputation for being more modern, cosmopolitan and affordable than its other Ohio peers like Cincinnati and Cleveland. U.S. News & World Report ranks Columbus among the top 30 “Most Fun Places to Live in the United States.” Then it should come as no surprise that according to a new Bank of America report, Columbus tied with Austin …

The capital markets continue to present challenges and create confusion across the U.S. transaction space. Most markets outside the Midwest have retreated toward a rent-growth flatline, or worse. However, in the midst of it all, the metro area stands like a pillar of stability. No longer known simply for its manufacturing prowess, Indianapolis boasts a long list of economic strengths. These include a diverse, sustainable and growing employment base; predictable fundamentals, including controlled levels of supply; a forward-thinking investment in infrastructure; and a growing base of capital. These capital sources, …

The multifamily sector in Dallas-Fort Worth has faced a challenging capital market environment over the past year. But like its counterparts in the Sun Belt, the local market has proven to be resilient based on economic performance, employment and population growth, as well as other market fundamentals. Sentiments about the commercial real estate sector in Dallas-Fort Worth, as a result, have turned very positive since the start of the year, though a significant number of investors remain cautiously optimistic. Employment indicators in Dallas-Fort Worth best displayed the resilience we saw …

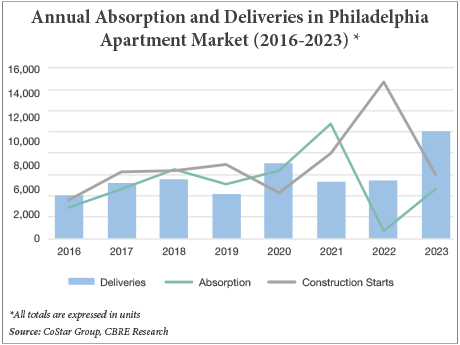

Metro Philadelphia has commonly been characterized as stable by multifamily investors. It’s akin to a backhanded compliment when comparing our region to those with higher population growth or more “business-friendly” governments. Cue the overused “eds and meds” story that fails to reference the technology, life sciences or gene therapy industries, all of which help to diversify the region’s employment base and contribute to a strong economy. (The “eds,” of course, are institutions of higher learning and the “meds” are medical facilities.) Historically, investors also haven’t differentiated between suburban Philadelphia, namely …

The multifamily market in Detroit, characterized by its mature and stable nature, boasts robust operating fundamentals, making it an attractive investment destination. While markets across the country are facing swells of new apartment deliveries resulting in oversupply, Detroit is forecast to easily absorb all new units that come online in 2024. In fact, 4,896 units are expected to be absorbed in 2024 while only 4,072 new units will be delivered — illustrating the strong, stable demand across the metro area. The positive outlook for rent growth is another encouraging sign. …

Boston is a famously difficult place to build or buy new apartments. Developers often spend years searching for a suitable site and gaining approvals from municipalities prior to construction. In the development boom that peaked in 2022, just on the heels of the coronavirus pandemic, developers started construction on hundreds of thousands of new apartments across the country — the largest amount of new construction in decades. In Boston, developers started tens of thousands of new apartments. It’s a lot of new construction, but it’s still less than Boston developers …

Chicago can’t match the number of construction cranes crowding the skylines in high-growth markets such as Nashville, Austin or Atlanta. But now there’s at least one high-profile symbol of growth in downtown Chicago as construction gets under way at 400 Lake Shore, a massive two-tower apartment development. Developer Related Midwest recently secured more than $500 million in construction financing for the project located on the last vacant waterfront site where the Chicago River meets Lake Michigan. The first phase, already under construction, includes a 72-story building with 635 new apartments, …

The combination of sustained job and population growth has put St. Charles County in the “Show-Me State” on the map and served as a catalyst for multifamily development. Buoyed by the presence of several multinational companies such as Amazon, General Motors and MasterCard, the county is home to several thriving suburbs northwest of St. Louis and posted a nearly 15 percent increase in population from 2010 to 2022. The number of residents rose from 360,485 to an estimated 413,803 during that period, according to the U.S. Census Bureau. St. Charles …