By Justin Fossum, senior director of asset management, Hamilton Zanze

In a period defined by shifting economic dynamics, demographic realignment and tightening capital markets, multifamily investors continue to seek clarity on where to find durable performance. While short-term volatility is likely to persist, certain metropolitan areas in the U.S. are demonstrating structural advantages that point to long-term outperformance.

Austin, Texas; Charlotte, North Carolina; Nashville, Tennessee; and Tampa, Florida, stand out as four such markets. Each market benefits from a rare alignment of employment growth, business investment, in-migration and relative affordability, making them well-positioned for continued strength in the multifamily sector over the next decade.

Employment Growth is the Engine of Demand

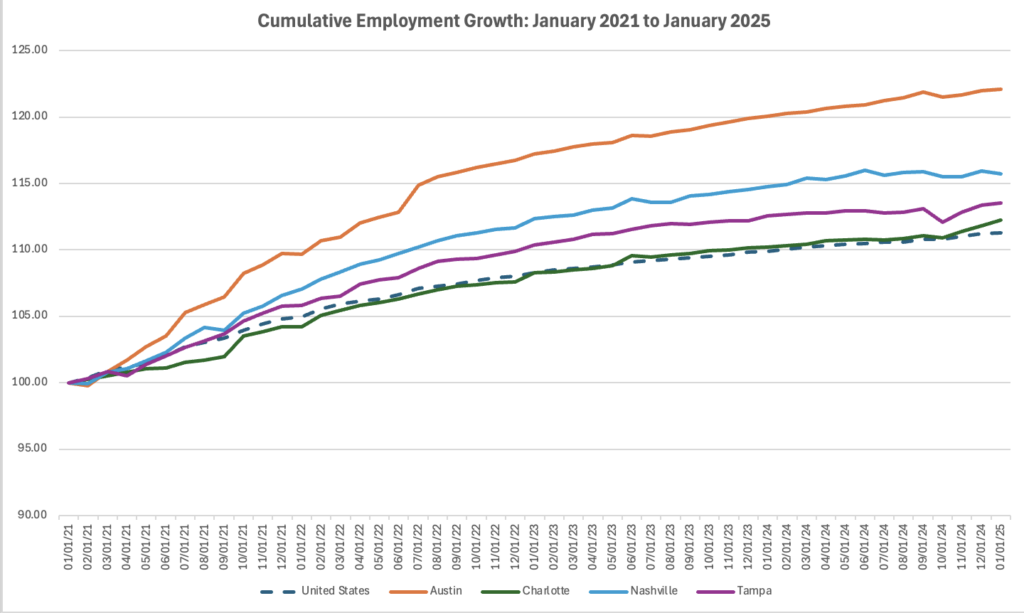

Jobs are a major driver of performance in the multifamily sector — and these four metros are delivering. Employment growth in Austin, Nashville and Tampa has outpaced the national average by a significant margin since early 2021. Growth in Charlotte has been in line with the national pace.

The robust job growth in each market stems from a foundation of diverse economic drivers.

Austin has become a magnet for innovation and advanced manufacturing. Major employers in the city include Tesla, Apple and Oracle, which have continued to expand their footprints. Healthcare, logistics and professional services also contribute to the city’s resilient job base.

Charlotte maintains its standing as a national banking hub, while also experiencing gains in energy, automotives and life sciences. Continued corporate relocations and expansions reflect the region’s business-friendly climate.

Nashville continues to grow as a healthcare powerhouse. The city’s entertainment, tourism and real estate sectors have also driven additional employment and wage gains.

Tampa, a long-time destination for retirees, is now attracting younger professionals and companies in financial services, healthcare and technology. These are all sectors that support long-term employment and wage growth.

Migration, Affordability Remain Key Drivers

Domestic and international migration continue to support housing demand in these Sun Belt metros. Relative to high-cost gateway markets such as New York City or Los Angeles, each of these cities offers an affordability profile that translates to more purchasing power — and strong demand for rental housing.

Let’s consider household income and cost-of-living data through the lens of purchasing power. The chart below features the regional price parity (RPP) statistic, which is catalogued by the U.S. Bureau of Economic Analysis. RPPs measure price level differences across geographic areas in a given year.

Expressed as a percentage of the national price level, RPPs allow for comparisons of buying power across regions. For example, Austin’s price level is 98.3 percent of the national average, meaning it is slightly more affordable than the national level.

| Metro | Median HH Income | Regional Price Parity (RPP) | Purchasing Power Insight |

| Austin | $91,461 | 98.3 | High income paired with moderate costs keeps Austin attractive for high earners migrating from California and the Northeast. |

| Charlotte | $78,438 | 95.4 | Lower cost of living allows residents to retain more disposable income, adding appeal to in-migrants and employers alike. |

| Nashville | $75,197 | 94.7 | Strong purchasing power is a draw for young professionals and families priced out of more expensive metros. |

| Tampa | $71,302 | 93.8 | Florida’s cost advantages and income growth continue to attract remote workers and investors. |

The result is not only population growth, but also economically productive growth that strengthens the fundamentals of the multifamily sector.

Ownership Rates Creates a Favorable Landscape

Homeownership rates in these metros are similar to — and, in some cases, less than — the national average. According to the U.S. Census Bureau, the national homeownership rate was 65.7 percent in fourth-quarter 2024. The rates for the four metros during the same period were as follows:

- Austin: 61.2 percent

- Charlotte: 67.4 percent

- Nashville: 65.6 percent

- Tampa: 64.8 percent

As such, there are substantial renter pools already present throughout these metros. These large populations of renters, combined with increasing housing costs, higher interest rates and tighter lending standards, support strong rental demand well into the future. Economists expect rental housing demand to outpace for-sale housing due to ongoing affordability challenges, evolving economic trends and broader market dynamics.

Resilient, Investable and Well-Positioned

The long-term outlook for Austin, Charlotte, Nashville and Tampa remains compelling. Each market continues to attract individuals and businesses seeking opportunity, affordability and quality of life. These metros benefit from a convergence of tailwinds — employment growth, in-migration, business investment and purchasing power — that support resilient multifamily operating fundamentals.

For institutional investors and private capital alike, these markets present a clear case: they offer the demographic and economic momentum needed to support stable income growth and capital preservation over a long-term hold.

Justin Fossum is Senior Director on the Asset Management team at Hamilton Zanze, a San Francisco-based real estate investment company. Founded in 2001, the company’s portfolio currently consists of 22,241 units across 124 properties in 28 markets. For additional information, visit www.hamiltonzanze.com.