WASHINGTON, D.C. — Multifamily executives across the nation report that deal flow is increasing and debt financing conditions are improving, according to the National Multifamily Housing Council’s (NMHC) latest quarterly survey. But there’s a caveat.

While respondents were confident about first-quarter market conditions, such as improving rent-growth trends, those who completed the survey after the April 2 tariffs were announced expressed a conspicuously different opinion. According to NMHC, about half the respondents completed the survey before the tariffs and the other half submitted responses after.

The April 2025 Quarterly Survey of Apartment Market Conditions was conducted from March 31 to April 25. The survey collected responses from 141 CEOs and other senior executives of apartment-related firms across the nation. NMHC refers to this quarterly survey as a “snapshot in time of apartment market sentiment.”

NMHC notes that changes in trade policy over the past two weeks altered the market sentiment captured in the survey. Apartment executives who responded after April 2 were more likely to report worsening conditions for debt and equity financing as well as decreasing sales volume over the preceding three months.

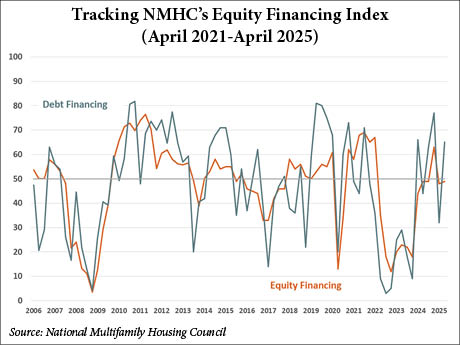

The survey recorded a debt financing index of 65 this quarter, indicating better conditions for debt financing compared with three months ago. The equity financing index came in at 49 this quarter, which reflects less available equity financing over the past three months.

The sales volume index of 60 indicates increasing deal flow over the past three months. Roughly half (49 percent) of survey respondents thought sales volume went unchanged over the past three months, while 34 percent of executives reported that sales volume was higher in the first quarter than it was in the fourth quarter of 2024, an increase from 16 percent in January 2025. On the other hand, 14 percent of respondents (down from 34 percent) reported that sales volume was lower.

The survey recorded a market tightness index of 52 for Q1 2025, which is above the breakeven level of 50 for the first time since July 2022. NMHC defines a “tight” market as one with low vacancies and high rent increases.

“We assume that any day-to-day changes that occur within the two-week survey period are negligible and not worthy of reporting,” said Chris Bruen, an economist and senior director of research at NMHC.

“This month was clearly atypical in the significant volatility we saw in both trade policy and financial markets,” Bruen added. “The rise in 10-year Treasury yield, specifically, appeared to negatively affect conditions for debt financing. Despite these disparities, conditions largely showed improvements compared to three months ago.”

Click here to read the full survey results.

— Channing Hamilton