In exclusive survey, lending community says apartment sector offers best financing opportunities in 2026, expresses confidence deal volume overall will surpass 2025 levels.

By Matt Valley

About half (46 percent) of France Media’s forecast survey respondents expect refinancing to make up the bulk of lending activity at their firms in 2026, followed by acquisition financing (27 percent). Pictured is Alexander Crossing, a 440-unit property in Yonkers, N.Y. Earlier this month, Walker & Dunlop arranged a $116 million Fannie Mae refinancing loan on behalf of the property owner, Rose Associates. (Image courtesy of Rose Associates)

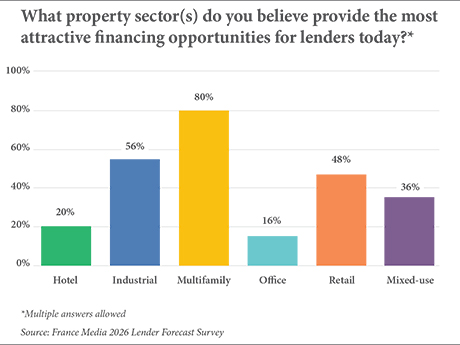

Despite pockets of overbuilding and stalled or falling rents in many apartment markets across the country, 80 percent of lenders and financial intermediaries who participated in France Media’s 15th annual forecast survey indicated the multifamily sector provides the most attractive financing opportunities for lenders today.

While multifamily is the clear leader of the pack in their eyes, 56 percent of respondents cited industrial as the next most attractive property type, followed by retail (48 percent), mixed-use (36 percent), hotel (20 percent) and office (16 percent). Multiple answers were allowed for this question.

France Media conducted the national email survey from mid-November to mid-December 2025. Slightly more than two-thirds of respondents (68 percent) identified themselves as either mortgage brokers or financial intermediaries, while 28 percent worked for either a community, regional or national bank. Survey respondents were most active in the Western and Southeast states, but all regions of the country were well-represented.

Multifamily Headwinds, Tailwinds

While the lending community is bullish on apartments, the average “advertised asking rent” nationally fell $5, or 0.3 percent, month-over-month to $1,737 in December 2025, according to Yardi Matrix. The research platform also determined that the year-over-year growth rate was flat.

In December, year-over-year growth in the advertised asking rent was negative in many Sun Belt and Western metros, with Austin (-5.2 percent), Phoenix (-4.1 percent), Denver (-3.9 percent), Las Vegas (-2.5 percent) and Portland (-2.0 percent) all posting losses. Rent growth was strongest in gateway and Midwest markets, led by New York City (5.8 percent), Chicago (3.6 percent), the Twin Cities (3.2 percent), Kansas City (2.6 percent) and San Francisco (1.9 percent).

“This performance highlights a widening geographic divide. Midwest metros have emerged as some of the most resilient, driven by limited new supply and greater affordability,” wrote Yardi Matrix in its National Multifamily Report for December 2025. “In contrast, many Sun Belt markets are still absorbing a wave of deliveries from recent years, which has weakened pricing amid softer demand.”

In its 2026 outlook for the U.S. apartment market, Yardi Matrix forecasts rent growth of 1.2 percent.

Since 2020, more than 3.2 million units have been delivered nationally, the majority in Sun Belt markets, reports Yardi Matrix. Austin added 109,000 units (48 percent increase relative to existing stock), Charlotte 68,000 (38 percent), Nashville 55,000 (37 percent) and Miami 101,000 (33 percent).

Current market conditions reflect both cyclical and structural factors, according to Yardi Matrix, which pointed out that rents nationally surged 22 percent between 2021 and 2022, making a pullback inevitable.

Demand has slowed amid flattening job growth and the impact of immigration policy, the Yardi Matrix report noted. The good news is that occupancy has held firm and absorption remains healthy by historical standards. The national occupancy rate registered 94.6 percent in November 2025, which was flat year-over-year.

Yardi Matrix emphasized that “despite ongoing economic uncertainty, stronger [gross domestic product] growth in the fourth quarter points to improving momentum. Greater stability in 2026 could help lift consumer confidence and support a gradual rebound in rental demand.”

As of mid-January 2026, the Federal Reserve Bank of Atlanta estimated that the U.S. GDP grew at an annualized rate of 5.3 percent in the fourth quarter of 2025.

Bearish on Office

A large majority of respondents (74 percent) to France Media’s lender survey indicated that the office sector provides the least attractive financing opportunities for lenders today while 44 percent cited hotels as the least attractive. (Multiple answers were allowed.)

The national office vacancy rate registered 18.5 percent in November 2025, a drop of 90 basis points year-over-year, according to CommercialCafe, which tracks market and industry trends in commercial real estate.

The recovery of this sector is expected to be a protracted, multi-year process due to the structural changes in work habits (remote and hybrid work), which has resulted in high vacancy rates and declining property values, according to CommercialCafe.

“The challenge is what to do with all the vacant, obsolete office buildings that are not candidates for a conversion to apartments or hotels. The demolition companies are going to get busy,” stated Ben Kadish, president of Chicago-based Maverick Commercial Mortgage Inc., in the write-in portion of the lender survey that asked respondents to identify the biggest opportunities and challenges ahead for the commercial real estate industry in 2026.

When asked how the volume of distressed properties in the office sector in 2026 will compare with the prior year, 26 percent of respondents said they expect the level of distress to increase significantly, 37 percent indicted it will increase somewhat, 19 percent expect it to remain the same, 15 percent said it will decrease somewhat and 3 percent were uncertain.

Still, it’s not all doom and gloom for this once coveted asset class. Cushman & Wakefield reports that demand for high-quality office space is gaining momentum.

“After years of portfolio rightsizing, companies are expanding footprints, especially in top-tier buildings,” the brokerage giant wrote in its MarketBeat report covering U.S. office activity in the third quarter of 2025.

“Class A net absorption has been positive for two straight quarters, with four-quarter rolling absorption topping 3 million square feet in the third quarter — a level not seen since early 2020,” wrote Cushman & Wakefield.

Coworking has continued to solidify its value and increase its share in the office market, according to CommercialCafe. Some 22 million square feet of coworking space opened in 2025, which was 16 percent more than the year before. (Coworking is an arrangement in which workers for different companies as well as entrepreneurs share an office space.)

Refi Business Dominates

Slightly less than half of respondents (46 percent) expect refinancing to make up the bulk of activity at their firm in 2026, followed by acquisition financing (27 percent), construction financing (15 percent) and other (12 percent). For borrowers, securing construction financing remains a challenge due to relatively high interest rates, tighter underwriting, rising construction costs and market uncertainty.

The 30-day average Secured Overnight Financing Rate (SOFR) — which closed at 3.7 percent at the end of business on Jan. 13, 2026 — is the benchmark used to set interest rates on construction loans. To put that figure into context, the 30-day SOFR was a minuscule 0.04 percent in mid-January 2022. Still, SOFR is down from 5.3 percent two years ago and 4.3 percent in January 2025.

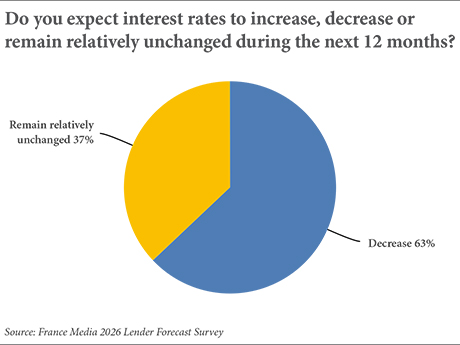

Nearly two-thirds of the lending community (63 percent) expect interest rates to decrease over the course of 2026, while 37 percent indicate rates will remain relatively unchanged (see chart). A year ago, 48 percent expected interest rates to decrease, and another 44 percent said rates would remain relatively unchanged over the ensuing 12 months. In short, lenders expressed more confidence heading into 2026 than 2025 that interest rates will fall.

Lenders were asked to provide their best guess as to where the U.S. 10-year Treasury yield will stand at the end of 2026. The largest group (41 percent) expects the benchmark rate to finish the year at 3.5 percent while another 38 percent predict it will close out the year at 4 percent.

When asked that same question a year ago, respondents most frequently indicated the 10-year yield would end 2025 at 4 percent while another 23 percent predicted the benchmark yield would finish the year at 4.5 percent. As it turns out, they were good prognosticators — the 10-year yield officially ended 2025 at 4.18 percent.

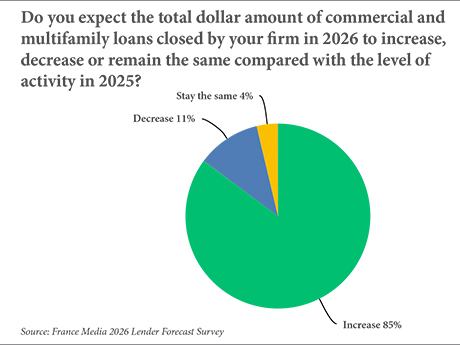

Eighty-five percent of respondents expect the total dollar amount of commercial and multifamily loans closed by their firm in 2026 to increase over the prior year, while 11 percent anticipate a decrease and 4 percent say deal volume will remain the same (see chart).

Of those who anticipate higher deal volume, the largest group of respondents (35 percent) expects to see an increase of 6 to 10 percent in the total dollar amount of loans closed. About one-quarter of respondents (26 percent) predict deal volume will increase more than 20 percent year-over-year and another 22 percent project an increase in deal volume of 16 to 20 percent.

Trump and Tariffs

U.S. President Donald Trump has implemented sweeping tariff policies as a central part of his economic plan. In fact, he has stated that “tariff” is his “favorite word.” The goal of tariffs is to protect American industries, reduce the U.S. trade deficit and to reshore manufacturing to the United States.

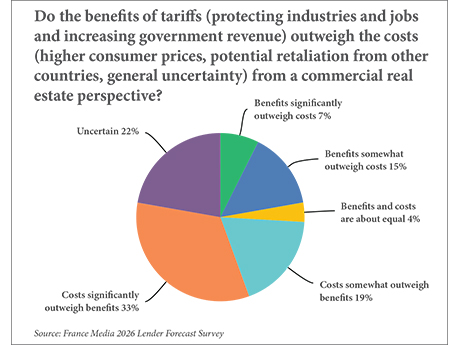

One-third of survey participants indicated the costs of tariffs (higher consumer prices, potential retaliation from other countries and general uncertainty) significantly outweigh the benefits. Another 19 percent said the costs somewhat outweigh the benefits.

On the flip side, 7 percent said the benefits significantly outweigh the costs, 15 percent indicated the benefits somewhat outweigh the costs and 4 percent said the benefits and costs are about equal. Another 22 percent expressed uncertainty (see chart).

It’s the Interest Rate, Stupid

Commercial real estate is influenced either directly or indirectly by an array of drivers, such as the state of the economy or structural changes in society.

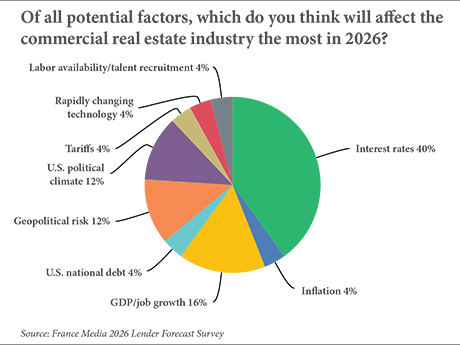

Survey participants were asked, “Of all potential factors, which do you think will affect the commercial real estate industry the most in 2026?” Respondents most frequently cited interest rates (40 percent), followed by GDP/job growth (16 percent) and geopolitical risk and the U.S. political climate (tied at 12 percent). Inflation, tariffs and rapidly changing technology each garnered 4 percent of responses (see chart).

Making Sense of It All

In the write-in portion of the survey, respondents were invited to share their views on the greatest opportunity and/or challenge for the commercial real estate industry in 2026.

“Commercial office space is doomed. The entire culture has changed, and the appetite is low and will not improve,” wrote an anonymous contributor who wrote the word “doomed” in all caps for emphasis.

Teresa Clark Mitchell, an area sales manager with Fifth Third Bank in Atlanta, wrote that the “greatest opportunity is leveraging AI, while the biggest challenge is high capital costs and debt refinancing pressure.”

Christina Heide, vice president and commercial loan officer at Southwest Heritage Bank in Scottsdale, Ariz., wrote that “the challenge will be keeping confidence and positivity stable throughout 2026 not only in commercial real estate/investment real estate but also in the economy, labor force and U.S. political atmosphere.”

Jeff Gottfried, CEO of Fort Lauderdale, Fla.-based Gottfried Financial Group, said “the greatest opportunity in the future is continued rate reductions. This will impact real estate value and future cash flow. Further, developers with entitled land ready for immediate development will benefit greatly as well, especially in markets with an increasing job market.”

Brad Berg, senior vice president of business development at Banc of California, cited competition as an opportunity and a challenge. “Most banks are actively lending and are willing to undermine profitability in order to book volume and deposits,” wrote Berg. “Lack of inventory nationwide is also a challenge for prospective buyers.”

One anonymous financial intermediary lamented that commercial real estate lenders are tightening rather than loosening their purse strings. “After years of seeing few debt covenants for my established commercial contractors, the covenants are back. Bankers seem to be returning to policing their borrowers like we saw in the last major decline. Consequently, the open-door policy for lending would appear to be closing. The next few years could be tough on commercial contractors.”