Austin has distinguished itself as one of the youngest markets in the nation, with a large portion of its population falling within the working-age bracket. Notably, individuals ages 25 to 34 comprise the largest segment of residents, making rental housing pivotal to support this demographic.

Population growth was exacerbated during the COVID pandemic and in the years immediately following. Within a short timeframe, Austin experienced a substantial influx of residents, driven partly by the relocation of numerous well-known companies, such as Oracle, Google and Tesla.

These organizations moved out of California in pursuit of several benefits, including a looser regulatory environment, lower operating costs and a deeper talent pool.

It’s estimated that nearly 100,000 people moved to the metro area in the first years of the pandemic, pushing Austin to rank first among the 50 largest U.S. metros based on net migration as a percentage of the total population in 2020, according to the U.S. Census Bureau.

As such, employment opportunities expanded faster than in other markets. Between 2022 and 2023, the Austin metropolitan statistical area (MSA) saw the seventh-largest increase in population, growing at a rate of 2.1 percent.

Developers Doubled Down on New Projects

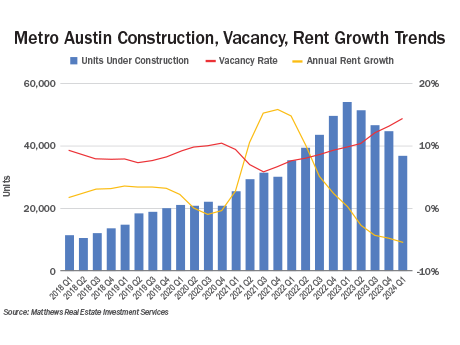

To meet the uptick in population and the related demand for housing, developers commenced construction projects en masse at the start of the pandemic.

During this time, the average monthly rent jumped 24 percent in one year, and the low interest rates further fueled the glut of new apartments added to the pipeline. In January 2020, interest rates on fixed-rate multifamily loans ranged from 3.5 percent to 5.5 percent.

In 2022, there were 22,600 building permits issued for multifamily housing units in metro Austin, according to apartment list, an online marketplace for apartment listings.

Developers started construction on nearly 13,000 units in 2022, double the number of units from the prior year. Many of these units under development are now being delivered to the market, and supply has outpaced renter demand. This misalignment between multifamily supply and demand results from inflation and higher living costs.

The market now faces an oversupply of vacant units, which is causing rents to decline. Between April 2023 and April 2024, about 25,000 units have been delivered, a historic high for the market and the second-highest number of deliveries in the United States during this time period.

Grappling with an accumulation of excess supply, the market witnessed a surge in vacancies and a decline in rents. The vacancy rate for the Austin market climbed from 9.8 percent in the first quarter of 2023 to 14 percent at the beginning of the second quarter of 2024.

Following a period of robust growth in the first quarter of 2021 when Austin experienced the 11th-highest annual rent growth rate in the country at 16.2 percent, the market’s average asking rent declined by 5.6 percent between the second quarter of 2023 and second quarter of 2024. Midway through the second quarter of 2024, the average rent for a one-bedroom is $1,411, a two-bedroom is $1,797, and a three-bedroom is $2,256.

Unsurprisingly, this trend is mirrored in other markets such as Orlando and Atlanta. But in Austin, this drop in rents over the past three years is one of the most pronounced nationally.

With rents falling, management companies are offering more concessions, a trend that disappeared during the height of migration. Renters are taking advantage of rent-free months to help landlords fill vacancies.

While lower overall renter demand is evident across metro Austin, submarkets such as Georgetown/Leander and Pflugerville are attracting more renters due to a blend of affordability, job opportunities and quality amenities.

Today, apartment construction in Austin continues to hover around record levels, with approximately 38,000 units currently under construction, nearly three times the average between 2017 and 2019.

It is worth noting that it is improbable that all projected units under construction will be delivered this year. The ongoing accumulation of supply, stringent underwriting standards, and the rising cost of capital have led many developers to shelve projects.

On top of that, rising property taxes and insurance costs are also negatively impacting the net operating income of apartment communities. With reduced profitability due to a decrease in rents, some developers are shifting their plans from rental projects to condos.

Sales Volume Will Remain Low

Despite encountering challenges related to decreasing overall occupancies, investors maintain an optimistic view of Austin’s long-term demographic and economic growth trajectory. Transaction activity is expected to remain subdued in the short term until the bid-ask spread between buyers and sellers converges.

While both parties remain at a standoff on price expectations, sales volume has effectively decelerated. Although investors are still keen on entering the Austin market, and deals are being completed, investment sales volume has not reached the 2021 record level.

Challenges in the debt markets hinder the completion of deals, affecting the pace of transactions. The 12-month sales volume through April was $515 million, down 58 percent from the five-year, pre-pandemic average.

Despite these obstacles, the underlying appeal of Austin’s multifamily market continues to garner investors’ attention, with many recognizing the market’s long-term growth potential.

Buyers are creatively finding ways to sidestep higher costs of capital, with many acquiring underperforming assets in the urban core that will undergo value-add improvements.

Investors are drawn to areas like Round Rock and San Marcos, which are generating the most interest due to promising growth and investment potential.

On the disposition side, lower valuations have deterred many owners from selling, but sellers with a low basis are redeploying their capital elsewhere, particularly in properties offering 8 to 9 percent capitalization rates.

Investors Bank on Popularity

While the Austin multifamily market is currently experiencing challenges stemming from oversupply, the market’s fundamental strengths remain intact. Austin’s youthful demographic, thriving job market and attractive lifestyle continue to drive rental demand.

Despite short-term headwinds, the long-term outlook for the market remains positive, with investors poised to capitalize on future growth opportunities as market dynamics stabilize.

As the market adjusts to align supply with demand, prudent investment strategies that account for Austin’s unique attributes will be essential for navigating current uncertainties and positioning for future success.

Tyler Marshall is associate vice president and associate director at Matthews Real Estate Investment Services, which specializes in investment sales and financing. Marshall is based in the company’s Austin, Texas, office. This article originally appeared in the May/June issue of Texas Multifamily & Affordable Housing Business.