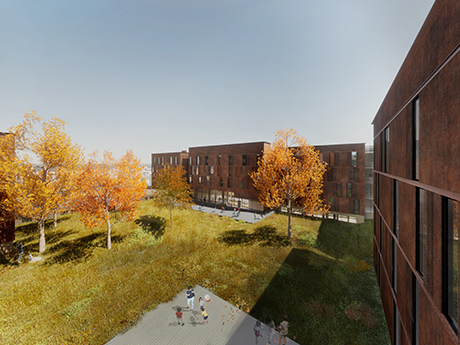

DENVER — Globeville Redevelopment Partners, a joint venture consisting of several public and private members, has started construction on 4965 Washington St., a five story, mixed-use affordable housing community in Denver’s Globeville neighborhood. The $132 million project involves the redevelopment of a 2.7-acre, city-owned site that was formerly a car dealership. The project will include 170 apartments reserved for households earning between 30 and 80 percent of area median income. Developed in partnership with the Denver Public Library and the city and county of Denver, the lower level of the …

Lynn Peisner

AUSTIN, TEXAS — Berkadia has arranged a $47 million refinancing loan for Griffin Capital, the El Segundo, California-based owner of 1900 Parmer Apartments in Austin. MF1 Capital was the lender, and Berkadia’s team was led by Mitch Sinberg, Scott Wadler, Brad Williamson, Matt Robbins and Patrick Johnson. The property, located at 1900 E. Parmer Lane, was developed in 2024 and was 98 percent leased at the time of the loan closing. In addition to one- and two-bedroom units, 1900 Parmer features two pools with cabanas, a two-story fitness center with …

FRISCO, TEXAS — Irvine, California-based The Bascom Group has sold Capitol at Stonebriar, a 424-unit community at 9600 Gaylord Parkway in Frisco that opened in 2018. JPI was the original developer. The buyer and sales price were not disclosed. The asset was 91 percent occupied at the time of the sale. Newmark Multifamily Capital Markets’ Brian Murphy, Brian O’Boyle Jr. and Richard Furr represented Bascom Group in the sales transaction, while David Schwarz arranged acquisition financing on behalf of the buyer.

LA HABRA, CALIF. — CBRE has arranged the sale of two properties totaling 38 units in La Habra, an Orange County city about 27 miles southeast of Los Angeles. CBRE’s Dan Blackwell and Amanda Fielder arranged the transactions. Combined, the sales totaled approximately $12.3 million. The properties included The Bungalows on Monte Vista and Villa Monica. The Bungalows on Monte Vista, constructed in 1964, is located at 141–247 South Monte Vista St. The 18-unit asset sold for $6.4 million and traded at a 5.74 percent cap rate. The seller was …

The recent arrest and extradition of Venezuelan leader Nicolás Maduro has once again put political instability in Latin America back in the headlines. For many people in the U.S., it’s just another international news story. For Latin American investors, it’s a reminder of something they’ve lived with for years: Political and economic conditions can change quickly, and when they do, the impact on currency, regulation and personal wealth can be immediate. That reality has long shaped how and where capital moves. When uncertainty rises, investors tend to look for places …

FREMONT, CALIF. — Berkadia has secured a joint venture equity partner for the final phase of development for Aurum, a 966-unit property adjacent to the Warm Springs BART station in Fremont. This final phase includes 336 units. Brett Betzler and Kaohu Berg-Hee of Berkadia’s Irvine and San Francisco offices brokered the deal. Aurum is located at 3300 Innovation Way and consists of a five-story, elevator-served building that features a structured parking garage, a fitness center, resort-style pool and approximately 4,900 square feet of ground-floor retail. Completion is expected in 2027.

Stockdale Capital Partners Buys Avant at Fashion Center in Phoenix Metro for $110.3 Million

CHANDLER, ARIZ. — Stockdale Capital Partners has acquired Avant at Fashion Center in Chandler for approximately $110.3 million. The 355-unit mid-rise community was built in 2017 and features a mix of studio, one- and two-bedroom units housed in seven, three- and four-story buildings on an 11.4-acre site. Amenities include a pool with a deck and cabanas, covered social areas, stainless steel grills, a resident lounge and a two-story fitness center. IPA’s Steve Gebing and Cliff David marketed the property on behalf of the undisclosed seller. This is Stockdale’s second acquisition …

GREENSBORO, N.C. — Crescent Communities has completed, opened and begun leasing HARMON Jefferson Village, a rental townhome community in Greensboro, less than half a mile from the Jefferson Village shopping center. The Charlotte, North Carolina-based investor, developer and operator’s HARMON brand portfolio is comprised of single-family rental communities in Sun Belt markets. Jefferson Village features three- to four-bedroom units and amenities that include a pool with a pavilion and outdoor kitchen with a grilling station and outdoor dining, an event lawn and trailhead access to Price Park. HARMON properties in …

OXNARD, CALIF. — Bascom Northwest Ventures has sold Tempo at Riverpark Apartments in Oxnard to a venture led by Hines for $105 million. The Bascom Group acquired the 235-unit asset via a value-add fund in 2018 for approximately $75.3 million. The asset was developed by The Wolff Co. in 2015. Bascom invested approximately $1 million in upgrades during its hold period, during which Apartment Management Consultants was the property manager. Both buyer and seller were represented in the sale by Blake Rogers, Alex Caniglia and Kip Malo at JLL. Tempo …

AZUSA, CALIF. — CBRE has arranged the $53 million sale of Lumia, a 127-unit community in Azusa, 23 miles east of Los Angeles. CBRE’s Chris Tresp, Derrek Ostrzyzek, Rachel Parsons, Mike Murphy and Kenji Thomas represented the seller, Serrano Development, in the transaction. The buyer is an entity doing business as Azusa LLC. Completed in 2024, Lumia features 9,132 square feet of street-level retail and a resort-style pool and hot tub, a fitness center, coworking spaces and pet amenities.