By Nellie Day It started as a convenience, but now it’s an expectation. Yes, we’re talking about online shopping — or more accurately, the mound of heavy, oddly shaped and ever-delivered boxes that unite multifamily residents with their latest e-commerce obsession. Once considered a tedious operational task, package management has become a daily — sometimes hourly — balancing act between service, space and sanity. Residents expect the same fast, efficient experience they get from Amazon, while owners and managers are left to pick up the pieces, or rather the packages, …

From the Magazines

By Joe Gose Compare the dynamics of the multifamily debt environment of four years ago to today, and at first glance not much appears to have changed. A wave of capital ready for deployment? Check then and check now. The same can be said for the type of lenders active in the space: Life insurance companies, Fannie Mae and Freddie Mac, private credit sources, and banks were all hungry for deals back then and have a similar appetite today. Of course, the economics have shifted dramatically. A spike in interest …

With a new presidential administration comes new policies and new economic uncertainties. But trying times such as these are no match for the consistency of the Indianapolis multifamily market. The metropolitan area’s “steady eddie” performance and resiliency during the tumultuous period of the COVID-19 pandemic has proven its staying power. Population, Job Growth Signal New Opportunities Metro Indianapolis, with a population base of 2.2 million people, experienced a sizeable population increase over the past four years. The metro area added more than 85,000 people during that period, with a good mix …

Looking at the multifamily industry today, it’s easy to forget that many of our current best practices were born of necessity five years ago, when the COVID-19 pandemic introduced phrases like “stay-at-home orders” and “social distancing.” As challenging as those times were, some of the adjustments we made ended up reshaping our business for the better. Nearly every aspect of multifamily has examples of these positive pandemic pivots. Here are the three I consider the most significant in the realm of marketing, leasing and how we interact with prospects. 1. …

The single-family rental (SFR) market, including purpose-built build-to-rent (BTR) communities, is the fastest-growing segment of the U.S. housing market, outpacing both single-family for-sale and multifamily growth in recent years. Although the concept emerged from the Great Recession, when large investors began buying up vacant homes to rent, it has evolved significantly over the past five years, attracting more sophisticated investors and expanding into new markets. Historically, Sun Belt markets, particularly Phoenix, were early adopters of BTR. Recently, however, areas like the Carolinas, Northern Virginia and even Boston have seen a …

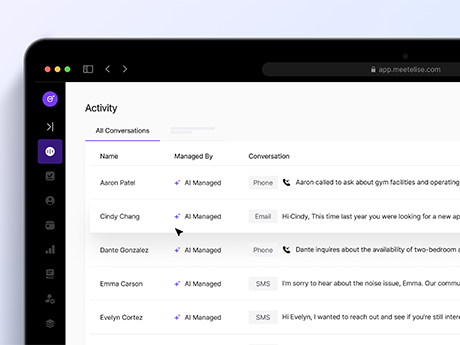

Members of Generation Z — born between 1997 and 2012 — are all in on artificial intelligence (AI). These young renters are not only fluent and reliant upon intelligent technology, but they are also more trusting of it than their elders. Gen Zers are more likely than other age groups to ask questions via chat or text during their apartment rental search journey, according to RealPage data, and they are even more likely to engage if AI is driving the messaging. In fact, 50 percent of Gen Zers say they are …

The need for affordable housing is palpable across the nation, and Atlanta is no exception to the rule. A 2023 report from the Georgia Department of Community Affairs found that there is an extremely inadequate supply of housing that is affordable and available for all income levels, but especially for the lowest income renter households. In 2021, Atlanta Mayor Andre Dickens established a goal to build or preserve 20,000 units of affordable housing across the city by the end of 2030. And a major contributor to these efforts is the …

Developers of affordable housing in the United States are flummoxed by the Trump administration’s bull-in-a-china-shop approach to breaking bloated bureaucracies. Like their brethren in the market-rate multifamily sector, affordable housing developers are anticipating potentially higher material costs because of tariffs and generally elevated interest rates. But more specific to the affordable sector, developers remain in the dark as to how the administration’s view on housing policies and programs will impact their ability to build low-income units in the coming months and years. Within two months after assuming office, the Trump …

The multifamily real estate market in Southern California, particularly in Orange County, is poised for significant shifts in 2025. The region has rebounded from the volatility of the COVID-19 pandemic but is still navigating regulatory pressures. In positive news, the rejection of Proposition 33 has averted the expansion of statewide rent control, offering a more favorable environment for investors. Amid elevated interest rates and a changing political landscape, the market presents both challenges and opportunities for buyers, sellers and investors alike. If passed, Proposition 33 would have allowed cities and …

For most of 2024, relatively high property values combined with rising interest rates priced buyers out of the market for new commercial and residential real estate acquisitions. This slowdown has not only impacted investors and homeowners, but it’s also affected the entire real estate industry — from lenders to appraisers, brokers, law firms, title insurance companies and beyond. Because Section 1031 exchange activity moves in lockstep with the real estate investment cycle, activity for qualified intermediaries has slowed as well. Section 1031 exchanges traditionally have been used by investors to …