FORT WORTH, TEXAS — Greystone has provided an $18.6 Fannie Mae Delegated Underwriting & Servicing loan for the acquisition of The Residences of Diamond Hill, a 204-unit asset in Fort Worth. John Williams of Greystone originated the loan, which carries a 10-year term and 35-year amortization, with interest-only payments for the first five years. The borrower was not disclosed. The Residences of Diamond Hill was built in 2003 and comprises 40 buildings. The garden-style community offers two-, three- and four-bedroom layouts. Amenities include a fitness center, pool, outdoor grill and …

Investment Sales

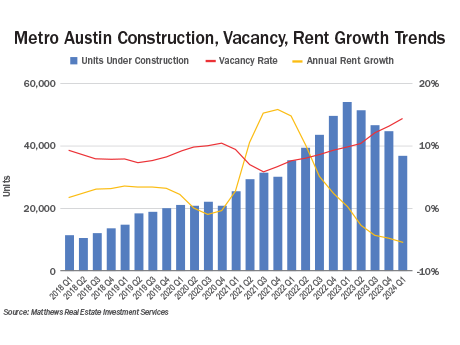

Austin has distinguished itself as one of the youngest markets in the nation, with a large portion of its population falling within the working-age bracket. Notably, individuals ages 25 to 34 comprise the largest segment of residents, making rental housing pivotal to support this demographic. Population growth was exacerbated during the COVID pandemic and in the years immediately following. Within a short timeframe, Austin experienced a substantial influx of residents, driven partly by the relocation of numerous well-known companies, such as Oracle, Google and Tesla. These organizations moved out of …

TEXARKANA, TEXAS — Marcus & Millichap has brokered the sale of a portfolio consisting of six assets in Texarkana, a city located on the Texas-Arkansas border. The 231-unit portfolio includes: Isabella Acres; Hidden Brook; Pecan Haven; Park Villa; Jasmine; and Gardens at Wake Village. The portfolio consists of build-to-rent communities and traditional multifamily complexes. Matt Aslan of Marcus & Millichap represented the seller in the transaction. The buyer assumed the seller’s loan, which carries a 3.48 percent fixed interest rate with four years of term remaining. Both parties requested anonymity.

FATE, TEXAS — American Landmark has purchased Prose Eastgate, a 366-unit community in the northeast Dallas suburb of Fate. The seller and sales price were not disclosed. Prose Eastgate was built in 2023. The community offers one- and two-bedroom units. Amenities include a pool, outdoor grilling and dining stations, resident lounge, entertainment kitchen, fitness center, business center, package lockers and dog park. American Landmark has since rebranded the property as Jameson Apartments.

MONROVIA, CALIF. — Institutional Property Advisors (IPA) has brokered the sale of Paragon at Old Town, a 163-unit community in Monrovia, 20 miles northeast of Los Angeles. Sequoia Equities sold the asset to SCS Development Co. Inc. for $87.3 million. Joseph Grabiec, Kevin Green and Gregory Harris of IPA represented the seller and procured the buyer. Paragon at Old Town offers amenities such as a resident lounge, fitness center, game room, pool and spa with private cabanas, outdoor lounges and courtyards. Units range from 744 square feet to 1,247 square …

LUBBOCK, TEXAS — KW Commercial has brokered the sale of Western Oaks and Omni, two properties totaling 171 units in the western Texas city of Lubbock. Western Oaks was built in 1972 and offers two-bedroom units, according to Apartments.com. Omni was constructed in 1979 and offers one- and two-bedroom apartments. Greg Brownd of KW Commercial represented the seller in the transaction, while Grant Roehm of KW Commercial represented the buyer. Both parties requested anonymity.

ATLANTA — CBRE has arranged the $126.3 million sale of Iris O4W, a 320-unit community in Atlanta’s Old Fourth Ward neighborhood. Equity Residential (NYSE:EQR) purchased the property from the developer, Trammell Crow Residential, and equity partner, Diamond Realty Investments. Shea Campbell, Ashish Cholia, Kevin Geiger, Colleen Hendrix and Don Hoffman of CBRE’s Southeast Multifamily team represented the sellers in the deal. Located at 652 Angier Ave. NE, Iris O4W was built in 2023. The community offers studio, one- and two-bedroom apartments with an average size of 860 square feet. Amenities include …

VERNON HILLS, ILL. — Bender Cos. has acquired Arrive Town Center in the northern Chicago suburb of Vernon Hills. Kevin Girard, Zach Kaufman and Bill Baumann of JLL represented the buyer in the deal. The seller and sales price were undisclosed. Arrive Town Center was built in 2010. The community offers 85 apartments with an average size of 1,200 square feet. Amenities include a lounge, fitness center, storage lockers and a heated indoor parking garage. The property also features 10,000 square feet of ground-floor retail space. The new ownership plans …

BOERNE, TEXAS — KW Commercial has negotiated the sale of Legacy at Cibolo, a 238-unit community located in the northwestern San Antonio suburb of Boerne. Greg Brownd of KW Commercial brokered the deal. The buyer and seller were not disclosed. Legacy at Cibolo was built in 2020. The property offers one- two- and three-bedroom units. Community amenities include a pool, fitness center, business center, clubhouse, outdoor grilling and dining stations and access to walking trails.

The method to buy below replacement cost is a tried-and-true investment strategy among real estate investors that allows them to capitalize on short-term fluctuations in the market in order to lock in long-term value. Grant Russell, director of investments at AvalonBay Communities Inc., said that multifamily investors today are in a “golden window” because they can acquire a Class A property for less than what it costs to develop the same community from the ground-up, all things being held equal. “Deals are trading for higher than yesterday’s costs and below …