NEW YORK CITY — SCALE Lending, the debt financing arm of Slate Property Group, has provided Beitel Group a $305 million construction loan for an unnamed development at 355 Exterior St. in the Mott Haven neighborhood of South Bronx. Landstone Capital Group arranged the financing. The community will consist of two connected 40-story and 26-story residential towers totaling 515,000 square feet with 755 units. The Beitel Group demolished the existing buildings and completed excavation work after entering a contract to purchase the site in October 2024. Construction began in December …

New York

Vanbarton Group Secures $250 Million Loan for Manhattan Multifamily Conversion Project

NEW YORK — Vanbarton Group has received $250 million in financing to convert the former Roman Catholic Archdiocese of New York headquarters into 420 multifamily units. Eldridge Real Estate Capital Management provided the acquisition and construction loan. The financing included the $103 million acquisition cost. CBRE’s Doug Middleton and Pierre Hills advised the archdiocese on the sale of the property, and Greenberg Traurig represented Vanbarton Group. The 20-story, approximately 400,000-square-foot building in the Sutton Place neighborhood had been the headquarters for the archdiocese since 1973 and was known as the …

YORKTOWN HEIGHTS, N.Y. — Marcus & Millichap has arranged the trade of York Farm Estates between seller, HVT Realty, and buyer, Westchester Management LLC. Marcus & Millichap’s Matthew Gault, Seth Glasser, Michael Turkiewicz and Michael Fusco marketed the property on behalf of the seller and procured the buyer. Built in 1996, York Farm Estates is fully occupied and sits on 8 acres. Units are a mix of one-, two- and three-bedroom apartments. The property is located in Yorktown Heights, a city in Westchester County, 42 miles north of Manhattan.

NEW YORK — KeyBank Community Development Lending and Investment (CDLI) has appointed Jon Burckin to senior business development banker on the equity distribution team. He is based in the firm’s New York City office and reports to Stacie Nekus, team leader for an equity growth initiative within CDLI. In this role, Burckin is responsible for raising capital and bringing in new investors for CDLI’s affordable housing equity syndication platform across the United States.

NEW YORK — Gilbane Development, in partnership with Blue Sea Development, Artspace and the City and State of New York, has secured $254 million to finance the development of a mixed-use, affordable housing property in Brooklyn’s Brownsville neighborhood. Brownsville Arts Center & Apartments (BACA) will include about 263,000 square feet of residential space and a 28,000-square-foot arts center, the centerpiece of which is a 3,440-square-foot multi-purpose performance, rehearsal and studio space for community arts groups. The 283-unit BACA development will include a mix of studios and one-, two- and three-bedroom …

NEW YORK CITY — Two unnamed private investors have traded a 97-unit property in Bronx, New York, for $7.5 million. Michael Fusco, Seth Glasser and Benjamin Myerow of Marcus & Millichap’s Manhattan office marketed the property on behalf of the seller and procured the buyer. Built in 1929, the six-story elevator building totals 90,000 square feet and is located at 1154 Ward Ave. in the Soundview neighborhood of the Bronx.

Eastham Capital, Merion Realty Complete Two-Property, Value-Add Acquisition Near Albany

CLIFTON PARK, N.Y. — Eastham Capital and Merion Realty Partners have acquired two assets, Foxrun and North Pointe, in Clifton Park, which is 20 miles north of Albany. The sales price was not disclosed. Florida-based Eastham Capital has a majority ownership through its Eastham Capital Fund VI. Pennsylvania-based Merion Realty, a co-investor, will oversee day-to-day property management at both properties. The new owners are planning a value-add approach with such upgrades as new roofs, parking lots, mechanical systems, landscaping, siding, amenity updates, new interiors and general site improvements. Combined, the …

BPG, LargaVista Secure $388.5 Million Loan, Resume Construction of Long Island City Tower

QUEENS, N.Y. — New York and Miami-based real estate developers Baron Property Group (BPG) and LargaVista Cos. have secured a $388.5 million construction loan for 30-25 Queens Boulevard, a 46-story mixed-use high-rise in Long Island City. Starwood Capital Group, Gotham Organization and Blackstone Real Estate Debt Strategies provided the financing. Ayush Kapahi, principal and founding partner at commercial real estate advisory HKS Real Estate Advisors, and Anthony Ledesma, principal and founding partner of real estate advisory firm DIA Capital Group, arranged the loan. Construction, currently underway, on 30-25 Queens Boulevard …

BFC Partners Secures $250 Million for Third Phase of Coney Island Affordable Housing Project

BROOKLYN, N.Y. — BFC Partners has closed on a $250 million construction loan to build the third and final phase of a three-building affordable-housing project along Surf Avenue in Coney Island. Loan specifics were not disclosed. The total project cost is approximately $700 million. This final phase, known as 1709 Surf Avenue, will include 420 new affordable units, bringing the total across all phases to 1,242 affordable homes. Project partners include the New York City Department of Housing Preservation and Development (HPD), the New York City Housing Development Corp. (HDC) …

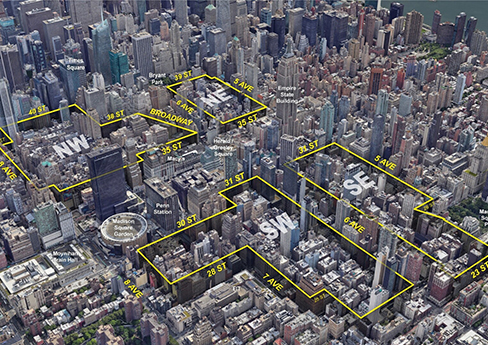

NYC Planning Commission Approves Midtown Manhattan Rezoning Proposal to Add Thousands of New Residences

NEW YORK CITY — The New York City Planning Commission has approved the Midtown South Mixed-Use Plan (MSMX), a rezoning initiative that could ultimately facilitate the creation of as many as 9,700 new residences across a 42-block section of Midtown Manhattan. The MSMX plan covers four areas centered around Herald and Greeley Square, located between West 23rd and West 40th streets, as well as Fifth and Eighth avenues. The area today is largely defined by commercial and industrial uses, with current land-use rules restricting new housing development. Midtown South is …