TOMS RIVER, N.J. — Dwight Mortgage Trust, the affiliate REIT of New York City-based Dwight Capital, has provided a $50 million bridge loan for the acquisition of Silverwoods, a 313-unit multifamily property located in the coastal New Jersey community of Toms River. The 55-acre, age-restricted property consists of 46 one-story buildings that house seven studios, 41 one-bedroom units and 265 two-bedroom units. Amenities include a pool, fitness center and a clubhouse. Moshe Feiner of Sevenstone Capital arranged the debt on behalf of the borrowers, Mathias Deutsch and Isidore Bleier. In …

Northeast

TRURO, MASS. — The Community Builders (TCB) has broken ground on Cloverleaf, a 43-unit affordable housing project in Truro, located roughly 100 miles southeast of Boston near the northern tip of Cape Cod. Thirty-nine units will be restricted to households earning between 30 and 100 percent of the area median income. The other four apartments will be rented at market rates. Units will come in one-, two- and three-bedroom formats and will be spread across 10 buildings. TCB is developing Cloverleaf in partnership with Community Housing Resource Inc. and the …

NORTH BERGEN, N.J. — Tower Management has received $24.2 million in financing for the acquisition of Hudson Ridge Apartments, a 215-unit asset in North Bergen. The property is situated at 7112-7312 Blvd. E, about eight miles north of New York City. Built in 1949, Hudson Ridge Apartments offers a mix of studio, one- and two-bedroom units. Apartments include hardwood flooring, stainless steel appliances and oversized closets. Residents have access to outdoor amenities such as picnic areas and garage parking. Thomas Didio, Thomas Didio Jr., Gerard Quinn and Michael Mataras of …

PITTSBURGH — A joint venture between Oxford Development Co. and RDC has received a $67 million construction loan for 21 West, a 291-unit project in Pittsburgh. Nick Unkovic and Zach Barone of JLL Capital Markets arranged the four-year floating rate construction loan through Dollar Bank. A construction timeline was not disclosed. Located at 430 W General Robinson St., the project will comprise 313,000 square feet across 11 stories. Units will come in studio, one- and two-bedroom floor plans. Residents will have access to amenities such as a sky bar on …

HANOVER, MD. — Pearlmark has provided a mezzanine loan for the refinancing of Bristol Court Apartments, a 311-unit asset in Hanover, roughly 12 miles south of Baltimore. Located within the Oxford Square planned community near the Dorsey MARC passenger rail station, Bristol Court offers one-, two- and three-bedroom apartments. Residents have access to amenities such as a pool, fitness center, yoga studio, lobby with coworking spaces and a clubroom with an entertainment kitchen and fireplace. Additional amenities include a library, lounge with a pool table, pet spa, foosball and shuffleboard, …

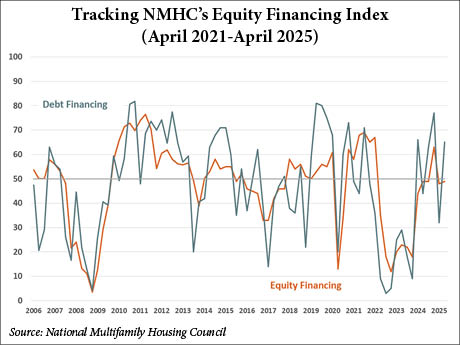

WASHINGTON, D.C. — Multifamily executives across the nation report that deal flow is increasing and debt financing conditions are improving, according to the National Multifamily Housing Council’s (NMHC) latest quarterly survey. But there’s a caveat. While respondents were confident about first-quarter market conditions, such as improving rent-growth trends, those who completed the survey after the April 2 tariffs were announced expressed a conspicuously different opinion. According to NMHC, about half the respondents completed the survey before the tariffs and the other half submitted responses after. The April 2025 Quarterly Survey of Apartment …

WOOD-RIDGE, N.J. — AvalonBay Communities has sold Avalon Wesmont Station, a 406-unit community located in Wood-Ridge, approximately 15 miles northwest of New York City. Cammeby’s International purchased the community for $161.5 million. Located at 100 Rosie Square, Avalon Wesmont Station offers a mix of studio, one-, two- and three-bedroom apartments. The average unit size is 959 square feet. Residents have access to amenities such as a pool, sundeck with grills, clubroom with workstations, fitness center. The property also offers covered parking and 18,000 square feet of ground floor retail space. Jose …

Texas Multifamily HVAC Trends: Why Developers Prefer All-Electric, All-Climate Heat Pumps

By Randall Towb of Mitsubishi Electric Trane HVAC US (METUS) Texas multifamily owners and developers are utilizing all-climate variable capacity heat pumps and variable refrigerant flow (VRF) systems for heating and air-conditioning (HVAC) needs in their low-rise, mid-rise and high-rise buildings. These systems deliver on both resident satisfaction and building owners’ return on investment (ROI) thanks to key benefits such as energy performance, zoned comfort, design flexibility, quiet operation, reduced maintenance and advanced controls and monitoring. In addition to resident comfort and ROI, these all-electric systems align with growing concerns …

READCO Secures $41.5 Million Construction Financing for Mixed-Use Project in Stonington, Connecticut

STONINGTON, CONN. — READCO has received $41.5 million in construction financing for Stonington Village, a 160-unit mixed-use development in Stonington, a town situated along the Long Island Sound in Connecticut’s New London County. Henry Schaffer and Madeline Joyce of JLL Capital Markets arranged the five-year, fixed-rate loan through Liberty Bank. Located at 85 Voluntown Rd., Stonington Village will feature six buildings. Units will come in studio, one-, two- and three-bedroom floor plans. Planned amenities include a clubhouse, pool and parking facilities. The project includes an affordable housing component. However, income …

WASHINGTON, D.C. — Akridge and National Real Estate Development have opened Colette and Everly, two apartment communities situated within The Stacks, a mixed-use project in the Buzzard Point neighborhood of Washington, D.C. The openings of Colette and Everly mark the completion of the mixed-use project’s first phase. Phase I of The Stacks totals nearly 1 million square feet, including three apartment buildings with 1,116 units and more than 90,000 square feet of amenity spaces. Phase I also includes approximately 22,000 square feet of public parks, 40,000 square feet of retail …