BROWNSVILLE, TEXAS — The Housing Authority of the City of Brownsville has opened El Jardin, an affordable housing LIHTC adaptive reuse project that converted a historic hotel, built in 1927, into 44 units of rental housing. Income caps range from 50 to 60 percent of area median income. Before the project began, the hotel sat vacant for 40 years. It operated as a hotel until the 1980s. Amenities at the renovated property include a fitness center, community garden, a play area, communal kitchen, barbecue and fitness area, a business center …

Texas

AUSTIN, TEXAS — The NRP Group, in partnership with Austin Independent School District (AISD), has broken ground on Phase I of the Anita Ferrales Coy school-to-housing redevelopment in East Austin. A school operated on the 18 acres at 4812 Gonzales St. from 1916 to approximately 2018, after which time the property was used as an alternative learning center. AISD selected The NRP Group as a redevelopment partner in 2023, and last year, AISD was relocated to prepare for redevelopment. The first phase includes 341 units, while the second phase, estimated …

SHERMAN, TEXAS — The NRP Group and Texahoma Housing Partners have opened and begun leasing Sutton Flats, a 300-unit mixed-income community in Sherman, 65 miles northeast of Dallas. Half of the units are reserved for households earning no more than 80 percent of area median income. Monthly asking rents across the community range from $1,132 to 1,540. Amenities include a fitness center, coworking spaces with conference rooms, a game room, clubhouse and lounge, resort-style pool and a dog park. Sutton Flats residents also may rent garage parking spaces. The NRP …

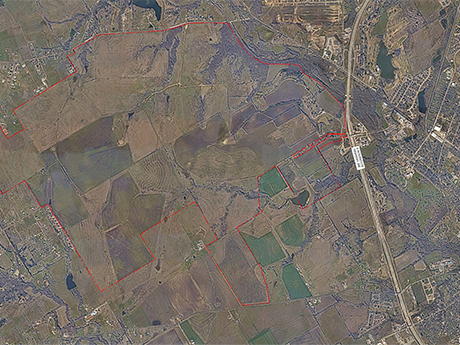

WAXAHACHIE, TEXAS — Minto Communities USA has acquired 3,170 acres in Waxahachie, 30 miles south of Dallas, where the Florida-based developer will build 13,270 new homes. Construction is expected to begin later this year followed by a multi-year buildout. The community will feature two residential districts — an active adult neighborhood and a traditional multifamily community — supported by approximately 140 acres of mixed‑use development. Plans include 750 multifamily units and 1.2 million square feet of retail and commercial space. Minto is planning amenities such as a town center, 400 …

HOUSTON — A joint venture comprised of Trammell Crow Residential and Haseko North America will develop Allora Fallbrook in Northwest Houston. Completion of the 366-unit community is slated for 2027. The four-story property will feature a mix of one- and two-bedroom floor plans highlighted by such amenities as a resort-style pool, a fitness center, clubhouse and outdoor gathering spaces. Haseko North America, based in Irvine, California, is the subsidiary of Haseko Corp., a Japanese residential construction firm.

DALLAS — FTK Construction Services has completed the $13.6 million renovation of West Virginia Park, a 204-unit LIHTC property in Dallas. The property owner is April Housing, a subsidiary of Blackstone Real Estate. Renovations at the 204-unit community included new paint, cabinetry, countertops, plumbing, appliances, flooring, lighting, HVAC and water heaters. Common areas were freshly painted, and landscaping and amenity updates also were provided.

DALLAS — Kushner has acquired Eastline Residences, a 330-unit, 28-story high-rise in Dallas. Northmarq’s Dallas-based Taylor Snoddy, Eric Stockley and Charles Hubbard arranged the deal on behalf of the seller, Convexity Properties. Convexity, a subsidiary of DRW, developed the community in 2021. The sales price has not been publicly disclosed, but, according to Northmarq, the trade reflected the second-largest residential sale in the metro area since 2022. Floors 25 through 28 feature penthouses with upgraded finishes and asking rents of approximately $6,500 per month. Amenities include a rooftop pool, a …

DALLAS — BDT & MSD Partners and Trammell Crow Co. have topped out the Knox Street mixed-use project under construction in Dallas. Knox Street includes The Lora, a 27-story, 186-unit apartment tower, as well as 150,000 square feet of office space, 100,000 square feet of retail, a half-acre park and The Knox Hotel and Residences, a 140-room hotel and 47 luxury for-sale condos. The Lora is one of the first buildings that will be complete this summer, according to the developers. The Lora will offer a mix of one-, two-, …

TOMBALL, TEXAS — Wood Partners has broken ground on Alta Timberline, a 204-unit community in Tomball, 34 miles northwest of Houston. Completion is slated for May 2027. The seven three-story buildings will feature a mix of one-, two- and three-bedroom layouts. The ground-floor units offer a private yard, while upper-level floors feature personal balconies. Amenities include a clubhouse, a resort-style pool, an outdoor kitchen area with gas grill stations, a TV, fans and seating for lounging and dining, two pickleball courts, a dog park, a pet spa, a business lounge, …

SAN ANTONIO — Walker & Dunlop has arranged a $46.5 million refinancing loan for GenCap Partners for the recently completed (2025) Park at Westover Hills, a 375-unit property located at 4103 Rogers Road in San Antonio. Walker & Dunlop’s team led by Stuart Wernick, Drew Garrison, Steve Mentesana and Matt Mentesana arranged the refinancing with a floating-rate, interest-only bridge loan provided by Geoff Smith and Mike Dunsheath of Walker & Dunlop Investment Partners. Park at Westover Hills consists of 14 buildings in San Antonio’s Far West submarket.