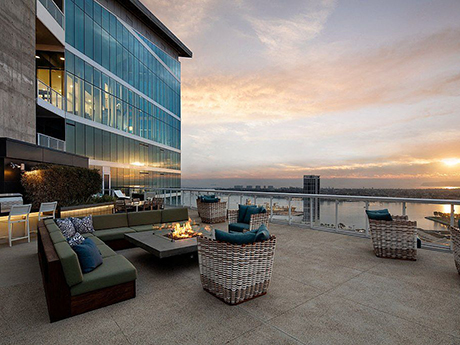

SAN DIEGO — MG Properties has acquired Park 12 Apartments, a 35-story high-rise property located in downtown San Diego, for $309 million. The property is situated adjacent to Petco Park, home of the San Diego Padres Major League Baseball team, within the Ballpark Village master planned community. Built in 2018, Park 12 offers a mix of studio, one-, two- and three-bedroom units, including penthouse units with exclusive access to a lounge on the 32nd floor. Shared amenities include pools with poolside event space, a fitness center, golf simulator and putting …

California

UPLAND, CALIF. — MJW Investments has acquired Coventry Square Apartments, a 92-unit community located in Upland, approximately 25 miles west of San Bernardino, California. MJW purchased the asset from an undisclosed seller in an off-market transaction. The sales price was also not disclosed. Built in 1980, Coventry Square Apartments consists of 46 buildings on 9.3 acres. The asset features two-bedroom apartments that average 1,178 square feet. Residents have access to amenities such as a pool, landscaped courtyards and on-site parking.

WEST SACRAMENTO, CALIF. — A partnership between The Bascom Group LLC and Oaktree Capital Management LP has acquired The Strand, a 408-unit property in West Sacramento. The garden-style asset traded for $126 million. The identity of the seller was not disclosed. The Strand was built in 2021 by MBK Rental Living. The property consists of 39 three-story buildings offering a mix of one-, two- and three-bedroom apartments. The average unit size is 885 square feet. Amenities include two pools with cabanas, a clubhouse, fire pits and gas grills, a spa …

INGLEWOOD, CALIF. — Bell Partners has received a $73 million loan for the refinancing of Bell South Bay, a 264-unit community located at 11622 Aviation Blvd. in Inglewood, about 13 miles southwest of Los Angeles. Justin Nelson and Craig West of Walker & Dunlop’s Capital Markets and Multifamily Finance teams arranged the bridge loan. The financing was provided by accounts managed by KKR. Built on 3.05 acres in 2016, Bell South Bay consists of 264 apartments. Units come in studio, one- and two-bedroom layouts. Amenities include a fitness center and …

IRVINE, CALIF. — Matthews Real Estate Investment Services has appointed Mark Bridge as executive vice president and senior director. Based in Matthews’s Orange County office in Irvine, Bridge will specialize in the acquisition and disposition of multifamily properties throughout Southern California. He will focus on communities with 20 to 100 units. Prior to joining Matthews, Bridge served as a managing director at Cushman & Wakefield. He previously spent 17 years at Marcus & Millichap.

SAN DIEGO — Murfey Cos. has received $46.5 million in construction financing for Stella Apartments in San Diego’s North Park neighborhood. Aldon Cole, Bryan Clark and Bharat Madan of JLL Capital Markets’ Debt Advisory arranged a three-year floating-rate loan through Buchanan Mortgage Holdings, an affiliate of Buchanan Street Partners, for the borrower. Located at 3104 El Cajon Blvd., Stella Apartments will consist of 149 apartments across nine stories. Units will come in studio, one- and two-bedroom layouts. Planned amenities include a rooftop terrace, community gym, outdoor amenity space and lobby. …

PHOENIX AND DENVER — NexMetro Communities has recapitalized four build-to-rent (BTR) properties in Phoenix and Denver. Valued at about $300 million, the properties, comprising 849 units, are Avilla Gateway, Avilla Magnolia and Avilla Canyon, which are in Phoenix. The fourth property, Avilla Eastlake, is in Thornton, Colorado, 25 miles north of Denver. NexMetro has developed 60 projects nationwide since its founding in 2012. According to the company’s website, NexMetro’s current portfolio is made up of 43 properties. The financing structure includes $160 million in senior debt invested and managed by Blackstone. The …

SAN DIEGO, CALIF. — Sunroad Enterprises has secured $188 million loan for Vive Luxe, a 442-unit property in San Diego. Aldon Cole, Tim Wright and Bharat Madan of JLL Capital Markets represented the borrower in arranging the five-year, fixed-rate loan from accounts managed by global investment firm KKR. Built in 2021 at 4890 Sunroad Centrum Lane, Vive Luxe rises five stories. The community offers one-, two- and three-bedroom apartments ranging from 726 to 1,122 square feet. Of the total unit count, 23 have been set aside as affordable housing. Income …

LOS ANGELES — Florida-based Material Comforts Inc. has acquired a portfolio of 16 parcels in California’s San Fernando Valley. Heitman LLC, Invesco LTD and ETHOS Real Estate sold the portfolio for $85 million. The portfolio totals 596 apartments in the Van Nuys, Panorama City, North Hills and Canoga Park neighborhoods of Los Angeles. Tony Azzi of Marcus & Millichap represented the sellers, while Rabbie Banafsheha, Kristen Sullivan and Arteen Zahiri of Marcus & Millichap represented the buyer in the deal.

SANTA MARIA, CALIF. — Beverly Hills, California-based investment firm Kennedy Wilson has sold La Vista Apartments, a 460-unit community in Santa Maria. Boston-based private equity firm Westview Capital purchased the asset for $116 million. Joseph Grabiec, Kevin Green and Gregory Harris of Institutional Property Advisors, a division of Marcus & Millichap, represented the seller and procured the buyer. Built in 1979 on 31 acres, La Vista Apartments offers studio, one-, two- and three-bedroom floor plans. Each apartment features a large closet, kitchen with breakfast bar and a pantry. Select units also have vaulted …