PHOENIX — JLL Capital Markets has arranged two refinancing loans totaling approximately $64.3 million on behalf of Chicago-based Blue Vista Capital Management and Palm Desert, California-based Family Development. The partners own Villas Litchfield (153 units) and Villas Goodyear (151 units), two newly constructed build-to-rent communities in Phoenix’s West Valley. ORIX Corp. was the lender. The loans — $33.1 million for the Litchfield property and $31.3 million for the Goodyear community — will serve as construction takeout financing for the two assets, which both opened in 2025. Greystar is the property manager at …

Western

OCEANSIDE, CALIF. — CBRE has arranged the $14.4 million sale of The Flats, an 18-unit property in Oceanside, approximately 38 miles north of San Diego. CBRE’s Rachel Parsons, Philip Buckley and Anna Kampling represented FABRIC, the seller, in the sale. Conor Brennan, also of CBRE, represented the Dan and Cynthia Kronemyer Family Trust in the acquisition. The property was developed in 2024 and includes two ground-floor retail spaces totaling 2,785 square feet. Units are offered as one- and two-bedroom floor plans.

GLENDALE, CALIF, — IPA Capital Markets has arranged a $52 million refinancing loan for Arista Glendale, a 98-unit property in Glendale. Dwight Capital was the lender. IPA’s Stefen Chraghchian, based in Encino, California, arranged the five-year, interest-only loan. AHC Capital Holdings and Adept developed the property. Arista Glendale was a redevelopment of a former office building. Amenities include a resort-style pool with private cabanas, grills, an entertaining kitchen, coworking spaces, a package locker system, garage parking and a 24-hour fitness center.

LOS ANGELES — CIM Group has completed and opened Coro, a six-story, 168-unit property with 40,000 square feet of ground-floor retail in the West Adams neighborhood of Los Angeles. Units are offered as studios, one- and two-bedroom floor plans, and 17 apartments are reserved for households earning no more than 30 percent of area median income. CIM Group acquired the 1.3-acre Opportunity Zone property for the Coro project in 2023 from the West Angeles Church of God in Christ. Coro replaces the vacant former church, which relocated to the intersection …

SAN DIEGO — Locally based MG Properties has acquired Dylan Point Loma in San Diego from JLL Income Property Trust for an undisclosed sum. The seller was represented by Rachel Parsons and Derrek Ostrzyzek with CBRE. Fannie Mae acquisition financing for the transaction was arranged by CBRE’s Scott Peterson, Bill Childs and Brian Cruz. The 180-unit property opened in 2016 and consists of one-, two- and three-bedroom floor plans complemented by a resort-style saltwater pool, a fitness center, community club house, a conference room, game lounge, demonstration kitchen, dog park …

LA HABRA, CALIF. — CBRE has arranged the sale of two properties totaling 38 units in La Habra, an Orange County city about 27 miles southeast of Los Angeles. CBRE’s Dan Blackwell and Amanda Fielder arranged the transactions. Combined, the sales totaled approximately $12.3 million. The properties included The Bungalows on Monte Vista and Villa Monica. The Bungalows on Monte Vista, constructed in 1964, is located at 141–247 South Monte Vista St. The 18-unit asset sold for $6.4 million and traded at a 5.74 percent cap rate. The seller was …

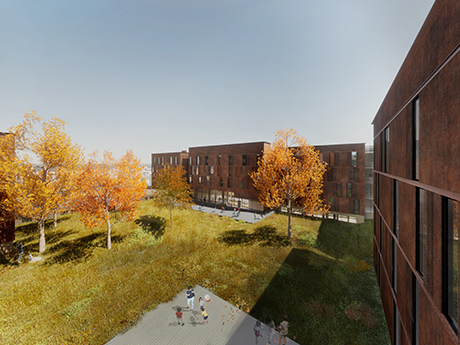

Public-Private Venture Begins Construction of $132 Million Mixed-Use Affordable Housing Development in Denver

DENVER — Globeville Redevelopment Partners, a joint venture consisting of several public and private members, has started construction on 4965 Washington St., a five story, mixed-use affordable housing community in Denver’s Globeville neighborhood. The $132 million project involves the redevelopment of a 2.7-acre, city-owned site that was formerly a car dealership. The project will include 170 apartments reserved for households earning between 30 and 80 percent of area median income. Developed in partnership with the Denver Public Library and the city and county of Denver, the lower level of the …

FREMONT, CALIF. — Berkadia has secured a joint venture equity partner for the final phase of development for Aurum, a 966-unit property adjacent to the Warm Springs BART station in Fremont. This final phase includes 336 units. Brett Betzler and Kaohu Berg-Hee of Berkadia’s Irvine and San Francisco offices brokered the deal. Aurum is located at 3300 Innovation Way and consists of a five-story, elevator-served building that features a structured parking garage, a fitness center, resort-style pool and approximately 4,900 square feet of ground-floor retail. Completion is expected in 2027.

Stockdale Capital Partners Buys Avant at Fashion Center in Phoenix Metro for $110.3 Million

CHANDLER, ARIZ. — Stockdale Capital Partners has acquired Avant at Fashion Center in Chandler for approximately $110.3 million. The 355-unit mid-rise community was built in 2017 and features a mix of studio, one- and two-bedroom units housed in seven, three- and four-story buildings on an 11.4-acre site. Amenities include a pool with a deck and cabanas, covered social areas, stainless steel grills, a resident lounge and a two-story fitness center. IPA’s Steve Gebing and Cliff David marketed the property on behalf of the undisclosed seller. This is Stockdale’s second acquisition …

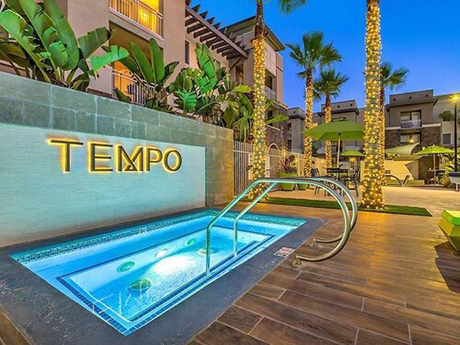

OXNARD, CALIF. — Bascom Northwest Ventures has sold Tempo at Riverpark Apartments in Oxnard to a venture led by Hines for $105 million. The Bascom Group acquired the 235-unit asset via a value-add fund in 2018 for approximately $75.3 million. The asset was developed by The Wolff Co. in 2015. Bascom invested approximately $1 million in upgrades during its hold period, during which Apartment Management Consultants was the property manager. Both buyer and seller were represented in the sale by Blake Rogers, Alex Caniglia and Kip Malo at JLL. Tempo …