PHOENIX, ARIZ. — Goodegg Investments has purchased North Edge Apartments, a 71-unit community in Phoenix, for an undisclosed price. According to Apartments.com, the property was completed in 1979 and consists entirely of one-bedroom units. Most of the apartments, as well as common areas, were renovated within the last 2 years. North Edge Apartments is the 38th multifamily community that Goodegg Investments has acquired since the company’s inception in 2018. The San Francisco, California-based firm now owns approximately 9,000 apartments, with roughly 4,500 currently under management.

Western

ONTARIO, CALIF. — Adept Urban Development has received $107 million in financing for the construction of a 384-unit community in Ontario, about 40 miles east of Los Angeles. The project is located at 4117 E Concours St., adjacent to the Toyota Arena, and will also feature 26,000 square feet of retail space. A development timeline was not disclosed. Stefen Chraghchian of Marcus & Millichap Capital Corp. arranged the financing through Affinius Capital and Bank OZK.

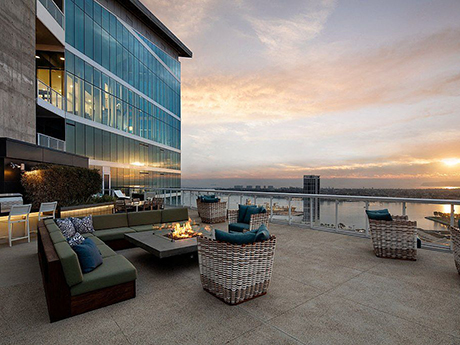

SAN DIEGO — MG Properties has acquired Park 12 Apartments, a 35-story high-rise property located in downtown San Diego, for $309 million. The property is situated adjacent to Petco Park, home of the San Diego Padres Major League Baseball team, within the Ballpark Village master planned community. Built in 2018, Park 12 offers a mix of studio, one-, two- and three-bedroom units, including penthouse units with exclusive access to a lounge on the 32nd floor. Shared amenities include pools with poolside event space, a fitness center, golf simulator and putting …

PARKER AND LAFAYETTE, COLO. — Bell Partners has acquired Bell Parker and Bell Lafayette, two assets located in the Denver metropolitan area. The company purchased the assets in separate transactions on behalf of its Bell Value-Add Fund VIII for a total of $185.8 million. Completed in 2002, Bell Parker is a 360-unit garden-style property located at 16950 Carlson Drive in Parker, roughly 25 miles southeast of downtown Denver. Bell Partners purchased the asset from Starwood Real Estate Income Trust for $103.3 million. JLL acted as the broker. Built in 2016, …

UPLAND, CALIF. — MJW Investments has acquired Coventry Square Apartments, a 92-unit community located in Upland, approximately 25 miles west of San Bernardino, California. MJW purchased the asset from an undisclosed seller in an off-market transaction. The sales price was also not disclosed. Built in 1980, Coventry Square Apartments consists of 46 buildings on 9.3 acres. The asset features two-bedroom apartments that average 1,178 square feet. Residents have access to amenities such as a pool, landscaped courtyards and on-site parking.

WEST SACRAMENTO, CALIF. — A partnership between The Bascom Group LLC and Oaktree Capital Management LP has acquired The Strand, a 408-unit property in West Sacramento. The garden-style asset traded for $126 million. The identity of the seller was not disclosed. The Strand was built in 2021 by MBK Rental Living. The property consists of 39 three-story buildings offering a mix of one-, two- and three-bedroom apartments. The average unit size is 885 square feet. Amenities include two pools with cabanas, a clubhouse, fire pits and gas grills, a spa …

BEAVERTON, ORE. — REACH Community Development and Mercy Housing Northwest have broken ground on Elmonica Station, a $51.8 million affordable housing project in Beaverton, eight miles west of Portland. The community will consist of 81 units for households earning at or below 60 percent of the area median income (AMI) or 30 percent AMI. Elmonica Station will feature a mix of studio, one-, two-, and three-bedroom apartments. Planned amenities include community rooms, outdoor play and gardening spaces, laundry rooms on all residential floors and a food pantry. The project is located at the …

EVERETT, WASH. — CEP Multifamily has purchased Nimbus, a 165-unit property located at 2701 Rockefeller Ave. in Everett, approximately 30 miles north of Seattle. David Young, Corey Marx and Chris Ross of JLL Capital Markets represented the seller, Trent Development, in the deal. The eight-story complex traded hands for $49 million. Completed in 2022, Nimbus offers a mix of studio, one- and two-bedroom units. Amenities include a coworking lobby, fitness room, arcade, entertainment kitchen and rooftop lounge.

PORTLAND, ORE. — Fairfield has secured a $26.4 million loan for the refinancing of 735 St. Clair, a 24-story building in Portland’s Goose Hollow neighborhood. The building consists of 212 apartments in studio, one- and two-bedroom layouts. Units range from 650 square feet to roughly 1,000 square feet. Joe Giordani, Scott Botsford, Brendan Golding, Alvin Cao and Stuart Oswald of Northmarq’s Newport Beach, California, and Seattle Debt + Equity teams arranged the permanent fixed-rate refinance loan through Northmarq’s direct Freddie Mac lender partnership. The loan features a five-year fixed term with …

LAS VEGAS — Steve Nosrat has joined The Mogharebi Group’s multifamily investment sales team as senior vice president in the firm’s Las Vegas office. The Mogharebi Group is headquartered in Costa Mesa, California. Nosrat’s prior commercial brokerage experience includes working with private capital, institutional transactions and new development. He comes to The Mogharebi Group from Avison Young, Las Vegas, where he was a principal. Previously, he was senior vice president at NAI Las Vegas.