— By Marc Hershberg, Topaz Capital Group —

The multifamily industry has grown massively over the past decade. Total transaction volume was up 250 percent from 2012 to 2018, the biggest year on record. For many, 2020 or 2021 were their best years yet.

Even when faced with multiple headwinds in 2022 that included ongoing supply chain disruptions, rising inflation and interest rate hikes, the overall resiliency of commercial real estate was on display. Now, however, we are faced with more economic uncertainty than we’ve experienced in the past 15 or so years. These adverse external headwinds can create ripple effects for multifamily investors and owners.

The situation provides the multifamily sector a golden opportunity. With all the wild-card variable expenses that are new since the most recent recession in the first decade of the 21st century, operational excellence is imperative.

Today, there are genuine concerns about the banking sector’s turmoil and volatility, property insurance costs, job and wage deceleration and taxes and payroll. All these concerns can erode margins, if not effectively managed. Employing creative and innovative solutions during this period to control expenses while increasing resident retention and increased leasing traffic is critical to keeping operating margins in the black.

Here’s a quick review of what the sector is currently facing, and a few ideas on how to respond:

Banking Sector Turmoil: On May 3, the Federal Reserve raised the federal funds rate a quarter point to a target range of 5 to 5.25 percent, up from near zero slightly more than a year ago. The decision, which marked the 10th consecutive rate increase by the Fed, comes as central banks around the globe confront banking-industry turbulence and stubbornly high inflation. The U.S. housing market is attempting to rebound, despite all this capital markets volatility.

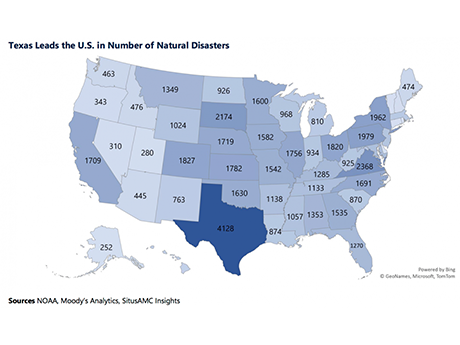

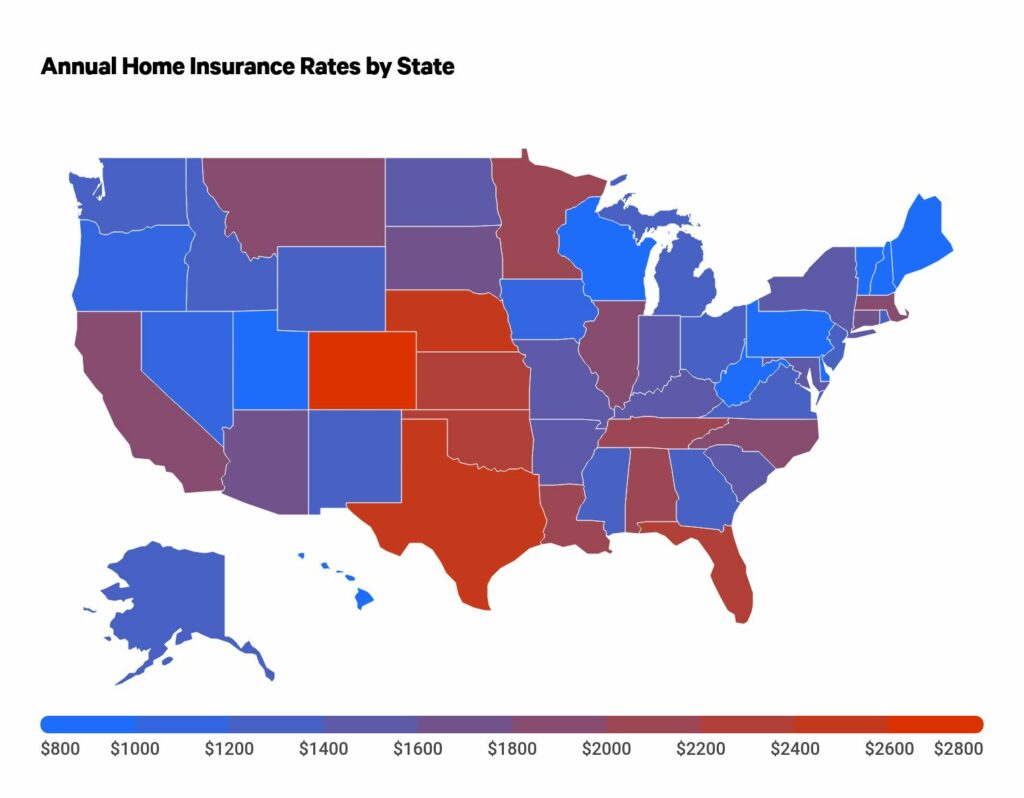

Property Insurance Rising: Seeing the spike in the chart above should drive anyone in pre-development to consider insurance a key influencer of design and material. The spike in costs follows directly behind increased construction costs for new buildings. Communities in development can lower risk through design, such as firewalls, and even location and asset selection. Managers and owners are approaching insurance brokers with portfolios versus individual properties to leverage scale and lower expenses.

Turnover and Retention: A vacant space is an expensive space. In multifamily, the unique relationship between the product — the customer’s home, workplace, play space and largest monthly expense — means service is key. Mitigating the expenses incurred in preparing a vacant unit for a new resident starts with resident retention, and the use of technology that can identify customer pain points is critical. Artificial intelligence platforms that bubble up concerns to on-site teams can increase customer satisfaction and lead to more positive online reviews, all while returning work hours back to the leasing team.

Utilities: The cost of utilities is increasing even as appliances and fixtures become more efficient, and smart managers are conserving and monitoring energy use. Controlling a vacant unit’s utilities with smart-home devices helps reduce the owner’s bill, and installing submeters with minute-by-minute connectivity immediately identifies energy peaks. Sensors and utility aggregators can also call out energy leaks and failing systems, leading to earlier repairs and a reduction in replacement costs.

Administrative and Maintenance Fees: Technology coming into the space will offer preventive alerts for maintenance, such as “this is the fifth visit for this air conditioner” or “this boiler is aging.” Almost all management companies track these types of issues, but not in a very efficient, technology-based way. New tools can also track employee engagement — how many service calls they’ve had or company events they’ve attended — to monitor for burnout.

The new generation of residents demands more virtual access to their homes (i.e. leasing bots, self-guided tours and apartment virtual apps) to help residents find, lease and live in rental housing communities on their own terms. Successful vendor partners must adapt and future-proof a community with new amenities and features, such as eco-friendly, solar-based buildings and services and electric vehicle charging stations.

Payroll and Taxes: Payroll and taxes, trailing the list of recent increases, has been growing for a decade. Finding and retaining key employees such as maintenance technicians from a small labor pool means not just making competitive employment offers but managing their timecards effectively. Equally, taxes have been increasing significantly for payroll across most of the country. New mobile-friendly service request programs manage parts inventory and can reduce the back and forth among suppliers, customers and management, with features including video and image sharing of problems and resolution, and digital project status updates.

Less physical oversight and implanted quality control increases efficiency and decreases repair time. As forward-thinking apartment communities shift from phone call to app, leasing and maintenance teams ensure fewer administrative duties and can focus on the customer experience. Smaller staff — or even no on-site staff — may not be far down the road.

Marketing and Leasing: Submarket competition, advertising costs and leasing demand ebb and flow on a daily/weekly basis. Top-performing digital marketing providers can provide dynamic offerings that adjust to the property’s needs, turning off an expense when the perfect balance of occupancy and retention is found. Other tech platforms adjust rental rates daily, anticipating turnover, seasonality and competition. Ultimately, you will want to buy the most expensive online apartment rental website packages coupled with four-plus Star Average Google Reviews until you exceed your pro forma rents — or at least be in a position to field higher leasing traffic.

Another primary solution to alleviate strain on onsite teams is automation. Many routine processes can be automated, which results in giving time back to associates. This includes simple tasks like following up on leads — without sacrificing personalization. Automation tools can be customized to send follow-ups at ideal times and tailor the communication based on where a prospect is in the apartment-shopping process.

The Investor’s Responsibility

As a multifamily sponsor and investor, your goal is to define a backup plan and alternatives and sensitize your portfolio and cash availability to determine if you have flexibility for future exposure. No matter how you’re impacted, reacting quickly (and being proactive) is crucial. In other words, risk management is a key factor to coming out on the other side of these challenges unscathed.

“After going through three major downturns in the multifamily real estate industry, one of the key factors in maintaining your appreciative values is to hold true to your operational fundamentals,” says Randy Ferreira, principal and CEO of Blue Roc Premier LLC, a Florida-based multifamily investment firm.

“The ‘back to basics’ philosophy while always striving to do the right thing in your organization will keep your management and construction firms well-grounded through the tumultuous times. Attention to detail relating to the needs of your existing residents and potential new residents on your properties is paramount.”

You are encouraged to shift your investments to markets and submarkets with high and somewhat proven potential of rental growth and stability and be well positioned not only to address current challenges but to take advantage of what may be once-in-a-generation investment opportunities as they become available.

This year, we already are seeing opportunities to recapitalize deals that need equity at attractive rates and in protected positions, and we also believe that we will be able to buy built assets and developments at significant discounts with flexible and developer-friendly financing structures.

While inflation coupled with the banking system instability is affecting every industry and household, multifamily is perhaps the least exposed to these external risks within all the CRE asset classes. But it does not mean that multifamily tenants and landlords aren’t susceptible to issues.

With expenses rising in almost every category of asset, property and construction management and multifamily operators/owners must develop a systematic approach to adopt and pilot technology and innovative systems to raise the quality bar while reducing costs.

These are just a few strategies to navigate this current climate in the short term in the face of increasing operational headwinds.

Marc Hershberg is managing partner and CEO of Topaz Capital Group, a New York City-based multifamily investment firm that was founded in 2018. Sources for data in this article include RealPage, The Federal Reserve and U.S. Consumer Price Index.