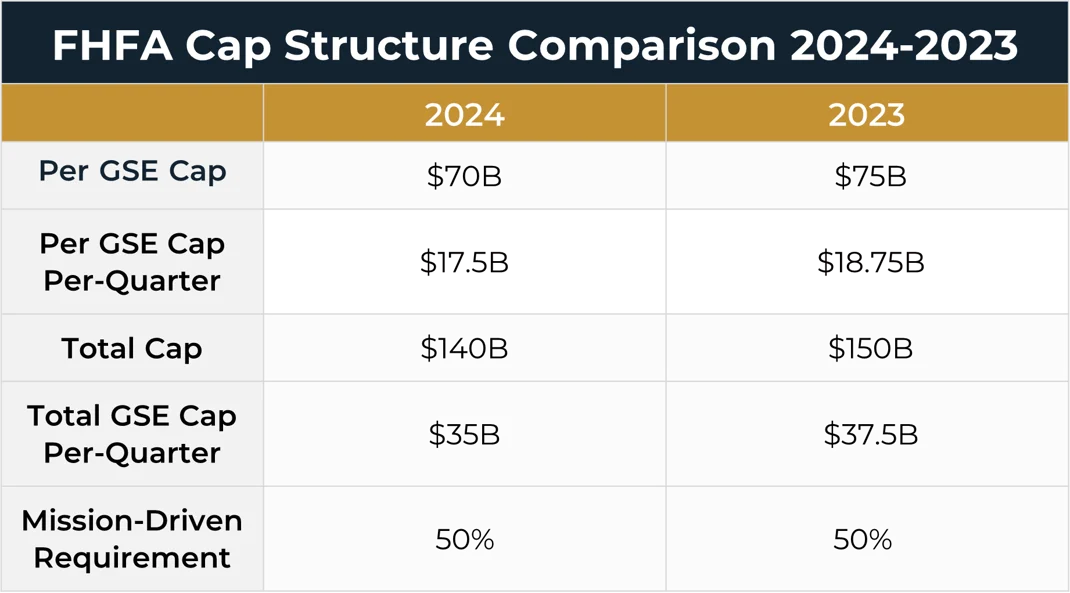

WASHINGTON, D.C. — The Federal Housing Finance Agency (FHFA) has announced that the multifamily loan purchase caps for Fannie Mae and Freddie Mac in 2024 will be $70 billion for each enterprise, for a combined total of $140 billion. FHFA’s 2023 volume cap is $75 billion for each agency.

Additionally, at least 50 percent of each enterprise’s multifamily business is required to be mission-driven affordable housing, which is unchanged from this year. Only loans classified as supporting workforce housing properties in Appendix A of the Conservatorship Scorecard will be exempt from volume caps. (The annual Conservatorship Scorecard provides FHFA’s guidelines to Fannie Mae and Freddie Mac for the upcoming year, including priorities and expectations for the two agencies.)

“The 2024 multifamily loan caps, coupled with the exemption for workforce housing properties from the caps, will promote the enterprises’ continued strong commitment to addressing the need for affordable rental housing,” says Washington, D.C.-based FHFA director Sandra Thompson.