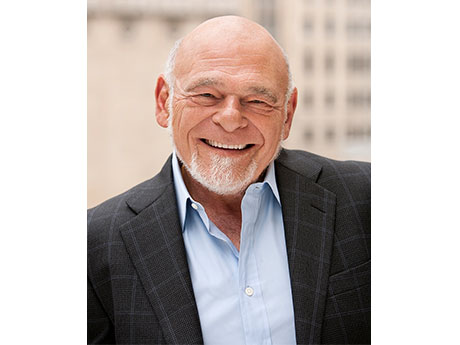

CHICAGO — Tributes highlighting the life and legacy of billionaire real estate investor Sam Zell, the charismatic founder and chairman of Chicago-based Equity Residential (NYSE: EQR) who died May 18 at the age of 81, have continued to pour in following his passing.

“Sam Zell was one of the most influential individuals, not just in commercial real estate, but in American business writ large. He was a great friend and an advocate on behalf of the multifamily industry,” said former National Multifamily Housing Council Chair David Schwartz in a statement from the organization. “Sam really was the godfather of the modern REIT (real estate investment trust) era with the creation of Equity Residential, Equity Office and Equity Lifestyle.”

“Sam Zell was a titan of the multifamily industry, and his memory will always be inextricably linked to success in both real estate and business,” said Bob Pinnegar, president and CEO of the National Apartment Association. “His pioneering spirit and friendship will be greatly missed, but his influence will continue to benefit many throughout the industry for years to come.”

According to Equity Group Investments, Zell passed away in his home due to complications from a recent illness. Zell was an active investor in real estate since the 1960s and helped popularize the REIT structure in the 1990s.

“Sam lived life testing his limits and helping those around him do the same. He was a self-made entrepreneur, an industry creator and leader, a brilliant dealmaker, a generous philanthropist and the head of a family he fiercely loved and protected,” said Scott Peppet, president of Chai Trust Co. and Sam’s son-in-law. “All those who loved and learned from him will miss him terribly.”

Zell was born in Chicago to Polish refugees Bernard and Rochelle Zielonka, who fled from Poland during the German invasion in World War II. He began his career by managing student housing apartments as an undergraduate at the Universityof Michigan.

Over the years, Zell invested in and grew businesses in multiple industries, including real estate, manufacturing, retail, travel, healthcare and energy. In 1990, Zell founded Equity Residential. The company was taken public in August 1993 and would grow into a $31 billion apartment owner, developer and operator under Zell’s leadership.

Zell founded Equity Office in 1976, and the company went public as a REIT in 1997. He sold the company to Blackstone Group for $39 billion in 2007. According to The Associated Press, this was the largest private equity transaction in history.

A month later, however, Zell acquired the Tribune Co. in a leveraged buyout. Infamously, Tribune Co. would declare bankruptcy less than a year later. According to the Wall Street Journal, Zell’s employees blamed him for the subsequent layoffs and the billions of debt the company accrued. Zell personally lost an estimated $315 million on the investment.

At the time of his death, Zell had an estimated personal net worth of $5.2 billion, according to Forbes. Zell was recognized by Forbes in 2017 as one of the “100 Greatest Living Business Minds.”

Zell was an active philanthropist with a focus on entrepreneurial education. Zell established several entrepreneurship programs, including the Zell Lurie Institute at the University of Michigan, the Zell Fellows Program for entrepreneurship at Northwestern University’s Kellogg School of Management, the Samuel Zell & Robert Lurie Real Estate Center at the University of Pennsylvania’s Wharton School and the Zell Entrepreneurship Program at Reichman University.

Equity Residential has appointed David Neithercut as chairman of the board of trustees effective immediately, a move that is consistent with Equity Residential’s long-term succession planning process. Mark Parrell, who has been CEO of Equity Residential since January 2019 and president of the company since September 2018, will continue to serve in his role. Equity Residential owns or has investments in 79,351 units across 301 properties.