AUSTIN, TEXAS — The NRP Group, in partnership with Austin Independent School District (AISD), has broken ground on Phase I of the Anita Ferrales Coy school-to-housing redevelopment in East Austin. A school operated on the 18 acres at 4812 Gonzales St. from 1916 to approximately 2018, after which time the property was used as an alternative learning center. AISD selected The NRP Group as a redevelopment partner in 2023, and last year, AISD was relocated to prepare for redevelopment. The first phase includes 341 units, while the second phase, estimated …

Top Story

Kane Realty Breaks Ground on Tributary Apartments in Raleigh, Announces 28-Acre Expansion and Next Phase of North Hills Innovation District

RALEIGH, N.C. — Locally based Kane Realty Corp. (KRC) has broken ground on Tributary, a 332-unit community within the North Hills Innovation District (NHID) in Raleigh. Tributary, designed by the Washington, D.C.-based architectural firm of Hickok Cole, will include 6,000 square feet of ground-floor retail, two courtyards, a digital content creation studio and a wellness center. The general contractor is John Moriarty & Associates. Completion is slated for spring 2028. NHID is a walkable, mixed-use destination situated around a tributary of Big Branch Creek and preserved wetlands. KRC also announced …

PHILADELPHIA — The Philadelphia Housing Authority (PHA) and partners LMXD and MSquared broke ground March 2 on the first phase of the Westpark Apartments redevelopment in West Philadelphia. The project as a whole covers 12 acres and will consist of upgrading existing structures as well as building new homes. The site is home to public-housing high-rises and was developed in the early 1960s. The project cost for Phase I, accounting for 327 new units, is approximately $205 million, according to the Philadelphia Tribune. WHYY reports the total project cost to …

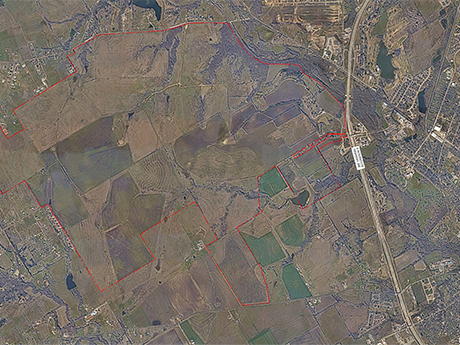

WAXAHACHIE, TEXAS — Minto Communities USA has acquired 3,170 acres in Waxahachie, 30 miles south of Dallas, where the Florida-based developer will build 13,270 new homes. Construction is expected to begin later this year followed by a multi-year buildout. The community will feature two residential districts — an active adult neighborhood and a traditional multifamily community — supported by approximately 140 acres of mixed‑use development. Plans include 750 multifamily units and 1.2 million square feet of retail and commercial space. Minto is planning amenities such as a town center, 400 …

LAS VEGAS — PCE Holdings, a California-based investment firm, has acquired Landing 36 in Las Vegas in an off-market transaction. The sales price was $79 million, and the seller was Craig Horn. Developed in 2025, the 308-unit community is comprised of studios and one- through three-bedroom floor plans complemented by amenities such as a resort-style pool and hot tub with shaded seating areas, a fitness center with cardio and strength-training equipment, a pet-friendly lawn with a play area and grilling and entertainment spaces. PCE’s strategy is to lease up the …

BOSTON — Mill Creek Residential has broken ground on Modera Allston, a midrise community in the Lower Allston neighborhood of Boston. The property, located at 250 Everett St., will feature 240 units in one-, two- and three-bedroom floor plans. Some units will include dens or private patios and balconies. Residents will have access to a rooftop deck, grilling area, clubhouse, a speakeasy-inspired lounge with a sports simulator, coworking spaces and private workstations and offices. A landscaped courtyard, pet spa, fitness center, electric vehicle charging stations, bike storage and a controlled …

DALLAS — Kushner has acquired Eastline Residences, a 330-unit, 28-story high-rise in Dallas. Northmarq’s Dallas-based Taylor Snoddy, Eric Stockley and Charles Hubbard arranged the deal on behalf of the seller, Convexity Properties. Convexity, a subsidiary of DRW, developed the community in 2021. The sales price has not been publicly disclosed, but, according to Northmarq, the trade reflected the second-largest residential sale in the metro area since 2022. Floors 25 through 28 feature penthouses with upgraded finishes and asking rents of approximately $6,500 per month. Amenities include a rooftop pool, a …

HENDERSON, NEV. — San Francisco-based multifamily investment firm Hamilton Zanze has acquired Fairways on Green Valley, a 320-unit garden-style community adjacent to the Legacy Golf Club in the Green Valley South neighborhood of Henderson, 18 miles southeast of Las Vegas. The deal closed on Feb. 19. Mission Rock Residential, an affiliate of Hamilton Zanze, has assumed the role of property manager. The purchase marks Hamilton Zanze’s first in 2026. The company acquired seven properties last year. Fairways on Green Valley was developed in 1990. The one- and two-bedroom units are …

BROCKTON, MASS. — Massachusetts Housing Finance Agency (MassHousing) has provided $50 million for the first phase of redevelopment at the Campello Apartments campus in Brockton, approximately 24 miles south of Boston. The total project cost is $115.3 million. The distressed public housing community was built in 1972. In the first of three redevelopment phases, a new seven-story, 144-unit building will be constructed. The overall plan calls for the demolition of one single-story and two high-rise buildings, which currently include 398 public housing units. The demolished buildings will be replaced with …

WinnDevelopment and Partners Launch Construction of $26M Renovation of Carroll Street Houses in Paterson, New Jersey

PATERSON, N.J. — WinnDevelopment, ART-JIUS, a locally based developer, and Rising Dove Carroll Street Houses, a nonprofit affiliate of Paterson’s Second Baptist Church, have begun the redevelopment of Carroll Street Houses, an 88-unit affordable housing community in Paterson. The $26 million renovation of the townhome-style property, originally developed in 1977, is anticipated to be complete within 18 months. Residents will remain in-place during construction. The LIHTC project will ensure rents remain affordable to households earning at or below 80 percent of area median income for the next 30 years. Rising …