Stability is a defining characteristic of the Northern New Jersey multifamily market. Unlike some markets that are prone to dramatic booms and busts, the region has long benefited from a diverse economy, proximity to New York City, an educated workforce and a steady flow of young professionals and families seeking high-paying jobs.

These fundamentals have allowed North Jersey to thrive over the past few years, with immigration fueling population growth and new industry clusters producing new jobs. These trends will drive demand for rental housing and allow investors to find strong risk-adjusted returns in the multifamily sector.

Strong Fundamentals Attract Industry

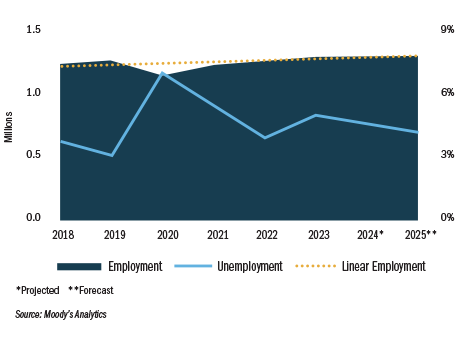

New Jersey was already one of the most densely populated states in the country, but the state’s population reached a record 9.5 million in 2024, according to the U.S. Census Bureau. Additionally, the state has added 176,900 new jobs over the past four years, a 4 percent gain since 2020.

This population increase has driven economic growth and demand for housing. Immigration into the region has played a significant role in the population explosion, which expanded the labor force, led to new business creation and helped offset some of the out-migration to other parts of the country.

North Jersey is less susceptible to large economic downturns due to its diversified economy. Life sciences, pharmaceuticals, advanced manufacturing, technology and financial services are all industries represented by employers in the area — and most require a highly trained workforce. As a result, New Jersey has the second-highest median annual income in the nation according to U.S. Census data, hovering at around $100,000.

One of the more exciting recent economic developments for the state is the expansion of the media industry.

Thanks to a 2018 program that offers tax-credit incentives for film and TV production companies, the industry has created roughly $2.15 billion in wages and 19,000 jobs since 2020, according to the Motion Picture Association of New Jersey. That number is expected to reach $1 billion annually by 2026, in large part due to two major projects, which are both in North Jersey.

Lionsgate Studios and the New Jersey Performing Arts Center have formed a partnership to transform a former public housing complex in Newark into a 300,000-square-foot production studio with five stages. Additionally, roughly an hour away in Monmouth County, Netflix plans to build a $1 billion studio complex on a former U.S. Army base.

These developments are expected to create thousands of new jobs across various sectors, from production crews and creative professionals to hospitality and infrastructural roles. As these projects ramp up, they will drive new demand for housing in surrounding submarkets.

Affordability Bolsters Submarkets

Nearly all submarkets throughout North Jersey experienced strong demand, low vacancy rates and consistent rent growth in 2024.

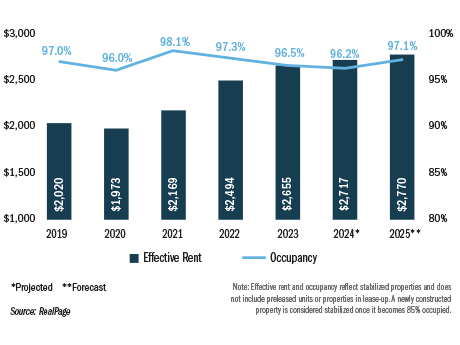

The North Jersey market absorbed more than 13,000 apartments between the third quarters of 2023 and 2024, according to Berkadia Research, which increased effective rent by 4.2 percent to an average of $2,745 per month. By the end of 2025, apartment occupancy is expected to climb to 97.1 percent, with effective rents rising 2 percent to an average of $2,770 per month.

The relative affordability of cities such as Hoboken and Jersey City is another major draw for renters. Many North Jersey cities offer several of the same advantages of larger cities, such as new-construction options, a variety of retail and restaurants and accessible public transit, at a lower cost of living. As of the third quarter of 2024, effective rent in New York stood at $4,544 — almost $2,000 more than the effective rent in North Jersey.

Suburban communities have also seen strong demand since 2020. This is in large part due to the shift to hybrid work, which has encouraged renters to seek housing options that strike a balance between urban convenience and suburban lifestyle benefits. As long as properties remain within reasonable commuting distance to key employment hubs such as New York City, they will continue to attract strong interest from renters and lease quickly.

Buyers Ready to Enter Market

Investment activity in New Jersey, like elsewhere in the country, was constrained by interest rate volatility last year. However, Berkadia Research indicates that deal activity is likely to pick up in the second half of 2025 as consumer sentiment has changed.

While bid-ask spreads were previously wide due to uncertainty in the capital markets, buyers and sellers appear to be closer to a meeting of the minds, with sellers feeling ready and buyers playing catch-up after two years on the sidelines.

With many optimistic that interest rates will come down, bridge lenders may be active this year in helping investors reach their acquisition targets. We expect that value-add properties will be among the most desirable for investors, but there may also be opportunities in new construction as well.

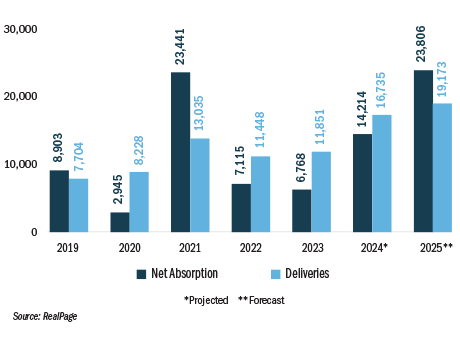

New Jersey, like many parts of the country, saw a post-pandemic multifamily construction boom. New deliveries are projected to peak in 2025 in North Jersey, but absorption is expected to significantly outpace new deliveries. Berkadia expects more than 23,000 apartments to be absorbed by year’s end.

A major state-level policy change could also impact the multifamily development pipeline. Landmark legislation signed last year to address a shortage of affordable housing in the state holds municipalities accountable for creating thousands of more affordable housing units by 2035. Municipalities have until next year to finalize plans — but that is something the development community will also be watching closely.

North Jersey remains a well-positioned multifamily market at the start of 2025, offering a compelling combination of stability, strong demand drivers and new growth catalysts. Opportunity continues to abound in the region, whether through investment, development or repositioning strategies.

Those who successfully establish themselves in North Jersey typically recognize the market’s long-term strength and stability. For investors and developers looking at the New Jersey multifamily market in 2025, the key is to act decisively. Many prospective out-of-state buyers hesitate or overanalyze deals, only to see those opportunities pass them by.

— Nat Gambuzza is a senior managing director with Berkadia. He is based in Berkadia’s investment sales office in Morristown, New Jersey. This article originally appeared in the January/February issue of Northeast Multifamily & Affordable Housing Business.