Members of Generation Z — born between 1997 and 2012 — are all in on artificial intelligence (AI). These young renters are not only fluent and reliant upon intelligent technology, but they are also more trusting of it than their elders.

Gen Zers are more likely than other age groups to ask questions via chat or text during their apartment rental search journey, according to RealPage data, and they are even more likely to engage if AI is driving the messaging. In fact, 50 percent of Gen Zers say they are in favor of living at a property that’s entirely automated and employs no on-site humans at all.

Research from career-placement firm INTOO drives this point home: 47 percent of Gen Zers say ChatGPT gives better career advice than their workplace managers. The multifamily industry is listening intently to — and acting upon — data points like these because Gen Z will make up the majority of U.S. renters by 2030, according to the National Apartment Association (NAA).

Most experts in multifamily leasing and marketing say AI’s time has come. When it’s firing on all cylinders, the technology is well-matched to many new challenges pressing down on the industry today.

What Makes AI So Special?

AI is a step beyond standard-issue property management software. A property’s customer relationship management (CRM) system can, for example, organize routine operations such as rent collection.

Adding AI tech to the mix not only organizes routine procedures but also advances these functions by adjusting processes based on learning as it goes.

In a Darwinian sense, the technology adapts to data that users program into it as well as data collected while managing tasks. Then it evolves and performs the tasks more effectively and efficiently.

“The multifamily industry demands a modern set of tools and touchpoints that not only remove friction for residents and enhance their experience but also fit seamlessly into the property technology platforms that operators, property staff and leasing teams use today to support residents and manage the business,” says Lance French, chief information officer with RealPage.

“At RealPage, we see the future as how to best personalize and digitally optimize the renter experience. We’re doing that by making strong investments in data and artificial intelligence platforms.”

RealPage debuted the Lumina AI Platform in April 2024. The tech uses AI for leasing, analyzing market trends, revenue management, maintenance and more.

AI commonly used in the realm of leasing includes chatbots that can schedule tours or answer questions. AI also can be used for tenant screening or for identifying prospects most likely to rent.

Costs to implement AI technology vary. Most multifamily owners opt to buy AI products off the shelf while a smaller number of owners, such as Scottsdale, Arizona-based Mark-Taylor Cos., develop their own.

Mark-Taylor develops, owns, self-manages and third-party manages multifamily properties primarily in Arizona and Nevada. In 2018, the company began centralizing leasing operations after identifying inefficiencies in call-response rates between on-site property staff and prospective renters. The company wanted AI to help achieve its goals by tailoring a product that provided custom-fit solutions to specific challenges.

“This approach allowed us to avoid software cluttered with non-essential functionality and ensured we were not constrained by solutions that no longer fit our evolving needs,” says Dustin Lacey, vice president of marketing and technology with Mark-Taylor Cos.

“It is important to note that Mark-Taylor does not absorb the development costs — which are significant — and, as a result, does not own the AI technology. To my knowledge, co-development partnerships (between multifamily and tech companies), where the owner/operator shares both development costs and ownership, are rare.”

Several factors influence decisions about where to spend money on AI. Lacey says owners and operators must evaluate their entire business through the lens of cost reduction and performance improvement when deciding which AI technologies to invest in — or to avoid.

“Given the vast array of AI use cases, narrowing down areas of focus can be challenging,” says Lacey. “We prioritized large functions such as call answering, centralized lead and resident channel management and maintenance

management.”

Expenses and internal resources needed to define the product roadmap internally and to support tech development can be more than some organizations can handle, says Lacey.

Is the Leasing Office Going Extinct?

AI’s capabilities are a boon for apartment managers who struggle to keep leasing offices staffed with real, live people.

NAA reported that, nationally, the property staff turnover rate was 33 percent as of 2022. This means that about one-third of property management employees left their jobs in 2022.

Industry-wide, that figure is now estimated to be well over 40 percent, according to Lacey. He adds that staff hired specifically for leasing likely have an even higher turnover rate that exceeds 40 percent. Compensation and the full-time, on-site requirement are among the causes turning jobseekers away from property management work.

The Bureau of Labor Statistics reports leasing agents earned an average annual salary of $37,510 in 2023. In addition to relatively low pay, most employees today want a remote or hybrid work schedule.

Before the pandemic, only about 5 percent of U.S. employees worked primarily from home, according to Global Workplace Analytics. A Pew Research Center survey conducted in 2022 found that 60 percent of workers desire to work from home full-time or part-time even after pandemic restrictions were lifted a few years ago.

“This highlights ongoing challenges as it relates to consistent performance and retainment of talent at this level,” says Lacey. Mark-Taylor’s hybrid leasing model means that some properties have their own on-site leasing offices while others outsource leasing to a central office.

Lacey says centralized leasing in multifamily might be considered a novel concept, but it is gaining traction. “Many multifamily companies are still in the early stages of exploring or piloting their approach, but the industry is clearly moving toward a broader adoption of centralized leasing,” he says.

This shift can even be seen in the physical footprint of some newer communities. Jim Elsman, vice president of development for Chicago-based Draper and Kramer, says that rather than dedicating a full-sized office to leasing, the company is building its newer developments with more of a hotel-style concierge kiosk that serves multiple functions, in addition to leasing.

Mark-Taylor’s offsite leasing office fields tasks such as virtual touring, application management, appointments, calls, emails, legal issues, move-outs and collections. AI handles many of these jobs. “Centralized leasing relies heavily on advanced technology, which serves as a fundamental component and prerequisite for a successfully centralized operating model,” says Lacey.

Additionally, AI technology listens to phone calls, analyzes prospects’ questions and suggests appropriate responses, which further streamlines the leasing process.

“AI tools have significantly enhanced our ability to manage workflows and deliver a more consistent, seamless leasing experience,” says Lacey. Centralized leasing has enabled the company to double the industry-wide call-response rate of 30 to 40 percent, says Lacey. “This drives higher conversion rates and reduces reliance on paid ads. As proof, Mark-Taylor is proud to be ILS (internet listing services) independent since 2018.”

A conversion rate refers to the percentage of prospective renters, or leads, who transition into residents. It is a key performance metric used to evaluate the effectiveness of leasing efforts and marketing strategies.

Property management companies have a complicated relationship with internet listing companies, such as Zillow or apartments.com. They catch the eyes of renters, but the service is costly and leaves property owners and managers with a lack of control over branding.

AI Does the Talking

Many property managers are dipping their toes into the AI-for-leasing pool by way of chat-based conversational AI.

The Breeden Co., for example, uses the AI component within AppFolio, which debuted in 2023, for introductory conversations with potential tenants. When prospects message a community, their first interaction is with an AI leasing assistant named Lisa.

Lisa is fully programmed by Breeden, meaning she only communicates what the property manager wants her to say. The AI susses out info from website visitors such as how much they want to pay for rent, when they’re looking to move in and whether they have a pet. It is like a first line of defense that analyzes potential tenants, prioritizing those that are most serious about moving.

“This AI has taken the burden off our onsite teams,” says Christine Gustafson, vice president of marketing and public relations for The Breeden Co. “Twenty or 30 years ago, we just wanted the phone to ring and didn’t care who was on the other line. Now, with this AI component, it’s quality over quantity for our teams. Instead of massaging a lead, our staff can be focused on resident experience and customer service.”

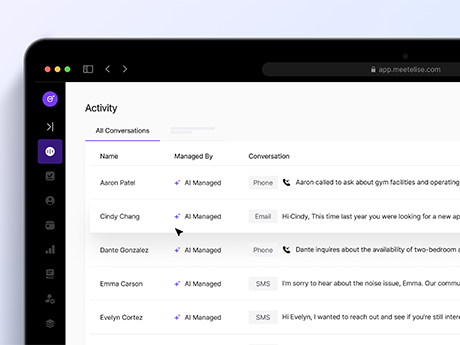

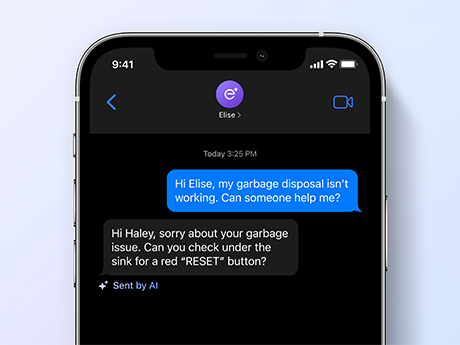

Venture-capital funded companies, including EliseAI, are entering the multifamily space, developing technology meant to ease the burden of understaffed leasing offices.

EliseAI products integrate with existing property management platforms, automating aspects of prospect management that previously required manual work from leasing agents.

According to Jacob Kosior, vice president of client strategy with EliseAI, the company’s conversational AI products respond to all prospect inquiries within five minutes, with some response times as quick as 30 seconds. This ensures that no leads are missed, even if the prospect reaches out in the middle of the night.

“Our hope is that our partners can start to re-examine their marketing spend, knowing now they don’t have to overspend to compensate for leads lost,” says Kosior.

Like Breeden’s tech, the EliseAI tool is designed to meet specific needs of individual property teams. The AI also monitors agent-to-prospect or agent-to-current-resident chats, incorporating agent responses into the AI’s knowledge bank when the computer encounters an answer to a question the AI did not previously know. The intent is for the AI to be able to answer that question in subsequent conversations.

“The AI is reviewing outbound communications to see what more it can learn,” says Kosior. “If an onsite team member answers a question about public transportation, for example, and there’s no knowledge that’s already in the system about that topic, the AI will surface and ask: ‘I saw you gave this answer about public transportation. Is this the answer you’d like to give to every prospect going forward?’”

EliseAI’s “knowledge bank” houses all the AI’s information about the property and organization at large. A section called “pending knowledge” catalogs information from agent-managed conversations that isn’t already in the AI’s knowledge bank, strengthening the self-learning component of the AI.

“We’ve seen conversations where a prospect might ask, ‘What utilities are included in the rent?’ And the AI will convey what’s in its knowledge about the subject,” explains Kosior. “However, it might have seen in another conversation that a leasing consultant said, ‘Electricity runs around X dollars per month.’ So, the AI will see that and ask, ‘Do you want me to convey this to every prospect now — that utilities run around X per month?’”

Kosior says EliseAI is also working on new lead-scoring capabilities, which would review data to find out which types of conversations were most likely to convert to leases. “These are some of the gaps in the leasing and marketing aspect of the industry that we’re trying to fill now with the data we have from these rich conversations with prospects.”

A growing number of companies are partnering with similar third-party vendors to explore AI. RKW Residential, for example, uses Apartment List’s Lea Light, which vets and routes leads to RKW’s leasing teams and Funnel’s virtual assistant, an AI tool that converses with prospects 24-7.

“By integrating these AI-powered solutions, we’ve been able to streamline lead management and enhance our team’s efficiency, ensuring that they can focus on the most promising opportunities while AI handles the rest,” says Sarah Randolph, director of marketing technology and IT solutions at RKW Residential.

The Charlotte, North Carolina-based property management firm also conducted an internal study comparing the productivity of two similar properties in the same market, one using a 9 a.m. to 6 p.m. leasing team and the other using a 24-7 virtual leasing agent.

RKW learned that 72 percent of property tours were scheduled afterhours by AI. The AI control group saw a 50 percent boost in tour-to-lease conversions compared with the other group.

James Love, vice president of marketing and brand with Draper and Kramer, says AI-driven chatbots and virtual assistants generate more targeted leads by engaging prospects in real time, gathering information on their preferences and identifying high-intent renters. “Through personalized, conversational interactions, they qualify leads and direct the most promising ones to leasing teams, helping streamline and improve lead quality.”

Renters Still Need a Human Touch

While AI seems almost too good to be true on many fronts, property managers say the technology can only go so far, for now. For example, Gustafson says she is leery about allowing AI to converse about sensitive subjects, such as Fair Housing laws, affordable housing or information about schools.

So when those questions are posed to Breeden’s AI, a human employee answers, not Lisa. “In marketing, it’s better to keep messaging broad, and it’s important to ensure your messages are inclusive and promote diversity. This is where I don’t trust AI.”

According to IBM, the models on which AI is based absorb social biases and subtly embed them in the copious amounts of data used to develop AI tools.

Renting a home is a personal — and sometimes emotional — decision. Not all aspects of that decision are best left to a machine. Randolph says RKW’s virtual leasing assistant is exceptional at interacting with prospects in real time, answering inquiries and nurturing leads around the clock. But it’s not all things to all people.

“While AI plays a crucial role in automating and streamlining many processes, we recognize that some prospects still prefer in-person tours or a personal conversation over the phone,” she says. “We don’t view AI as a replacement for human interaction, but as a complement to it.”

Gustafson shares a similar view. “With artificial intelligence, you can’t do all or nothing because you are dealing with people and their homes. While it is possible to set up tours online, sign a lease online, get a code and move in, I think that creates a break in the renting experience. People move to our communities for social engagement.”

— By Lynn Peisner. This article originally appeared in the March/April issues of Multifamily & Affordable Housing Business.