WYOMING, MICH. — Cherry Health and Woda Cooper Cos. have broken ground on Shea Ravines, a 56-unit affordable housing community in Wyoming, about six miles south of Grand Rapids. Shea Ravines will be a LEED-certified, four-story building with an elevator. It will offer 40 one-bedroom and 16 two-bedroom apartments for singles, families and seniors who earn up to 80 percent of area median income. The property will have 20 Permanent Supportive Housing (PSH) units. These units are specifically reserved for people experiencing homelessness or people with disabilities. The PSH units …

Affordable Housing

Specialized Financial Institutions Help Affordable Housing Developers Get Shovels in the Ground

By Noni Ramos Across the country, affordable housing is facing intensifying headwinds. From Oakland to Omaha, developers are navigating rising construction costs, protracted approval processes and a funding landscape that rarely aligns with the urgency or complexity of the work. Public subsidies — while essential — are often insufficient to bring projects across the finish line. These conditions are particularly acute in high-cost regions, but they are playing out in communities of every size and type. In the face of these challenges, community development financial institutions (CDFIs) are stepping up. …

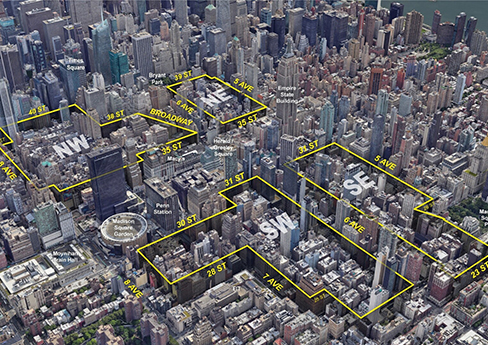

NYC Planning Commission Approves Midtown Manhattan Rezoning Proposal to Add Thousands of New Residences

NEW YORK CITY — The New York City Planning Commission has approved the Midtown South Mixed-Use Plan (MSMX), a rezoning initiative that could ultimately facilitate the creation of as many as 9,700 new residences across a 42-block section of Midtown Manhattan. The MSMX plan covers four areas centered around Herald and Greeley Square, located between West 23rd and West 40th streets, as well as Fifth and Eighth avenues. The area today is largely defined by commercial and industrial uses, with current land-use rules restricting new housing development. Midtown South is …

Decatur Housing, PAHI Complete First Phase of $49 Million Ground-Up Affordable Housing Development

DECATUR, GA. — The Housing Authority of the City of Decatur (Decatur Housing) and nonprofit developer partner Preserving Affordable Housing Inc. (PAHI) completed Phase I and broke ground on Phase II of Village at Legacy on June 18. Once completed, the two-phase development will offer 132 one-, two- and three-bedroom residences across two phases and in a variety of floor plans including townhomes and apartments. The first 66 units in Phase I are being delivered under a $20.4 million construction contract with total project costs reaching $27.9 million. The second …

SAN FRANCISCO — MidPen Housing, along with the City of San Francisco, has broken ground on two affordable housing communities in San Francisco. Combined, the buildings will include 167 units for low-income families and employees of the San Francisco Unified School District and the San Francisco Community College District. Rent restrictions and a construction timeline were not disclosed. In 2019, California Gov. Gavin Newsom signed an executive order allowing state agencies to use excess properties for affordable housing development. In May 2021, the state of California selected MidPen to develop …

Woda Cooper, Parallel Housing Deliver First Phase of $36.7 Million Affordable Housing Project in Madison, Georgia

MADISON, GA. — Woda Cooper Cos. and Parallel Housing opened Carmichael Commons in Madison on June 18. The $18.2 million, 60-unit townhome community is comprised of eight one-bedroom, 32 two-bedroom and 20 three-bedroom townhomes. Units are reserved for residents with household incomes up to 50 and 60 percent of area median income (AMI). Six units are offered at market rates without income restrictions. The developers also are underway constructing Prior Farms, an $18.5 million, 40-unit build-to-rent community on adjoining land. The two-phase project will include a new park developed by …

DALLAS — LEDG Capital has secured the financing necessary to convert an existing mixed-income property to an all-affordable community and to complete a $5.2 million renovation. Under the plan, the 90 market rate units at Paradise Gardens will be converted to affordable housing for 30 years under a Low-Income Housing Tax Credit agreement, while the Housing Assistance Payment contract protecting the remaining 23 units, which was due to expire in May 2025, will be renewed for 20 years. Under the new rent and income restrictions, apartments will be affordable to households …

CHICAGO — Lument has provided $90.6 million in Fannie Mae loans to refinance four Chicago properties with a total of 654 units. All the communities are located in the Lakeview neighborhood on the city’s North Side and were constructed in the 1920s. Lument, a Fannie Mae lender approved to originate and service loans under the agency’s Delegated Underwriting and Servicing (DUS) program, secured the debt on behalf of BJB Properties. The loans replace existing life company debt for BJB, a Chicago-based operator focused on long-term holds. Evan Hom, a senior …

Denton, Texas — Berkadia has arranged approximately $132 million in loans through its newly launched construction-to-permanent financing program. The loan proceeds will fund building and mortgage costs of Jefferson Bonnie Brae, an affordable housing development in the Dallas suburb of Denton. JPI is the merchant developer. When complete, the project will be solely owned by the Denton Housing Authority. Senior Managing Director Tim Leonhard of Berkadia Affordable Housing arranged the financing. The property will include 461 units, half of which will be reserved for families earning no more than 80 …

LOS ANGELES — BH Properties has launched Haven Housing, an affordable housing company, and hired Connor Mortland to lead it. Mortland, formerly senior vice president of investments at Avanath Capital Management, will be based out of the firm’s San Diego office. As managing director and head of affordable housing acquisitions, he will direct Haven’s strategy to acquire and operate affordable and market-rate assets in the Western United States. Haven Housing aims for garden-style, value-add acquisitions with 100 or more units with value-add potential in Texas, Arizona, Nevada, Oregon, Washington, Colorado …