ATLANTA — Affordable housing is facing a tumultuous second half of the year. Tariffs on building materials such as lumber, steel and aluminum are slowing development activity as they elevate construction costs. Investment sales are also likely to be impacted by unstable economic conditions in the affordable housing sector, where many transactions are conducted within a limited budget due to the nature of income restrictions for renters. Amid high costs and trade uncertainty, many investors are making the decision to stay on the sidelines or invest in markets with more …

Features

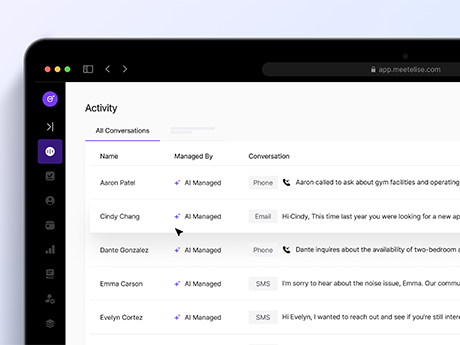

Members of Generation Z — born between 1997 and 2012 — are all in on artificial intelligence (AI). These young renters are not only fluent and reliant upon intelligent technology, but they are also more trusting of it than their elders. Gen Zers are more likely than other age groups to ask questions via chat or text during their apartment rental search journey, according to RealPage data, and they are even more likely to engage if AI is driving the messaging. In fact, 50 percent of Gen Zers say they are …

Developers of affordable housing in the United States are flummoxed by the Trump administration’s bull-in-a-china-shop approach to breaking bloated bureaucracies. Like their brethren in the market-rate multifamily sector, affordable housing developers are anticipating potentially higher material costs because of tariffs and generally elevated interest rates. But more specific to the affordable sector, developers remain in the dark as to how the administration’s view on housing policies and programs will impact their ability to build low-income units in the coming months and years. Within two months after assuming office, the Trump …

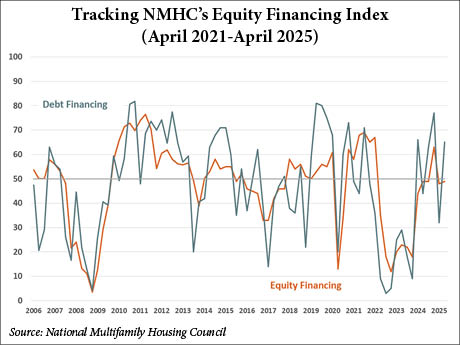

WASHINGTON, D.C. — Multifamily executives across the nation report that deal flow is increasing and debt financing conditions are improving, according to the National Multifamily Housing Council’s (NMHC) latest quarterly survey. But there’s a caveat. While respondents were confident about first-quarter market conditions, such as improving rent-growth trends, those who completed the survey after the April 2 tariffs were announced expressed a conspicuously different opinion. According to NMHC, about half the respondents completed the survey before the tariffs and the other half submitted responses after. The April 2025 Quarterly Survey of Apartment …

Texas Multifamily HVAC Trends: Why Developers Prefer All-Electric, All-Climate Heat Pumps

By Randall Towb of Mitsubishi Electric Trane HVAC US (METUS) Texas multifamily owners and developers are utilizing all-climate variable capacity heat pumps and variable refrigerant flow (VRF) systems for heating and air-conditioning (HVAC) needs in their low-rise, mid-rise and high-rise buildings. These systems deliver on both resident satisfaction and building owners’ return on investment (ROI) thanks to key benefits such as energy performance, zoned comfort, design flexibility, quiet operation, reduced maintenance and advanced controls and monitoring. In addition to resident comfort and ROI, these all-electric systems align with growing concerns …

WASHINGTON, D.C. — Economic uncertainty has continued to be a primary concern for multifamily construction and development firms. More than half say current and future projects have experienced construction delays, according to the National Multifamily Housing Council’s (NMHC) Quarterly Survey of Construction & Development Activity. Fifty-eight percent of respondents stated they had experienced construction delays between January and March in the jurisdictions in which they operate. The most frequently cited causes for delays were economic uncertainty (68 percent) and economic feasibility (68 percent); followed by permitting, entitlement and professional services (58 percent); availability of construction …

For most of 2024, relatively high property values combined with rising interest rates priced buyers out of the market for new commercial and residential real estate acquisitions. This slowdown has not only impacted investors and homeowners, but it’s also affected the entire real estate industry — from lenders to appraisers, brokers, law firms, title insurance companies and beyond. Because Section 1031 exchange activity moves in lockstep with the real estate investment cycle, activity for qualified intermediaries has slowed as well. Section 1031 exchanges traditionally have been used by investors to …

Property owners are learning how to provide fast internet at their communities for good reason. According to a 2024 renter preferences survey by the National Multifamily Housing Council (NMHC) and Grace Hill, high-speed internet is one of the top requirements for renters today. Ninety percent of respondents said they would not rent without it. Lisa Clark, senior director, MDU sales, with Lumos goes a step further, calling internet the “fourth utility,” behind water, electricity and gas. Consistently strong internet doesn’t just power remote work and streaming services, it’s the fuel …

WASHINGTON, D.C. — Rising insurance costs are standing in the way of building more affordable housing. According to a survey from the National Multifamily Housing Council (NMHC), about 77 percent of owner/developer firms reported rate increases of up to 20 percent or more compared with 2023 costs. NMHC’s 2024 State of Multifamily Risk Report attributes the high costs to a variety of factors, including increased cost valuation, limited capacity within the reinsurance market, shrinking underwriting capacity and restricted availability of guaranteed cost/zero deductible programs. Previous NMHC research, such as the 2023 State of …

When it comes to access control and security at multifamily communities, the mechanical lock-and-key system is as old and reliable as ever. However, many property owner-operators are in search of a more advanced security solution and are increasingly turning to digital access control to satisfy that demand. A digital access control system is a technology-based system to regulate who can access a property and when. There are two types of digital access control systems: online and offline. An offline access control system does not require Wi-Fi or cellular network connectivity. …