By David NelsonTo the general public, Reno, Nevada, conjures up visions of casinos, nightlife, giant neon signs and vintage mid-century motels, as well as the beauty of nearby Lake Tahoe. In the multifamily investment world, the metro is drawing increased attention because of its limited incoming supply, steady population growth, business-friendly environment and diversified employment base, which combine to create a strong apartment market that can deliver attractive returns. Reno, which calls itself “The Biggest Little City in the World,” may not be on investors’ radar as prominently as some …

Investment Sales

PALM BEACH GARDENS, FLA. — The Dermot Co., in partnership with Dutch pension fund provider PGGM and TD Asset Management (TDAM), has acquired The Quaye, a 341-unit community in Palm Beach Gardens. Affinius Capital originated a $110 million loan to support the acquisition. Walker & Dunlop’s South Florida Investment Sales team, led by Still Hunter, arranged the sale, while Walker & Dunlop’s Aaron Appel, Dustin Stolly and Michael Ianno arranged the financing. The community is comprised of one-, two-, three- and four-bedroom apartments and townhomes. It is situated on a …

CHICAGO — Interra Realty has arranged the $11.7 million sale of a 46-unit apartment building at 4400 Drexel Blvd. in Chicago’s Kenwood neighborhood. Neither the buyer nor seller’s identity was disclosed. Interra’s Lucas Fryman represented the seller during the 2020 trade when the party was on the buy side. The community was 91 percent occupied at the time of the sale. Rents are subsidized via vouchers administered through the Chicago Housing Authority. Built in 1924, the courtyard-style building features one- and two-bedroom units.

CONCORD, N.C. — Gamma Real Estate has sold Laurel View Apartments in Concord to Southwood Realty for $41.4 million. Northmarq’s Carolinas Investment Sales Team that arranged the sale was led by Andrea Howard, John Currin, Austin Jackson, Jeff Glenn and James Dorsett. Developed in 2017 on approximately 11 acres, the 174-unit property is located 20 miles northeast of Charlotte. The community features one-, two- and three-bedroom floor plans outfitted with luxury vinyl plank flooring, granite countertops, stainless steel appliances, walk-in closets and patios or balconies. Amenities include a fitness center, …

CHATHAM, N.J. — New Jersey-based ICON Real Estate Advisors has arranged the $11.2 million sale of Chatham Arms, a renovated 31-unit building at 49 S. Passaic Ave. in Chatham, 27 miles west of Manhattan. The property was acquired by a private investor completing a 1031 exchange doing business as Cornerstone 2025 LLC, while the seller was named as Chatham Arms JV LLC. The building features studio, one- and two-bedroom residences with open floor plans, updated kitchens, hardwood flooring, 9-foot ceilings, stainless steel appliances and in-unit climate control systems. Common areas …

LARGO AND SUITLAND, MD. — Colliers’ Debt & Structured Finance has arranged $232.7 million in acquisition financing for a three-property, 1,225-unit portfolio located in Prince George’s County, Maryland. The portfolio, which was acquired by 29th Street Capital and Willton Investment Management, consists of Allure Apollo, Aspire Apollo and Ascend Apollo. The transaction involved the reassignment of existing tax increment financing (TIF) agreements associated with the Allure and Aspire properties, which are adjacent communities in Suitland. Ascend is in Largo, about 10 miles southwest.

PRINCE GEORGE, VA. — Aspen Oak Capital Partners has acquired Independence Place Apartments in Prince George for $39 million. Northmarq’s Charlotte, North Carolina-based investment sales team led by Ron Corrao, Eric Liebich, Scott Fuller, Dane Lozier, Matthew Weinstein and Dominic Bologna represented the undisclosed seller. The property, built in 2011, is situated on approximately 14 acres and includes 11 three-story garden-style buildings and an additional building that houses the clubhouse and leasing office. Independence Place’s amenity package consists of a 24-hour fitness center, resort-style pool, game room, sand volleyball and …

NEW YORK CITY — R.A. Cohen has sold a 16-unit mixed-use building at 259 East Broadway in Manhattan’s Lower East Side for approximately $7.8 million. Marcus & Millichap’s Joe Koicim, Logan Markley and Matt Berger represented the seller and procured the buyer, an unnamed private out-of-state investor. The 12,076-square-foot building includes ground-floor retail leased to Ernesto’s, a Basque restaurant, through April 2028. The two-bedroom apartments are a mix of free-market and rent-stabilized units. The building was developed in 1900.

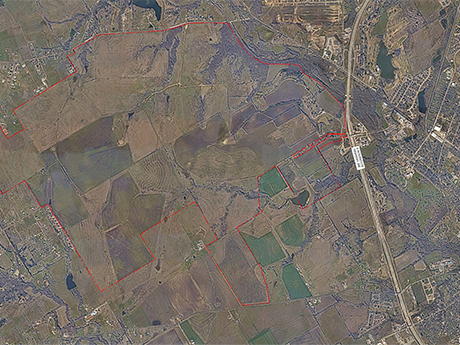

WAXAHACHIE, TEXAS — Minto Communities USA has acquired 3,170 acres in Waxahachie, 30 miles south of Dallas, where the Florida-based developer will build 13,270 new homes. Construction is expected to begin later this year followed by a multi-year buildout. The community will feature two residential districts — an active adult neighborhood and a traditional multifamily community — supported by approximately 140 acres of mixed‑use development. Plans include 750 multifamily units and 1.2 million square feet of retail and commercial space. Minto is planning amenities such as a town center, 400 …

NEW YORK CITY — Marcus & Millichap has arranged the sale of a 25-unit property at 443 East 88th St. in the Yorkville neighborhood of Manhattan, located on the Upper East Side. The property sold to Jade Century Properties for $16.5 million. Joe Koicim and Logan Markley of the NYM Group of Marcus & Millichap’s New York City office represented the undisclosed seller and procured the buyer.