SEATTLE — CBRE has arranged the sale of Walton Lofts, a 136-unit high-rise located at 75 Vine St. in Seattle’s Belltown neighborhood. The property was developed in 2015 by the Schuster Group. Clarion Partners was the seller, represented by CBRE’s Eli Hanacek, Mark Washington, Kyle Yamamoto and Natalie Kasper. Neither the buyer nor the sales price was disclosed, but Clarion purchased the property in 2016 for about $76 million. Walton Lofts includes studios and one- and two-bedroom units. Amenities feature a rooftop lounge with panoramic views of Elliott Bay, the …

Investment Sales

ATLANTA — Bell Partners has acquired Rock Springs Village in Atlanta. The seller and sales price were not disclosed. The 558-unit property was developed in three phases in 1987, 2003 and 2005. Greensboro, North Carolina-based Bell Partners bought the property with a value-add fund and is planning renovations to units and common areas. It will be rebranded as Bell Rock Springs. The community features two pools and two fitness centers, a clubroom and outdoor gathering areas. The property is adjacent to Bell Morningside, a 110-unit asset Bell Partners acquired in …

CEI Launches Affordable Housing Investment Partnership

LOS ANGELES — Los Angeles-based developer Cypress Equity Investments (CEI) and an unnamed Florida-based investment firm have partnered to build or acquire approximately $1.2 billion worth of affordable housing communities. The venture is being launched with 11 ground-up projects that are already in place in California and Florida. Target markets for future opportunities include the Carolinas, Tennessee, Texas and some markets in the Northeast. Some of the deal characteristics CEI is seeking will include communities with on-site resident services, developments that partner with nonprofits and acquisitions of other existing institutional …

CHESAPEAKE, VA., ELIZABETH CITY, N.C. — Newbrook Capital Properties has acquired a two-property portfolio for $58.2 million. The assets are Green Tree, a 208-unit garden-style property in Chesapeake, and Emerald Lake, a 132-unit garden-style property about 40 miles south in Elizabeth City. Both communities were developed in the 1990s. The buyer is planning to update approximately 70 percent of the portfolio’s units. Newbrook Capital Properties was co-founded in late 2023 by hedge fund manager Robert Boucai and James Broyer, former president of multifamily investments at JRK Property Holdings. The unnamed …

MINNEAPOLIS — San Francisco-based FPA Multifamily has purchased a 679-unit portfolio consisting of seven properties throughout the Twin Cities metro from Centerspace (NYSE: CSR), a Minot, North Dakota-based REIT. The Minneapolis/St. Paul Business Journal reports the portfolio traded for $76 million. CBRE’s Ted Abramson, Keith Collins and Abe Appert represented Centerspace in the transaction. Properties in the portfolio range from historic redevelopments in the North Loop area to contemporary, boutique-style assets in the Edina and South Minneapolis submarkets. Several properties have undergone renovations. All seven properties are equipped with SmartRent …

PLANO, TEXAS — Clover Capital Partners has acquired The Woodlands of Plano in Northeast Plano, 20 miles north of Dallas. CBRE arranged the sale of the 232-unit community that was developed in 1968. The seller’s identity was not disclosed. The Dallas-based buyer will assume fixed-rate debt at a 3 percent interest rate with 10 years remaining on the loan. The property provides a mix of one-, two- and three-bedroom floor plans.

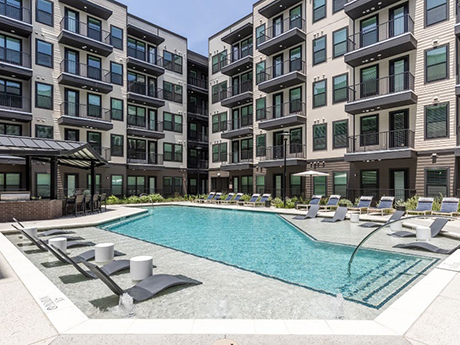

CHARLOTTE, N.C. — Mesa West Capital has provided a joint venture between Hillridge Capital and Broad Creek Capital with a $69.8 million first mortgage loan for the acquisition and renovation of Loft One35 in Charlotte’s South End neighborhood. The total acquisition cost was $94 million, according to the Charlotte Business Journal. Loft One35 is a 298-unit, six-story community that offers a mix of loft-style apartments as well as townhomes. Amenities include a resort-style pool, a courtyard with a fire pit and grilling stations, a pet spa, a coffee bar and …

MCKINNEY, TEXAS — Equus has sold McKinney Village to Weidner Apartment Homes. The 245-unit community about 50 miles north of Dallas in McKinney was built in 2017 with a unit mix comprised of studios, one- and two-bedroom floor plans as well as two-story townhomes with attached garages. Amenities include a resort-style pool with covered seating and grilling stations, a fitness center with cardio and strength equipment, a clubhouse lounge, a pet park and a community garden. Brian O’Boyle Jr. with Newmark represented Philadelphia-based Equus in the transaction. The sales price …

FRISCO, TEXAS — Bell Partners has acquired The Albee Apartments in Frisco and will rebrand the asset Bell Southstone Yards. Neither the seller nor the sales price was disclosed. The 355-unit community was completed earlier this year and is located within the Southstone Yards mixed-use community currently under development by multiple partners including Crow Holdings and Rosewood Property Co. With this acquisition, Greensboro, North Carolina-based Bell Partners now owns or manages 42 communities comprising approximately 15,200 units across the Dallas-Fort Worth region.

ALBERTVILLE, MINN. — Dominium has sold Albertville Meadows to an undisclosed buyer for $11.2 million. The property is located 32 miles northwest of Minneapolis in Albertville. Mox Gunderson, Dan Linnell, Adam Haydon and Devon Dvorak of Colliers arranged the sale. The 75-unit affordable housing community was built in 1993. To qualify, a single tenant can earn no more than $55,620 per year. Rents are capped at combined annual salaries of $63,600 for two occupants; $71,520 for three occupants; and $79,440 for units with four residents.