By Paul Berry Jacksonville is increasingly recognized as an outstanding place to live, work and build a business. Its multifamily sector, while recently challenged by a wave of new supply, is set for a rebound that will reward patient investors. With peak deliveries now in the rearview mirror, the metro area is well positioned for a strong cyclical upswing, complementing its already robust economic trajectory. Core Drivers: Population Growth, Pro-Business Jacksonville is a legitimate, big-league city. The population of the metro area has reached 1.76 million, growing by about 37,000 …

Market Reports

Multifamily Investor Sentiment Strengthens, Urgency Builds to Deliver More Affordable Housing, 2026 Emerging Trends Forecast Reveals

Commercial real estate industry leaders are more bullish on the investment prospects for the multifamily sector than they were a year ago, according to the newly released 2026 Emerging Trends in Real Estate forecast conducted by the Urban Land Institute (ULI) and PwC. Among major property types on a scale of 1 to 5 — where 1 is abysmal and 5 is excellent — multifamily (including single-family rentals) achieved a rating of 3.67, second only to mixed-use/alternative assets, which posted a rating of 3.69. The industrial/distribution sector scored 3.61, followed …

By David NelsonHamilton Zanze There’s a real argument to be made that Kansas City is one of the country’s most overlooked cities as well as one of its most underappreciated multifamily investment markets. The metro’s residents and visitors can provide ample testimony to the city’s jazz culture, museums, sports scene, affordability and world-class barbecue. But beyond lifestyle, Kansas City has the qualities that matter most to multifamily investors: steady population growth, a balanced economy, measured supply and consistent apartment demand. For investors looking for durable performance across market cycles, metro …

By Chad Thomas Hagwood The most successful investors in Birmingham are those who have allowed the economy’s natural forces to do the work for them, counting on the city’s steady growth to raise rents and elevate operating income. Until about two decades ago, The Magic City was a sleeper market reserved for local multifamily investors, but the word has long since gotten out. Large, sophisticated institutions like Blackstone and Starwood Capital are now active participants. Birmingham produces such stable results because it offers an attractive quality of life at a …

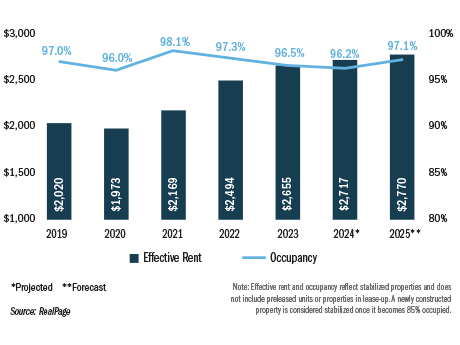

No matter how drastically the national economy fluctuates, Boston’s multifamily market, supported by an educated workforce, hardly wavers. Supply and demand are rarely that far from equilibrium, given the tightness of the residential housing market and the hurdles facing multifamily developers. Consequently, rent growth is dependable, and modest vacancy rates are the norm. Never as flashy as New York City or San Francisco — or such relative newcomers as Austin and San Jose — Boston is sometimes overlooked, but it has long been one of the top multifamily markets in …

With a new presidential administration comes new policies and new economic uncertainties. But trying times such as these are no match for the consistency of the Indianapolis multifamily market. The metropolitan area’s “steady eddie” performance and resiliency during the tumultuous period of the COVID-19 pandemic has proven its staying power. Population, Job Growth Signal New Opportunities Metro Indianapolis, with a population base of 2.2 million people, experienced a sizeable population increase over the past four years. The metro area added more than 85,000 people during that period, with a good mix …

The single-family rental (SFR) market, including purpose-built build-to-rent (BTR) communities, is the fastest-growing segment of the U.S. housing market, outpacing both single-family for-sale and multifamily growth in recent years. Although the concept emerged from the Great Recession, when large investors began buying up vacant homes to rent, it has evolved significantly over the past five years, attracting more sophisticated investors and expanding into new markets. Historically, Sun Belt markets, particularly Phoenix, were early adopters of BTR. Recently, however, areas like the Carolinas, Northern Virginia and even Boston have seen a …

The need for affordable housing is palpable across the nation, and Atlanta is no exception to the rule. A 2023 report from the Georgia Department of Community Affairs found that there is an extremely inadequate supply of housing that is affordable and available for all income levels, but especially for the lowest income renter households. In 2021, Atlanta Mayor Andre Dickens established a goal to build or preserve 20,000 units of affordable housing across the city by the end of 2030. And a major contributor to these efforts is the …

The multifamily real estate market in Southern California, particularly in Orange County, is poised for significant shifts in 2025. The region has rebounded from the volatility of the COVID-19 pandemic but is still navigating regulatory pressures. In positive news, the rejection of Proposition 33 has averted the expansion of statewide rent control, offering a more favorable environment for investors. Amid elevated interest rates and a changing political landscape, the market presents both challenges and opportunities for buyers, sellers and investors alike. If passed, Proposition 33 would have allowed cities and …

Stability is a defining characteristic of the Northern New Jersey multifamily market. Unlike some markets that are prone to dramatic booms and busts, the region has long benefited from a diverse economy, proximity to New York City, an educated workforce and a steady flow of young professionals and families seeking high-paying jobs. These fundamentals have allowed North Jersey to thrive over the past few years, with immigration fueling population growth and new industry clusters producing new jobs. These trends will drive demand for rental housing and allow investors to find …