The multifamily sector in Dallas-Fort Worth has faced a challenging capital market environment over the past year. But like its counterparts in the Sun Belt, the local market has proven to be resilient based on economic performance, employment and population growth, as well as other market fundamentals. Sentiments about the commercial real estate sector in Dallas-Fort Worth, as a result, have turned very positive since the start of the year, though a significant number of investors remain cautiously optimistic. Employment indicators in Dallas-Fort Worth best displayed the resilience we saw …

Market Reports

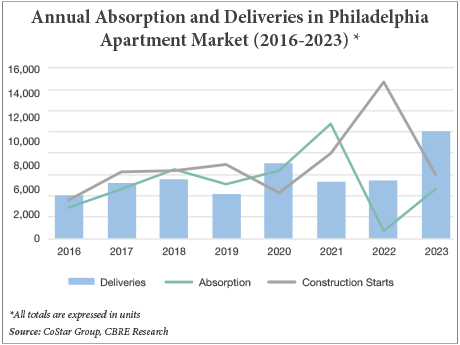

Metro Philadelphia has commonly been characterized as stable by multifamily investors. It’s akin to a backhanded compliment when comparing our region to those with higher population growth or more “business-friendly” governments. Cue the overused “eds and meds” story that fails to reference the technology, life sciences or gene therapy industries, all of which help to diversify the region’s employment base and contribute to a strong economy. (The “eds,” of course, are institutions of higher learning and the “meds” are medical facilities.) Historically, investors also haven’t differentiated between suburban Philadelphia, namely …

The multifamily market in Detroit, characterized by its mature and stable nature, boasts robust operating fundamentals, making it an attractive investment destination. While markets across the country are facing swells of new apartment deliveries resulting in oversupply, Detroit is forecast to easily absorb all new units that come online in 2024. In fact, 4,896 units are expected to be absorbed in 2024 while only 4,072 new units will be delivered — illustrating the strong, stable demand across the metro area. The positive outlook for rent growth is another encouraging sign. …

Boston is a famously difficult place to build or buy new apartments. Developers often spend years searching for a suitable site and gaining approvals from municipalities prior to construction. In the development boom that peaked in 2022, just on the heels of the coronavirus pandemic, developers started construction on hundreds of thousands of new apartments across the country — the largest amount of new construction in decades. In Boston, developers started tens of thousands of new apartments. It’s a lot of new construction, but it’s still less than Boston developers …

Chicago can’t match the number of construction cranes crowding the skylines in high-growth markets such as Nashville, Austin or Atlanta. But now there’s at least one high-profile symbol of growth in downtown Chicago as construction gets under way at 400 Lake Shore, a massive two-tower apartment development. Developer Related Midwest recently secured more than $500 million in construction financing for the project located on the last vacant waterfront site where the Chicago River meets Lake Michigan. The first phase, already under construction, includes a 72-story building with 635 new apartments, …

The combination of sustained job and population growth has put St. Charles County in the “Show-Me State” on the map and served as a catalyst for multifamily development. Buoyed by the presence of several multinational companies such as Amazon, General Motors and MasterCard, the county is home to several thriving suburbs northwest of St. Louis and posted a nearly 15 percent increase in population from 2010 to 2022. The number of residents rose from 360,485 to an estimated 413,803 during that period, according to the U.S. Census Bureau. St. Charles …

The average effective rent in the Dallas-Fort Worth apartment market declined by 0.5 percent between the third quarter of 2022 and the third quarter of this year, the first drop in rent since late 2021, according to Newmark. Whether this is a blip on the radar screen or an inflection point remains to be seen. Oversupply is contributing to the drop in rents. Newmark reports that developers opened 25,386 new units in the past 12 months as of the third quarter of 2023, compared with 8,742 units absorbed during the …

Across the United States, real estate markets are in a recession for dealmakers. The run-up in interest rates over an 18-month period has choked off transactions. Potential buyers and sellers are deadlocked over price. Vulture investors are waiting for owners who paid too much for properties during boom years to be forced to sell. New York City reflects all those trends — only more so. Many investors spent billions of dollars to buy rent-stabilized buildings in the city with plans to eventually raise the rents. But in 2019, lawmakers made …

Atlanta has experienced a dip in rents amid a surge of supply. The number of deliveries in the third quarter of this year increased 63 percent compared with the same period in 2022. Most data sources indicate about 15,000 units have been delivered so far this year, but only about 5,000 have been absorbed. In short, new supply is greatly outpacing tenant demand, and effective rents fell on a year-over-year basis as of the third quarter. Still, industry experts say this is likely only a temporary condition with developers struggling …

The apartment market in San Antonio today is a mixed bag. Like most Sun Belt metros, supply exceeds demand in Alamo City. While property managers are struggling to lease up their communities, investors are sitting on the sidelines until interest rates stabilize and the market starts absorbing units developed during the post-COVID building boom. On the plus side, population growth, a metric apartment investors prize because it feeds renter demand, is solid in San Antonio. In May, the U.S. Census Bureau ranked San Antonio the third fastest-growing city in the …