PHILADELPHIA — The Philadelphia Housing Authority (PHA) and partners LMXD and MSquared broke ground March 2 on the first phase of the Westpark Apartments redevelopment in West Philadelphia. The project as a whole covers 12 acres and will consist of upgrading existing structures as well as building new homes. The site is home to public-housing high-rises and was developed in the early 1960s. The project cost for Phase I, accounting for 327 new units, is approximately $205 million, according to the Philadelphia Tribune. WHYY reports the total project cost to …

News

DACULA, GA. — Thompson Thrift has unveiled plans for Lineage, a 300-unit community situated on 15 acres about 30 miles northeast of Atlanta. Lineage marks the Terre Haute, Indiana-based developer’s 100th multifamily project. Completion is slated for April 2028. PNC Bank is the construction lender. Amenities complementing the one-, two- and three-bedroom units include a dedicated event space available for private rental, a golf simulator, fitness center, resort-style heated pool, a pickleball court, coworking and conference spaces, a pet spa and dog park.

SHERMAN, TEXAS — The NRP Group and Texahoma Housing Partners have opened and begun leasing Sutton Flats, a 300-unit mixed-income community in Sherman, 65 miles northeast of Dallas. Half of the units are reserved for households earning no more than 80 percent of area median income. Monthly asking rents across the community range from $1,132 to 1,540. Amenities include a fitness center, coworking spaces with conference rooms, a game room, clubhouse and lounge, resort-style pool and a dog park. Sutton Flats residents also may rent garage parking spaces. The NRP …

TAMPA, FLA. — Tampa-based owner-operator American Landmark Apartments has hired Adam Smolyar as chief technology officer. In his role, Smolyar will oversee core systems, data architecture, cybersecurity, data analytics and resident-facing platforms. He is responsible for ensuring the firm’s platforms are scalable and reliable and will partner with American Landmark’s executive leadership team to streamline technology solutions and financial systems. In Smolyar’s recent experience, he served as director of innovation initiatives and tech investments at UDR. Prior to that, he was chief marketing and technology officer at the Urban Land …

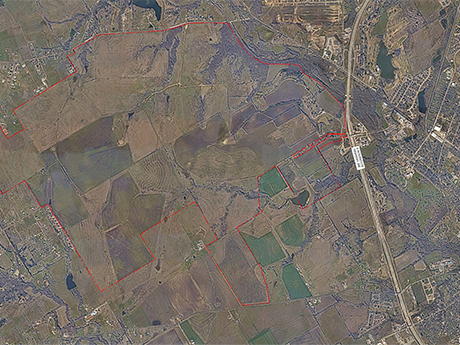

WAXAHACHIE, TEXAS — Minto Communities USA has acquired 3,170 acres in Waxahachie, 30 miles south of Dallas, where the Florida-based developer will build 13,270 new homes. Construction is expected to begin later this year followed by a multi-year buildout. The community will feature two residential districts — an active adult neighborhood and a traditional multifamily community — supported by approximately 140 acres of mixed‑use development. Plans include 750 multifamily units and 1.2 million square feet of retail and commercial space. Minto is planning amenities such as a town center, 400 …

HOUSTON — A joint venture comprised of Trammell Crow Residential and Haseko North America will develop Allora Fallbrook in Northwest Houston. Completion of the 366-unit community is slated for 2027. The four-story property will feature a mix of one- and two-bedroom floor plans highlighted by such amenities as a resort-style pool, a fitness center, clubhouse and outdoor gathering spaces. Haseko North America, based in Irvine, California, is the subsidiary of Haseko Corp., a Japanese residential construction firm.

DALLAS — FTK Construction Services has completed the $13.6 million renovation of West Virginia Park, a 204-unit LIHTC property in Dallas. The property owner is April Housing, a subsidiary of Blackstone Real Estate. Renovations at the 204-unit community included new paint, cabinetry, countertops, plumbing, appliances, flooring, lighting, HVAC and water heaters. Common areas were freshly painted, and landscaping and amenity updates also were provided.

NEW YORK CITY — Marcus & Millichap has arranged the sale of a 25-unit property at 443 East 88th St. in the Yorkville neighborhood of Manhattan, located on the Upper East Side. The property sold to Jade Century Properties for $16.5 million. Joe Koicim and Logan Markley of the NYM Group of Marcus & Millichap’s New York City office represented the undisclosed seller and procured the buyer.

LAS VEGAS — PCE Holdings, a California-based investment firm, has acquired Landing 36 in Las Vegas in an off-market transaction. The sales price was $79 million, and the seller was Craig Horn. Developed in 2025, the 308-unit community is comprised of studios and one- through three-bedroom floor plans complemented by amenities such as a resort-style pool and hot tub with shaded seating areas, a fitness center with cardio and strength-training equipment, a pet-friendly lawn with a play area and grilling and entertainment spaces. PCE’s strategy is to lease up the …

BOSTON — Mill Creek Residential has broken ground on Modera Allston, a midrise community in the Lower Allston neighborhood of Boston. The property, located at 250 Everett St., will feature 240 units in one-, two- and three-bedroom floor plans. Some units will include dens or private patios and balconies. Residents will have access to a rooftop deck, grilling area, clubhouse, a speakeasy-inspired lounge with a sports simulator, coworking spaces and private workstations and offices. A landscaped courtyard, pet spa, fitness center, electric vehicle charging stations, bike storage and a controlled …