SILVER SPRING, MD. — Green Street Housing and TM Associates Development have broken ground on Sligo Apartments, an affordable housing development in Silver Spring. All 102 units at the community will be available at restricted rents. The project is financed through a Low Income Housing Tax Credit (LIHTC) investment from Hudson Housing Capital and Capital One, who is also providing the permanent debt financing, as well as loans from the Maryland Department of Housing and Community Development.

Northeast

NEW YORK CITY — Marcus & Millichap has brokered the sale of a building located at 923 Bedford Ave. in the New York City borough of Brooklyn. Built in 1901, the property offers eight units across four stories. Units come in studio, one- and two-bedroom floor plans. Eyny family purchased the community from an individual/personal trust for $3.4 million. Daniel Greenblatt and Shaun Riney of Marcus & Millichap’s Manhattan office marketed the property on behalf of the seller and procured the buyer.

MEDWAY, MASS. — Toll Brothers has completed Hathon, a 190-unit complex in Medway, southwest of Boston. Cube3 Architects designed the property. Mary Cook Associates provided interior design services. Hathon offers one-, two- and three-bedroom units that are furnished with stainless steel appliances, quartz countertops and individual washers and dryers. Select units offer private balconies or patios. Amenities include a pool, game room, fitness center, playground, catering kitchen, coworking lounge and a rooftop deck.

BOSTON — Cottonwood Group, a Los Angeles-based private equity real estate firm, has provided $240 million in senior mortgage financing for the St. Regis Residences in Boston’s Seaport District. The borrower was Cronin Development. The high-rise development features 114 apartments across 22 stories. Amenities include a pool, spa, fitness center, lounge, concierge services and an onsite restaurant.

CLARK, N.J. — JLL Capital Markets has arranged $49.5 million in financing for Walnut Hill, a 177-unit complex in Clark, 23 miles southwest of New York City. An affiliate of Garden Communities was the borrower. Evan Pariser, Matthew Pizzolato and Jackie Ferrer led the Debt Advisory team that represented the borrower and negotiated the 10-year, fixed-rate loan from Nationwide. Recently completed in 2023, Walnut Hill comprises 240,000 square feet across a pair of four-story buildings. Of the total unit count, 28 are affordable. Income restrictions for these units were not disclosed. …

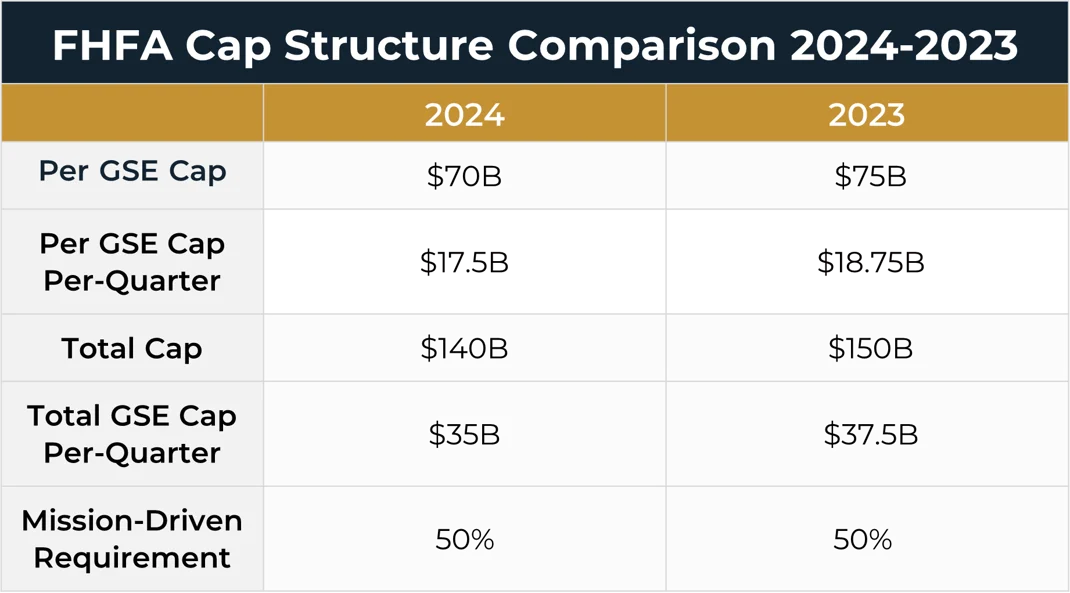

WASHINGTON, D.C. — The Federal Housing Finance Agency (FHFA) has announced that the multifamily loan purchase caps for Fannie Mae and Freddie Mac in 2024 will be $70 billion for each enterprise, for a combined total of $140 billion. FHFA’s 2023 volume cap is $75 billion for each agency. Additionally, at least 50 percent of each enterprise’s multifamily business is required to be mission-driven affordable housing, which is unchanged from this year. Only loans classified as supporting workforce housing properties in Appendix A of the Conservatorship Scorecard will be exempt from …

NEW YORK CITY — Merchants Capital has provided $225 million in Freddie Mac financing for seven affordable housing properties in the New York City borough of The Bronx. The portfolio comprises 983 units across 18 buildings. The properties carry a range of income restrictions. The borrower is a joint venture consisting of The Arker Cos., SBV RE Investments LLC and Dabar Development Partners. The joint venture will use the financing to refinance existing debt, rehabilitate units with building-wide improvement plans and preserve affordability. The scope of work includes kitchen upgrades, …

BELLEVILLE, N.J. — The Kislak Co. Inc. has negotiated the $11.8 million sale of Brighton Estates, a 95-unit property in Belleville, five miles north of Newark, New Jersey. Tom Scatuorchio of The Kislak Co. represented the seller in the deal. Andrew Scheinerman of The Kislak Co. procured the buyer. Both parties requested anonymity. Brighton Estates was built in 1962 and recently renovated. The community comprises 95 units across three two-story buildings. The unit mix includes 13 studios, 66 one-bedroom units and 16 two-bedroom units.

NEWVILLE, PA. — Northmarq has negotiated the sale of Big Spring Terrace, a 159-unit manufactured housing community in Newville, about 140 miles west of Philadelphia. Anthony Pino and Ari Azarbarzin represented the seller, Big Springs Properties, in the transaction. The buyer and sales price were not disclosed. Big Spring Terrace was originally built in 1975 on a 94-acre site. The property was roughly 94 percent occupied at the time of sale.

SILVER SPRING, MD. — PGIM Real Estate has provided a $188 million loan for The Blairs, a five-property portfolio in downtown Silver Spring. The borrower, Tower Cos., will use the fixed-rate loan to refinance the portfolio, which comprises The Pearl, Blair Towns, Blair House, Blair East and Blair Plaza. The five properties are located within a master-planned community that Tower Cos. owns, and offer 1,396 units altogether. According to PGIM, The Blairs was the first residential campus to receive the LEED Gold certification for operations and maintenance.