ARLINGTON, VA. — The National Apartment Association (NAA) has selected Rick Snyder, president and owner of San Diego-based R.A. Snyder Properties, as 2024 Chair of the Board. Snyder was formally installed at NAA’s Assembly of Delegates in San Diego last November. NAA’s headquarters are located in Arlington. Snyder has been involved with NAA for nearly 20 years, having previously served as a Regional Vice President, Membership Committee Chair and as a member of several committees. Snyder received his Bachelor of Science degree in Business Administration from San Diego State University …

Operations

BOSTON — WinnCos. has promoted three employees to vice president roles in its property management, sustainability and development functions. Michael Milko was promoted to the role of executive vice president at WinnResidential, a subsidiary of WinnCos. Milko joined the company in 1995. He now oversees the management operations of approximately 5,000 residential units across 40 properties in the Northeast and Mid-Atlantic. Christina McPike was promoted to Vice President of Energy & Sustainability. In this role, she will oversee new construction, historic adaptive reuse and deep energy retrofit projects. According to WinnCos., McPike …

NEW YORK CITY AND TORONTO — Affiliates of Blackstone (NYSE: BX) have entered into an agreement to acquire Canadian owner-operator Tricon Residential (NYSE: TCN) for $3.5 billion. The deal is expected to close in the second quarter and will take Tricon Residential private. Blackstone will acquire all outstanding shares of Tricon’s common stock for $11.25 per share in cash. The per-share price represents a 30 percent premium over Tricon’s closing stock price on Thursday, Jan. 18 and a 42 percent premium over the weighted average share prices of the last 90 …

— By Adam Wolfson and Darryl Kasper of Wolfson Development Co. — Against a backdrop of recently proposed (though unlikely to pass) legislation aimed at forcing large build-to-rent (BTR) and single-family-rental investors to shed units and convert them to for-sale housing, BTR fundamentals — and the investment case for the sector — remain strong as ever. While debatably well-intentioned, the legislation mistakes correlation for causation. The BTR sector is indeed benefitting from problems in the housing market. However, these problems pre-dated the industry and are more likely caused by factors …

HOUSTON — Cushman & Wakefield has hired Nicholas Murphy as a senior director. Murphy will join the Equity, Debt & Structured Finance team at Cushman & Wakefield’s Houston office. In this role, he will advise clients in Texas on capital-stack strategies, with a focus on the multifamily sector. Murphy most recently worked as a director of acquisitions at Sync Residential. Prior to this, he was a director at Berkadia. Murphy graduated from the St. Edwards University and earned a master’s in real estate development at Arizona State University.

ATLANTA — Shortened attention spans and the desire for instant gratification are a couple of the changing consumer behaviors that impact the multifamily operations industry. Karen Key, a president with Houston-based Asset Living, said that 75 percent of consumers expect a response time in less than 24 hours from a business. Twenty percent expect a response time within minutes. “If you’re missing that mark and someone else is responding to them, whether it’s a client, prospect or resident, you’ve lost them. They’re gone.” Key’s remarks came during the operations panel …

— By Mark Peters, president and general manager at Zego — Property managers are always looking for ways to improve resident satisfaction. But that’s not so easy in today’s competitive rental market, where renters reportedly have higher standards of value and service than they once did. Resident satisfaction directly affects a property’s financial performance. A recent study from financial advisory firm Deloitte found that great customer experiences grow revenue. Companies can earn up to 140 percent more from customers who have had positive experiences with their business. These individuals are also likely to remain customers …

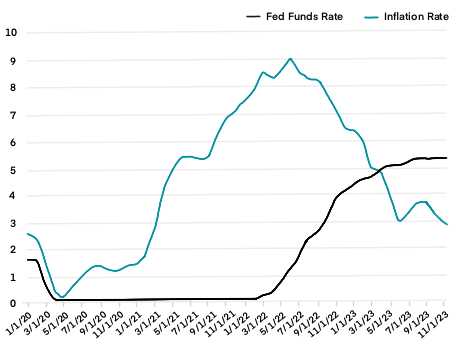

ATLANTA — Depending on the era in which you came of age and the general experiences you’ve had in life, the notion that “things can always get worse” can be easy to endorse. As it pertains to commercial lending and borrowing, the consensus narratives that have prevailed ever since the Federal Reserve began jacking up interest rates in early 2022 has largely followed the same script: “Hunker down.” “Survive till ’25.” “Delay and defer.” In other words, do whatever you have to do to avoid the sting of the 11 …

CHICAGO — An analysis from Origin Investments (Origin) predicts a tumultuous 2024, with concerns of a recession and elevated interest rates likely to continue. Despite this, the Chicago-based real estate fund manager expects next year to bring unique opportunities for multifamily investors to secure protected positions in the capital structure and enhance investment returns. “The volume of variable-rate bank loans — made when the Secured Overnight Financing Rate was 0 percent and the 10-year Treasury note yield was below two percent — coming due in 2024 will create a generational …

WASHINGTON, D.C. — Senate Finance Committee Chair Ronald Wyden (D-Ore.), Sen. Daniel Sullivan (R-Alaska) and U.S. Representatives James Panetta (D-Calif.) and Michael Carey (R-Ohio) have introduced the Workforce Housing Tax Credit Act into the U.S. House and Senate. The bipartisan proposal would establish a Workforce Housing Tax Credit (WHTC) that would complement the Low-Income Housing Tax Credit (LIHTC). The Workforce Housing Tax Credit Act would establish a public-private partnership that allows state housing agencies to issue credit allocations to developers through a competitive process. These credit allocations would then subsequently …