MANTECA, CALIF. — Marcus & Millichap has arranged the sale of Manteca Golf & Tennis Villas, a 56-unit property in Manteca, a city between Modesto and Stockton, California, and about 76 miles west of San Francisco. The property sold for $15.6 million. Stephen Jackson and Joe Owens, both senior directors with Marcus & Millichap, represented the seller. Neither party to the transaction was identified. Completed in 1985, Manteca Golf & Tennis, which is adjacent to a golf course, has a pool, laundry facilities and a tennis court. Units feature washer …

News

DENVER — Nick Steele has joined Lument to lead investment sales across Colorado, Idaho, Montana and Wyoming. Steele joins Lument from Berkadia, where he worked in the firm’s Denver office. Prior to Berkadia, Steele held senior roles at Marcus & Millichap and started his career at Apartment Realty Advisors. Over the course of his career, Steele has closed approximately $1.5 billion in multifamily sales. Lument is a banking and lending company that launched an investment sales division in 2024.

GREER, S.C. — Material Capital Partners has acquired 25 acres in Greer, 16 miles northeast of Greenville, South Carolina, to develop Mill Landing, a build-to-rent community. The project will consist of 163 single-family, detached homes and townhomes in a mix of three- and four-bedroom floor plans. Each home will feature an attached private garage and a private patio. Amenities will include a clubhouse with coworking and lounge spaces, a resort-style pool, fitness center, a dog park and walking trails. Greystar will serve as the property manager. The developer will break …

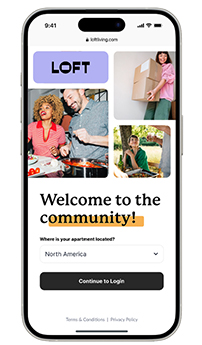

RICHARDSON, TEXAS — RealPage has acquired Livble, a flexible-payment company, and will incorporate the new payment technology into two of its own software solutions, LOFT and Buildium. LOFT is a resident-facing app RealPage launched in January. LOFT’s payment function allows users to pay their rent traditionally, directly from their bank in one lump sum, or residents can pay in two installments. With the Livble technology, residents now can split up payments into up to four installments per month. RealPage assumes nonpayment risk and manages collections should residents not pay. In …

VALLEJO, CALIF. — Prime Residential has received a $91.5 million loan to refinance Blue Rock Village, a 560-unit property the company owns in Vallejo, 36 miles north of San Francisco. Walker & Dunlop’s Bryan Frazier and Blake Hockenbury arranged the 10-year, full-term interest-only loan at a fixed rate from Freddie Mac. Blue Rock Village was developed in two phases in the mid 1980s. The property consists of 41 buildings housing a total of 560 units, a leasing office, a fitness center and a maintenance building, all situated on about 36 …

FRISCO, TEXAS — Rosewood Property Co. and equity partner MetLife Investment Management, the institutional asset management business of MetLife, have broken ground on Penrose, a 382-unit property in Frisco. Located on a 5-acre site at 4301 Tributary Way, Penrose is a part of the Southstone Yards masterplan, a pedestrian-oriented, 45-acre, mixed-use project featuring multiple phases of development with such uses as office, residential, restaurant, hotel and green space. Completion of the greater Southstone Yards development is slated for 2030, while Dallas-based Rosewood is estimating a fall 2027 completion date for …

OLATHE, KAN. — PeakMade Real Estate and Blue Vista Capital Management have broken ground on Olathe Commons, a build-to-rent (BTR) community in the Kansas City suburb of Olathe. Developers anticipate leasing will begin in August 2026 with a final project completion date slated for September 2027. Construction financing was provided by Old National Bank, and Open House Group is a joint venture limited partner for the project. Olathe Commons will be comprised of 60 single-family cottages and 154 townhomes. Units will feature two- to four-bedroom layouts with select floorplans offering …

DEBARY, FLA. — MTK Developments has sold Allure on Enterprise in DeBary for an undisclosed cost. KRI Partners bought the build-to-rent property that sits 26 miles north of Orlando, Florida. Cushman & Wakefield’s Nick Meoli, Joey Blakley and Mike Donaldson represented MTK in the transaction. Completed in 2023, Allure on Enterprise was 98 percent occupied at the time of the sale. It includes amenities such as gated access, a clubhouse, a resort-style pool, a fitness center and yoga studio, a dog park with a wash station, an electric vehicle charging …

Berkadia Arranges $107.3 Million Refinancing of Three Vintage Properties In Central Florida

ORLANDO, FLA. — Berkadia has arranged $107.3 million in debt to refinance a three-property, 944-unit portfolio owned by Tampa, Florida-based Robbins Property Associates. The assets are located in and around Orlando. Senior Managing Director Mitch Sinberg, Managing Directors Scott Wadler and Brad Williamson and Vice President Hugo Hernandez of Berkadia Boca Raton and Miami arranged the 10-year, fixed-rate Freddie Mac loan. The deal closed on June 30. The properties are the 460-unit Briarcrest at Winter Haven, built in 1972; Legend Oaks in Tampa with 416 units that was constructed in …

RICHARDSON, TEXAS — Hunt Development Group has launched leasing at Caroline Eastside, a newly completed community developed in Richardson. The 384-unit property features many amenities including: a two-level fitness center with a yoga room; a resort-style pool with an indoor, air-conditioned pool house; a game lawn; coworking spaces; a dog park and dog-washing facilities; a rooftop deck with a coffee bar; and property-wide, high-speed WiFi. In Richardson, which is 15 miles north of Dallas, Hunt also has developed The Mallory Eastside, a 281-unit property that was completed in 2017.