SAN JOSE, CALIF. — IPA Capital Markets, a division of Marcus & Millichap, has arranged $62 million in acquisition financing for DUO Apartments, a 301-unit asset in San Jose. The loan features a 10-year, interest-only term and is fixed at 5.4 percent. DUO Apartments was built in 2020 on a 4.6-acre site, 11 miles from San Jose’s downtown area. IPA’s Brian Eisendrath, Cameron Chalfant and Jake Vitta originated the financing on behalf of the undisclosed borrower. Salvatore Saglimbeni, Stanford Jones and Philip Saglimbeni brokered the sale of the leasehold interest.

Top Story

GILBERT, ARIZ. — Institutional Property Advisors (IPA) has arranged the sale of Aiya, a 360-unit property in Gilbert. The Wolff Co. acquired the community from Olumpus Property for $112 million. Steve Gebing and Cliff David of IPA represented the seller and procured the buyer. Brian Eisendrath, Cameron Chalfant and Jake Vitta arranged the acquisition financing. Aiya was built in 2022 on 16 acres. Amenities include EV chargers, a pool and spa, conference room, private offices and a community kitchen. Apartments come in studio, one-, two- and three-bedroom floor plans with …

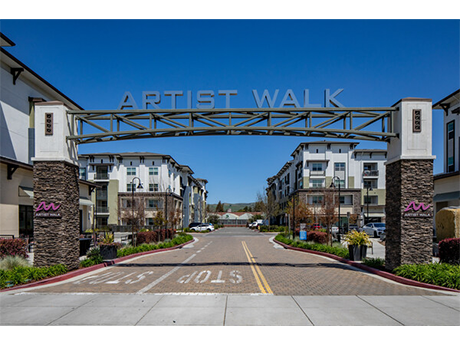

FREMONT, CALIF. — MG Properties has acquired Artist Walk Apartments, a mixed-use community located in Fremont, within San Francisco’s Bay Area. The asset traded hands for $89.8 million. Artist Walk Apartments comprises 185 apartments and 30,000 square feet of ground floor retail space. The property was built in 2017. Jason Parr, Seth Siegel and Scott MacDonald of Cushman and Wakefield represented the seller, Clarion Partners. CBRE Capital Markets arranged financing for the deal through Freddie Mac.

GARLAND, TEXAS — Anthem Development, a Beck Ventures company, has broken ground on the first phase of redevelopment for the new Transit-Oriented District in Garland. The first phase includes the development of Lofts iThirty, a 340-unit project located at 6302 Greenbelt Pkwy. Lofts iThirty will comprise five buildings that each rise four stories, with amenities such as two pools, a pet spa, park, game room, coffee bar, sky-lounge, outdoor kitchens and two fitness centers. The total cost of the first phase is expected to be $64 million. At full build-out, the redevelopment project …

ARLINGTON, TEXAS — Bridgeview Multifamily will develop a 250-unit community in Arlington, west of Dallas. The project, which is tentatively called Mercantile Lofts, will comprise one four-story building with three-story wings on a 6.3-acre site. Units will come in one- and two-bedroom floor plans. Amenities will include a pool, courtyard and single-level parking garage. Construction is expected to begin next summer.

MIAMI — Crescent Heights has topped off NEMA Miami, a 39-story rental tower in downtown Miami. McHugh Construction and Stiles Construction are the general contractors for the project. NEMA Miami will offer 588 apartments, as well as ground-floor retail, including a 42,030-square-foot Whole Foods Market, and a seven-story parking garage with 748 spaces. Units will come in studio, one-, two- and three-bedroom floor plans. Amenities will include a pool, sauna and steam rooms, event space, a private bar lounge and a fitness center. First move-ins are slated for summer 2024. …

PHOENIX — Harvard Investments has sold FirstStreet Happy Valley, a 212-unit build-to-rent community in Phoenix. Spruce Capital Group, a private family-owned investment firm, acquired the asset for $87.9 million. FirstStreet Happy Valley offers one-, two- and three-bedroom floor plans with attached and detached garages. The average size of the units is 1,904 square feet. Amenities include a dog park and washing station, a pool, spa, fitness center and clubhouse. The property was built two years ago and was 94 percent occupied at the time of sale.

PHOENIX — JLL Capital Markets has arranged $62.6 million in construction financing for Meritum Sonoran Desert, a garden-style development in Phoenix. Kevin MacKenzie, Brad Miner and Elle Miraglia worked on behalf of the borrower, IDM Cos., to secure the loan through a life company. Slated for completion in 2025, Meritum Sonoran Desert will comprise 348 apartments across 13 buildings. Units will come in one-, two- and three-bedroom layouts. Planned amenities include a clubhouse with a resident living room and kitchen, fitness center, a dog park and two pools.

PHOENIX — Milhaus and Banyan Residential have begun constructing the first phase of a 515-unit community in Phoenix. UMB, with syndication by First Merchants and Academy Bank, provided a $63.3 million construction loan for the project. The community will feature studio, one-, two- and three-bedroom units ranging in size from 415 to 1,392 square feet. Amenities will include two clubhouses, pools, a fitness center, green spaces and a dog park. Phase one is expected to deliver in the fourth quarter of 2025, with a total development cost of $117 million.

WAYNE, N.J. — Cushman & Wakefield has brokered the sale of Mountain View Crossing, a 465-unit community in the New York City suburb of Wayne. The Pomeranc Group acquired the asset from UBS Realty Investors. Mountain View Crossing offers units in studio, one-, two- and three-bedroom floor plans. Amenities include a pool with a subdeck, barbeque area, tennis and basketball courts, a clubroom, fitness center and dog park. Cushman & Wakefield’s Niko Nicolaou, Ryan Dowd, Peter Welch and Mitch Rothstein represented the seller and procured the buyer. Additionally, Cushman & Wakefield’s equity, debt …