MIAMI — JLL Capital Markets has arranged $115 million in financing for Metro Edgewater, a 279-unit high-rise development in the Edgewater neighborhood of Miami. The building rises 32 stories and offers one-, two- and three-bedroom units averaging 955 square feet in size. Units feature walk-in closets, stainless steel appliances, hardwood and plank vinyl flooring, quartz countertops, and balconies. Amenities include a pool with cabanas and dry beds, fitness center, clubroom, a sky lounge, dining room and coffee bar. The borrower was a consortium consisting of Lujeni Corp., Camino Capital Management …

Finance

JERSEY CITY, N.J. — JLL has negotiated an $18.6 million loan to refinance an 83-unit complex in the Journal Square neighborhood of Jersey City. JLL’s Matthew Pizzolato, Max Custer and John Cumming arranged the fixed-rate loan through a life insurance company. The borrower was a partnership between Spitzer Enterprises and Titanium Realty Group. The six-story complex was built earlier this year at 39 High Street. Units come in studio, one-, two- and three-bedroom units. Amenities include a fitness center, tenant lounge, children’s playroom and a rooftop terrace.

WARNER ROBINS, GA. — Berkadia has arranged a $36.8 million loan for Pointe Grand Warner Robins, a 288-unit property in Warner Robins. Located at 1601 Leverette Road, Pointe Grand Warner Robins consists of ten residential buildings and a clubhouse. Each residential building rises three stories. Units come in two-bedroom layouts and are 1,170 square feet in size. Amenities include a pool, fitness center and business center. Berkadia’s Proprietary Lending Group provided the loan, which features a two-year, competitive floating-rate with extensions and full-term interest only. Michael Weinberg and Wesley Moczul …

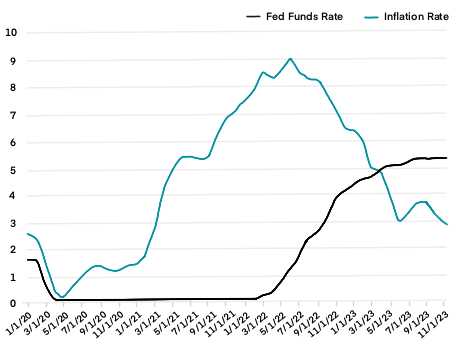

ATLANTA — Depending on the era in which you came of age and the general experiences you’ve had in life, the notion that “things can always get worse” can be easy to endorse. As it pertains to commercial lending and borrowing, the consensus narratives that have prevailed ever since the Federal Reserve began jacking up interest rates in early 2022 has largely followed the same script: “Hunker down.” “Survive till ’25.” “Delay and defer.” In other words, do whatever you have to do to avoid the sting of the 11 …

NEW YORK CITY — Dwight Mortgage Trust, the affiliate REIT of Dwight Capital, has provided $100 million in bridge financing for a property located at 224 W. 124th St. in New York City’s West Harlem neighborhood. The borrower and developer, Carthage Real Estate Advisors, will use the proceeds to refinance existing construction debt and fund lease-up of the property and other capital expenditures. The 19-story building was completed earlier this year and comprises 168 units. The community offers one-, two- and three-bedroom apartments, as well as townhomes and penthouse suites. …

CHICAGO — An analysis from Origin Investments (Origin) predicts a tumultuous 2024, with concerns of a recession and elevated interest rates likely to continue. Despite this, the Chicago-based real estate fund manager expects next year to bring unique opportunities for multifamily investors to secure protected positions in the capital structure and enhance investment returns. “The volume of variable-rate bank loans — made when the Secured Overnight Financing Rate was 0 percent and the 10-year Treasury note yield was below two percent — coming due in 2024 will create a generational …

MOUNT VERNON, N.Y. — JLL Capital Markets has arranged a 93 million loan to refinance 42 West Broad Street, a high-rise community in Mount Vernon. The borrower was a joint venture between Alexander Development Group, The Bluestone Organization and institutional investors advised by JP Morgan Asset Management. Kellogg Gaines and Geoff Goldstein led the JLL Debt Advisory team. Canadian institutional lender Otera Capital provided the loan. Situated in Mount Vernon’s Fleetwood neighborhood, 42 West Broad Street comprises 249 units across 16 stories. Units come in studio, one-, two- and three-bedroom …

WEST WINDSOR, N.J. — JLL Capital Markets has arranged permanent financing for Woodmont Way at West Windsor, a garden-style community in West Windsor, 12 miles northeast of Trenton, New Jersey. The borrower, Woodmont Properties, will use the funds to refinance the property. Thomas Didio, Thomas Didio Jr., Salvatore Buzzerio and Benjamin Morgenthal led the JLL Capital Markets Debt Advisory team, which represented Woodmont Properties in the transaction. Woodmont Way at West Windsor was built in 2022. The property comprises 443 units across 13 buildings. Units come in one-, two- and three-bedroom …

SOUTH HILL, VA. — Advantage Capital has provided financing to construct Mecklenburg Manor, a 51-unit affordable housing community in South Hill, a rural town 80 miles south of Richmond. Mecklenburg Manor will comprise seven buildings. The complex will offer one-, two- and three-bedroom units to households earning between 40 and 60 percent of the area median income. The company has partnered with Gateway Development Associates and NFP Affordable Housing Corp. to construct the community. Advantage Capital invested in the development through the Virginia Housing Opportunity Tax Credit program, which is …

WASHINGTON, D.C. — Senate Finance Committee Chair Ronald Wyden (D-Ore.), Sen. Daniel Sullivan (R-Alaska) and U.S. Representatives James Panetta (D-Calif.) and Michael Carey (R-Ohio) have introduced the Workforce Housing Tax Credit Act into the U.S. House and Senate. The bipartisan proposal would establish a Workforce Housing Tax Credit (WHTC) that would complement the Low-Income Housing Tax Credit (LIHTC). The Workforce Housing Tax Credit Act would establish a public-private partnership that allows state housing agencies to issue credit allocations to developers through a competitive process. These credit allocations would then subsequently …