NASHVILLE, TENN. — JLL Capital Markets has arranged the $101.2 million refinancing for Kenect Nashville, a 420-unit high-rise community in Nashville’s Midtown neighborhood. The borrower, Akara Partners, secured the loan through MF1. Jesse Wright, Kenny Cutler, Brian Dawson, Joshua Odessky and J.J. Hovenden led the JLL Capital Markets Debt Advisory team. Sitiated at 800 19th Ave. South, Kenect Nashville is located in proximity to Vanderbilt University, Belmont University and Nashville’s Music Row historic district, which is considered the heart of the city’s entertainment industry. According to Apartments.com, the property was built …

Finance

There is one U.S. county that has largely outpaced all the rest before, during and after COVID-19. It’s Maricopa County, which includes the Phoenix metropolitan statistical area (MSA). The county was home to about 4.2 million residents in 2012. Today, that number stands at more than 5 million, per the U.S. Census Bureau. Prior to COVID-19, much of that migration was tied to job growth, notes Christian Garner, president and CEO of Avanti Residential. “Phoenix over the past 10 years has greatly diversified through industries like education, medical and technology,” …

ROCKFORD, ILL. — PACE Equity has provided $10.9 million in Commercial Property Assessed Clean Energy (C-PACE) financing for a 215-unit industrial-to-multifamily conversion project in Rockford. The complex consists of two buildings that previously served as industrial space. The C-PACE financing will help fund energy-efficient improvements to the property’s HVAC system, LED lighting, windows, walls, roof and water conservation. The Illinois Energy Conservation Authority, an Illinois tax-exempt 501(c)(3) nonprofit organization, worked to close the financing with PACE Equity.

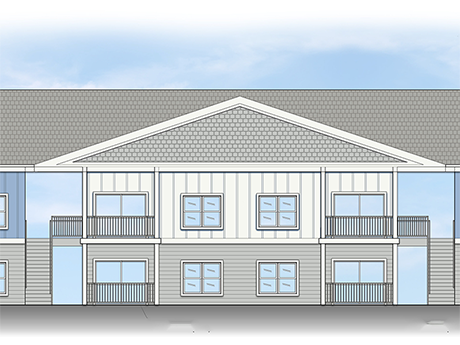

VICTOR, IDAHO — NewPoint Real Estate Capital has provided $22.5 million in HUD/FHA 221(d)(4) construction-to-permanent financing for the development of The Larkspur, an 86-unit market rate workforce housing community in Victor. Plaza Equity Partners, a Miami-based real estate development company, broke ground on the project in October. The loan was originated by NewPoint’s Karen Kim, and features a 22-month construction period followed by a 40-year term. The Larkspur is a planned three-story garden-style community. The property will offer studio, one-, two- and three-bedroom floor plans. Amenities include an outdoor fire pit, barbecue …

WILDWOOD, FLA. — JLL Capital Markets has arranged $32.7 million in LP equity and non-recourse construction financing for the development of Townhomes at Powell, a 132-unit build-to-rent community in the Wildwood suburb of The Villages, Florida. JLL’s Samy Cohen, Alberto Dichi and Alan Benenson worked on behalf of the borrower, Agador Spartacus Development, to secure the financing. Max La Cava, Shane Ciacci and Justin Sosa led the JLL Capital Markets Capital Advisory team. The property will include 92 two-story flats and 36 townhomes. Units come in one-, two- and three-bedroom layouts …

BOWLING GREEN, KY. — Lument has provided a $78.8 million loan through HUD’s 223(f) program for The Hub, a 590-unit community in the southern Kentucky city of Bowling Green. Ryan Duling of the company’s Columbus, Ohio office originated the financing, which was underwritten with a low fixed interest rate and a 25-basis-point mortgage insurance premium. The borrower was not disclosed. The Hub was built in 2020. The property offers 42 buildings surrounding a central park. Amenities include pickleball courts, a splash pad, pet park and resort-style pools with multiple pavilions and …

HOBOKEN, N.J. — JLL Capital Markets has brokered the sale of and negotiated $27 million in financing for Edge Lofts in the New York City suburb of Hoboken. Edge Lofts comprises 69 units across two buildings located at 1405 Clinton and 1405 Adams St. The buildings each rise five stories, and were constructed in 2013 and 2019, respectively. Units come in one-, two- and three-bedroom floor plans. Amenities include a package room, resident lounge with a bar and TV, fitness center and a common terrace with grilling stations. JLL Capital Markets …

SAN ANTONIO — JLL Capital Markets has arranged the refinancing for Farm Haus, a 142-unit built-to-rent community in San Antonio. AHV Communities was the borrower. Matthew Putterman and John David Johnson led the JLL Capital Markets Debt Advisory team, which worked on behalf of the borrower to secure the four-year, fixed-rate loan through a life insurance company. Completed in 2022, Farm Haus offers units in two-, three and four-bedroom layouts. Units feature private yards, attached garages, smart home technology, stainless steel appliances and quartz countertops. Amenities include a lounge, community …

WASHINGTON, D.C. — The Biden-Harris Administration has released a new guidebook, developed in partnership with the U.S. Department of Housing and Urban Development (HUD) and other federal agencies. The goal of the guidebook is to help housing providers identify federal resources to finance the conversion of commercial properties to residential and mixed-use developments. In addition to the guidebook, HUD will release an updated notice on how its Community Development Block Grant (CDBG) funding — $10 billion of which has been allocated during the current administration — can be used to boost …

ROGERS, ARK. — CBRE has arranged financing for the development of Pinnacle Springs, a mixed-use development located at 1800 S. Osage Springs Drive in Rogers. Pinnacle Springs will comprise 362 apartments and 91,000 square feet of retail space, including a 37,000-square-foot Whole Foods Market grocery store. SJC Ventures plans to break ground on the project before the end of the year. The developer plans for the development to deliver in 2025. Richard Henry, Mike Ryan, Brian Linnihan and J.P. Cordeiro of CBRE Capital Markets’ Debt & Structured Finance team in Atlanta …