WASHINGTON, D.C. — Economic uncertainty has continued to be a primary concern for multifamily construction and development firms. More than half say current and future projects have experienced construction delays, according to the National Multifamily Housing Council’s (NMHC) Quarterly Survey of Construction & Development Activity.

Fifty-eight percent of respondents stated they had experienced construction delays between January and March in the jurisdictions in which they operate. The most frequently cited causes for delays were economic uncertainty (68 percent) and economic feasibility (68 percent); followed by permitting, entitlement and professional services (58 percent); availability of construction financing (33 percent); and materials sourcing and delivery (15 percent).

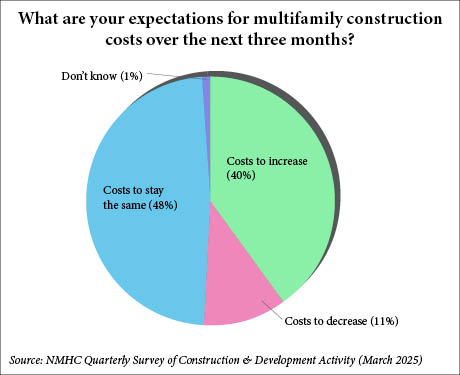

Additionally, 40 percent of construction and development companies said they expect construction costs to increase over the next three months. This is a dramatic change from December, when 8 percent of survey respondents expected construction costs to increase.

The Quarterly Survey of Construction & Development Activity collected responses from 74 multifamily construction and development firms. The survey was conducted online between March 4 and March 18. NMHC has conducted the survey on a quarterly basis since March 2022.

Staffing shortages were not a cause of concern for many general contractors and developers,with only 5 percent of respondents citing labor issues as a cause for delayed construction starts. Twenty-six percent of respondents stated that they had experienced delays with receiving specific materials.

Despite persistent headwinds, survey participants were optimistic about long-term, overall market conditions. Approximately half (51 percent) of respondents predicted the market environment will remain the same over the next three to six months. However, 60 percent expect that conditions will improve over the next six to 12 months.

Seventy-five percent of general contractors and developers reported that they had seen repricing for projects that were put on hold. The share of respondents who reported deals repriced down decreased to 50 percent (from 59 percent last quarter), while those reporting deals repriced up increased to 25 (up slightly from 22 percent in December).

“The March findings make it clear that while we are witnessing some market improvements, rental housing providers continue to face real challenges when it comes to the construction of new communities,” said NMHC President Sharon Wilson Géno. “Economic uncertainty, high interest rates, rising insurance costs and increasing construction costs all continue to make the building of badly needed housing challenging or even impossible.”

Click here to read the full survey.

— Channing Hamilton