NEWINGTON, CONN. — Northmarq has secured $37.5 million in construction financing for the development of The Pike in Newington, a southwest suburb of Hartford. The developer broke ground at the end of 2022. The project completion date was not disclosed. The capital stack included a $25 million senior construction loan with a bank, and preferred equity in the amount of $12.5 million from a real estate private equity firm. The combined senior construction loan and preferred equity represents 85 percent loan-to-cost. Financing was secured by Brad Burns, Brandon Harrington, Tyler …

Kari Lloyd

Scannell Properties, Pittman Investors Begin Phase I of Pittman Farms Mixed-Use Development

ZIONSVILLE, IND. — Developers Pittman Investors and Scannell Properties have begun work on the first phase of Pittman Farms, a mixed-use development in Zionsville, a northwest suburb of Indianapolis. The 48-acre development will feature a mix of retail amenities and a 400-unit apartment development. The first phase will include land preparation and infrastructure for the entire development and the three-building, four-story, 400-unit apartment development. Planned amenities include a golf simulator, saltwater pool, fitness lab, library, work-from-home space, dog park, covered parking and an outdoor pavilion. Phase one is expected to …

The Annex Group Breaks Ground on 102-Unit Workforce Housing Development in Bloomington, Indiana

BLOOMINGTON, IND. — Indianapolis-based developer The Annex Group has started work on a 102-unit workforce housing community in Bloomington. The Annex of Bloomington will be located at the corner of Third and Grant St. in an area called the University Village Downtown Character Overlay District. The development is set to include enclosed parking and ground-floor retail space. Construction is scheduled for completion in spring 2023. Project partners include Gilliatte General Contractors, Inc., architect KTGY, engineering firm Smith Design Group Inc. and STAR Financial Bank, which has provided $18.1 million …

The Annex Group Breaks Ground on 192-Unit Affordable Housing Community in Lincoln, Nebraska

LINCOLN, NEB. — Indianapolis-based developer The Annex Group has started work on Union at Middle Creek, a 192-unit affordable housing community in Lincoln. The $34.4 million development will be located at 2643 W. Timberlake Drive, and feature 192 units targeting people who make up to 60 percent of the area median income (AMI). Property amenities will include a clubhouse, fitness center, nature trail, a balcony or patio for all units, and limited private carport parking. The Annex Group will also create a Community Impact Plan specific to Union at Middle …

Fields Grade, Park Stone Management Secure $37 Million to Refinance Property in Jersey City, New Jersey

JERSEY CITY, N.J. — Development partners Park Stone Management and Fields Grade Development Company received a $37 million-dollar permanent loan to refinance Le Léo, a 99-unit luxury rental building in Jersey City’s Journal Square. Mark DeLillo and Marc Schulder of Blue Gate Partners arranged the loan provided by Lakeland Bank. Located at 244 St. Paul’s Ave., the six-story building is currently 88 percent leased and occupied. Property amenities include a fitness center, yoga studio, coworking space with conference room, outdoor rooftop terrace with barbecues, sun loungers and firepits. The property …

Empty Office Buildings in Chicago’s Financial District Offer Possible Solution to Housing Crisis

Often dubbed the Wall Street of Chicago, the LaSalle Street corridor historically has been the location of choice for big business in the Windy City. However, in recent years the corridor has suffered from significant vacancies largely due to the remote work trend of the pandemic and an overall shift to remain remote permanently. In response, Chicago’s employers either downsized office space or completely left the office environment altogether. Chicago’s overall office vacancy situation has been on an increasing trend for over two years. According to fourth-quarter 2022 data from …

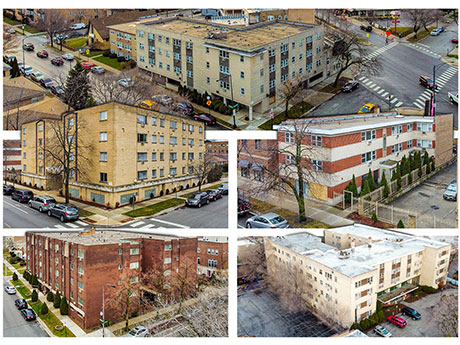

CHICAGO — Kiser Group has arranged the sale of a five-building apartment portfolio in Chicago for $23 million. The mostly vacant properties have a total of 198 units and are located within the northern Chicago neighborhoods of West Rogers Park, Bowmanville and Budlong Woods. The sale represents one of the largest transactions completed in 2022 throughout the far northside of Chicago, according to CoStar. Danny Logarakis, director of Kiser Group, brokered the sale. The seller was a private individual that had owned the properties for more than 40 years. The …

WEST DES MOINES, IOWA — Thompson Thrift has sold Watermark at Jordan Creek, a 176-unit apartment community in West Des Moines. The sales price and buyer were undisclosed. Completed in 2015 and located at 6455 Galleria Drive, the Class A property consists of four-story buildings with detached garages. Amenities include a resident social lounge, heated pool and spa, clubhouse, fitness center, dog park and community grilling areas. The community was 94 percent leased at the time of sale.

EagleBank Provides $25 Million in Construction Financing for Affordable Housing Project in Washington, D.C.

WASHINGTON, D.C. — EagleBank, a Washington, D.C.-based community bank, has provided $25 million in construction financing to The Community Builders (TCB) and Dantes Partners for a new 100 percent affordable development in the Park View neighborhood of Washington, D.C. The development is part of the larger Park Morton and Bruce Monroe redevelopment plan to transform a 174-unit former public housing property into a mixed-income community of nearly 500 units. Upon completion, the five-story development will offer 142 units, including 40 public housing replacement units. Planned amenities include a rooftop lounge, …

Wells Fargo Provides $288 Million in Financing for Affordable Housing Project in New York City

NEW YORK CITY — Wells Fargo has provided $288 million in financing for North Cove, a 611-unit affordable housing project in the Inwood neighborhood of Manhattan. The financing package includes $155 million in debt that backs city-issued, tax-exempt bonds, as well as $133 million in equity that was generated through the purchase of tax credits. The borrower and developer is a partnership between Joy Construction Corp. and Maddd Equities. Units will be restricted to households earning between 27 and 110 percent of the area median income (AMI), and approximately 15 …