BOSTON — Cottonwood Group, a Los Angeles-based private equity real estate firm, has provided $240 million in senior mortgage financing for the St. Regis Residences in Boston’s Seaport District. The borrower was Cronin Development. The high-rise development features 114 apartments across 22 stories. Amenities include a pool, spa, fitness center, lounge, concierge services and an onsite restaurant.

Finance

CLARK, N.J. — JLL Capital Markets has arranged $49.5 million in financing for Walnut Hill, a 177-unit complex in Clark, 23 miles southwest of New York City. An affiliate of Garden Communities was the borrower. Evan Pariser, Matthew Pizzolato and Jackie Ferrer led the Debt Advisory team that represented the borrower and negotiated the 10-year, fixed-rate loan from Nationwide. Recently completed in 2023, Walnut Hill comprises 240,000 square feet across a pair of four-story buildings. Of the total unit count, 28 are affordable. Income restrictions for these units were not disclosed. …

CHICAGO — Chicago-based Origin Investments forecasts that year-over-year national Class-A apartment rent growth will normalize by January 2025 and range from 2 to 3 percent, in keeping with historical rent growth averages. However, Origin also cautions that “unquantifiable risks” loom large over the market and could have broad implications for multifamily properties. The findings are from the company’s Multilytics Rent Growth Forecast Report. “The return to normalization has been expected because the rent growth levels of 2021 and 2022 were unsustainable. We are now paying for the distortions of the …

As secondary markets, the Huntsville, Birmingham and the Gulf Coast areas can’t lay claim to the dramatic population growth and major corporate relocations that have driven apartment demand in many neighboring Sun Belt cities. That, however, has not prevented some developers from rushing into Huntsville. As a result, that market, like many others, is adjusting to what is arguably too much new supply. Meanwhile, Birmingham is growing at a more measured pace. Those who invest in Alabama multifamily say the state may be close to attracting institutional investors’ attention because …

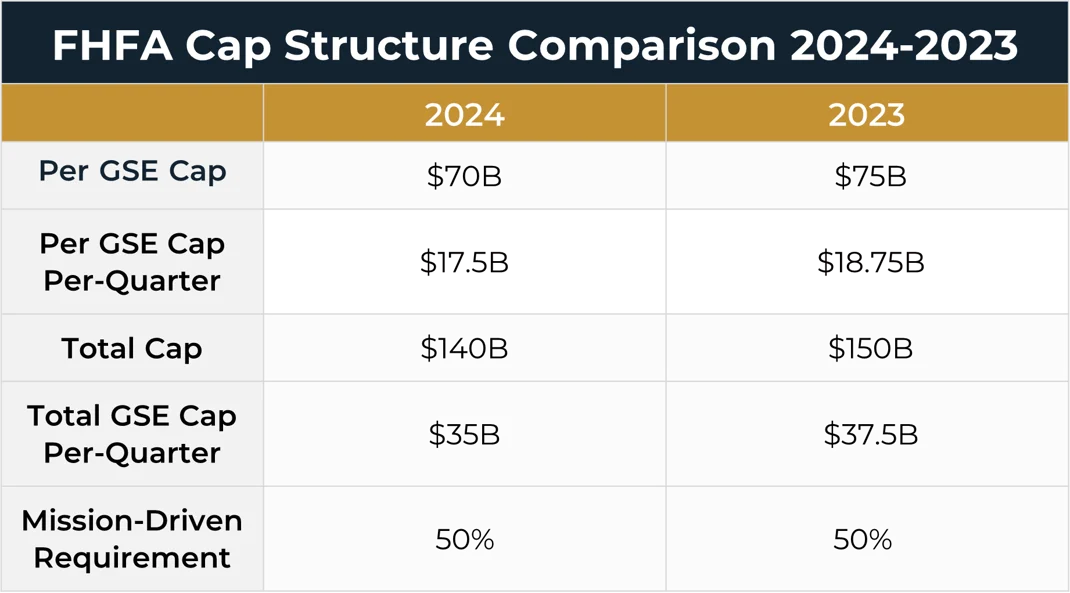

WASHINGTON, D.C. — The Federal Housing Finance Agency (FHFA) has announced that the multifamily loan purchase caps for Fannie Mae and Freddie Mac in 2024 will be $70 billion for each enterprise, for a combined total of $140 billion. FHFA’s 2023 volume cap is $75 billion for each agency. Additionally, at least 50 percent of each enterprise’s multifamily business is required to be mission-driven affordable housing, which is unchanged from this year. Only loans classified as supporting workforce housing properties in Appendix A of the Conservatorship Scorecard will be exempt from …

MARION, OHIO — United Church Homes, a Marion-based non-profit organization that specializes in developing affordable and mixed-income communities, has secured $11.5 million to refinance four properties in Ohio, Indiana and Tennessee. Lument provided the financing. Lument’s Paul Weissman and Andy Nicoll led the transactions. The four refinanced loans were completed under the FHA Section 223(f) program and closed between May and September. The financing includes: $1.8 million for Pickfair Square, a 33-unit property in Pickerington, Ohio; $4.8 million for Salem Manor, an 84-unit complex in Fort Wayne, Indiana; $2.3 million …

JACKSONVILLE, FLA. — Lument has provided a $22.6 million Fannie Mae loan to refinance Pinebrook Apartments, a 208-unit property in Jacksonville. Tim Stevens of CREFCO brokered the transaction. The loan features a 10-year year term with seven years of interest only payments and a 30-year amortization schedule. The financing originated in June 2021 as a Lument proprietary bridge loan through Lument’s Real Estate Investment Strategy group. Originally built in 1974, Pinebrook Apartments consists of 16 buildings on an 11.1-acre site. The garden-style community offers amenities such as a pool, fitness center, clubhouse, …

CARMEL, IND. — CREC Real Estate has sold its stake in VER at Proscenium, a 196-unit community located at the intersection of Rangeline Road and West Carmel Drive in the Indianapolis suburb of Carmel. CREC Real Estate acquired the stake in 2019, prior to the project’s construction. VER at Proscenium was completed in 2021. The complex comprises four buildings and offers studio, one- and two-bedroom floor plans. Amenities include a fitness center, pool, putting green, multi-sport virtual simulator and club area with a beer tap. The property also includes commercial space, …

NEW YORK CITY — Merchants Capital has provided $225 million in Freddie Mac financing for seven affordable housing properties in the New York City borough of The Bronx. The portfolio comprises 983 units across 18 buildings. The properties carry a range of income restrictions. The borrower is a joint venture consisting of The Arker Cos., SBV RE Investments LLC and Dabar Development Partners. The joint venture will use the financing to refinance existing debt, rehabilitate units with building-wide improvement plans and preserve affordability. The scope of work includes kitchen upgrades, …

BAYTOWN, TEXAS — Eastern Union has negotiated a $17.5 million loan to facilitate the acquisition of The Lakes at Madera, a 392-unit complex in Baytown, 26 miles east of Houston. Arbor Realty Trust provided the financing, which was a loan assumption that carried a three-year term, with an interest rate of 4.3 percent. Built in 1983, The Lakes at Madera comprises 22 two-story buildings situated on a 20-acre parcel. The apartment mix includes 242 one-bedroom units, 120 two-bedroom units and 30 three-bedroom units. The property was 92 percent occupied at the time of sale. The …

![20-REBO[5]](https://multifamilyaffordablehousing.com/wp-content/uploads/2023/11/20-REBO5.jpg)