BOCA RATON, FLA. — A joint venture between South Florida-based developer 13th Floor Investments and Boston-based private equity firm Rockpoint has obtained a $100 million construction loan from Santander Bank for Link at Boca, a 340-unit property with 24,000 square feet of retail space in Boca Raton. The project was announced in 2025. Construction is expected to begin later this month. The developers estimate the project will be complete within two years. The project, located at 680 Yamato Road, is adjacent to the Boca Raton Tri-Rail station, which is a …

Top Story

Mark IV Secures $86 Million Construction Loan to Launch Dell Campus Redevelopment in Metro Austin

ROUND ROCK, TEXAS — Newport Beach California-based Mark IV Capital has received an $86 million construction for the first phase of The District in Round Rock, a master-planned, mixed-use project in Round Rock approximately 20 miles north of Austin. The lenders were BDT & MSD Partners and an affiliate of Apollo (NYSE: APO). George Smith Partners arranged the financing. Mark IV acquired the site from Dell Technologies in 2016 and has since been finalizing planning and entitlements. Loan proceeds will fund vertical construction of Phase I, which consists of a …

FORT WAYNE, IND. — Pennsylvania-based Morgan Properties has acquired Canterbury Green, a 1,998-unit community situated across 195 acres in Fort Wayne. The seller was a joint-venture between New York City-based Osso Capital and Philadelphia-based GoldOller Real Estate Investments. CBRE’s Hannah Ott, George Tikijian, Cam Benz, Claire Hassfurther, Ryan Stockamp, Taylor Ford and Sean Pingel represented the seller. GoldOller and Prospect Capital Corp. bought the property from AIMCO Holdings QRS in 2014 for $85.5 million. The asset, among the larger single-site multifamily communities in the nation, was developed between 1969 and …

SECAUCUS, N.J. — Woodmont Properties and Canoe Brook Development have sold The Waverton in Secaucus, with Canoe Brook retaining its minority ownership. The asset, completed in 2022, traded for $47.8 million. The name of the buyer was not disclosed. A 30-Year PILOT agreement is in place at the property. Twenty percent of The Waverton’s 116 units are offered at affordable rents. Income restrictions were not disclosed. The property features a 191-space parking garage, a fitness center with a yoga studio and an outdoor lounge with grills, fire pits and an …

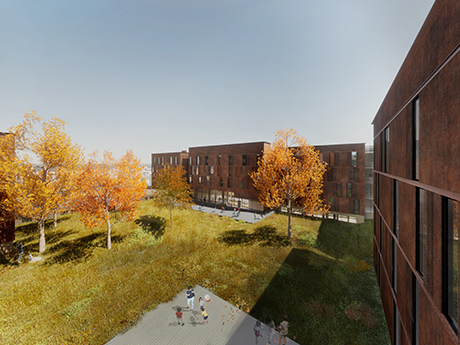

Public-Private Venture Begins Construction of $132 Million Mixed-Use Affordable Housing Development in Denver

DENVER — Globeville Redevelopment Partners, a joint venture consisting of several public and private members, has started construction on 4965 Washington St., a five story, mixed-use affordable housing community in Denver’s Globeville neighborhood. The $132 million project involves the redevelopment of a 2.7-acre, city-owned site that was formerly a car dealership. The project will include 170 apartments reserved for households earning between 30 and 80 percent of area median income. Developed in partnership with the Denver Public Library and the city and county of Denver, the lower level of the …

Stockdale Capital Partners Buys Avant at Fashion Center in Phoenix Metro for $110.3 Million

CHANDLER, ARIZ. — Stockdale Capital Partners has acquired Avant at Fashion Center in Chandler for approximately $110.3 million. The 355-unit mid-rise community was built in 2017 and features a mix of studio, one- and two-bedroom units housed in seven, three- and four-story buildings on an 11.4-acre site. Amenities include a pool with a deck and cabanas, covered social areas, stainless steel grills, a resident lounge and a two-story fitness center. IPA’s Steve Gebing and Cliff David marketed the property on behalf of the undisclosed seller. This is Stockdale’s second acquisition …

LONG BEACH, CALIF. — JPI has broken ground on Portico, a 272-unit project with 18,841 square feet of ground-level retail. The $150 million development marks Phase I of a master plan for Mosaic, which is the redevelopment of the former City Place Long Beach shopping center. Completion of the eight-story building is slated for June 2028. City Place Long Beach was developed in the 1990s on about 14 acres in downtown Long Beach. The site was cleared earlier this year. Units will be offered as studios through three-bedroom floor plans …

ORLANDO, FLA. — Avanath Capital Management has acquired Retreat at Valencia in Orlando from an undisclosed seller for $73.5 million. The Irvine, California-based affordable housing investment firm will reserve one half of the property’s 336 units for families earning up to 60 percent of area median income. The remaining 168 units will be rented at market rates. Avanath also plans to provide financial counseling programs, health and wellness initiatives and resident activities and events. Retreat at Valencia was built in 2001 and is comprised of one-, two-, three- and four-bedroom …

LOUISVILLE, KY. — Walker & Dunlop has arranged $96.7 million in refinancing for three recently built assets in Louisville owned by Highgates Group. Jonathan Zilber, Joel Chetner and Josh Geller secured three floating-rate, interest-only loans from an institutional lender. Proceeds will be used to repay existing debt, fund closing costs and return capital to investors. The properties are comprised of Belmond Flats (240 units), Cedar Creek Flats (168 units) and Glengrove Apartments (232 units). Highgates is a development firm with offices in Kentucky, New Jersey and the United Kingdom.

WinnDevelopment Begins Construction of $44 Million Affordable Housing Community in Baltimore

BALTIMORE — WinnDevelopment, along with nonprofit partners BRIDGES Community Development Corp. and Bon Secours Unity Properties, have secured financing for the $44 million Residences at Belvedere Place in northwest Baltimore. The development includes 83 units of affordable housing as well as 8,442 square feet of commercial space. Financing partners for the project include the Maryland Department of Housing & Community Development (MD-DHCD), which delivered Low-Income Housing Tax Credits (LIHTC), tax-exempt bond financing and a subordinate loan; the City of Baltimore, which provided additional gap financing; Bank of America, which is …