NORFOLK, VA. — Bonaventure has purchased Monticello Station Apartments, a 121-unit complex in downtown Norfolk, for $42 million. The property will be rebranded as Attain Downtown East. The community offers one-, two-, three- and four-bedroom units featuring full-size washers and dryers, granite countertops, private patios, stainless steel appliances and energy efficient design throughout. Amenities include a swim spa, courtyards with gas grills and firepits, a fitness center and conference room. The property also includes 33,000 square feet of ground-floor retail space, with current tenants including Buffalo Wild Wings, 7-Eleven and …

Channing Hamilton

CHICAGO — Chicago-based Origin Investments forecasts that year-over-year national Class-A apartment rent growth will normalize by January 2025 and range from 2 to 3 percent, in keeping with historical rent growth averages. However, Origin also cautions that “unquantifiable risks” loom large over the market and could have broad implications for multifamily properties. The findings are from the company’s Multilytics Rent Growth Forecast Report. “The return to normalization has been expected because the rent growth levels of 2021 and 2022 were unsustainable. We are now paying for the distortions of the …

As secondary markets, the Huntsville, Birmingham and the Gulf Coast areas can’t lay claim to the dramatic population growth and major corporate relocations that have driven apartment demand in many neighboring Sun Belt cities. That, however, has not prevented some developers from rushing into Huntsville. As a result, that market, like many others, is adjusting to what is arguably too much new supply. Meanwhile, Birmingham is growing at a more measured pace. Those who invest in Alabama multifamily say the state may be close to attracting institutional investors’ attention because …

TEMPE, ARIZ. — MG Properties has purchased NOVO Broadway Apartments, a recently built apartment community in the eastern Phoenix suburb of Tempe, from Evergreen Devco Inc. for $100.2 million. The seller originally delivered the property as Parc Broadway in 2022. According to Apartments.com, NOVO Broadway Apartments totals 324 units in studio, one-, two- and three-bedroom floor plans. Units range in size from 632 to 1,262 square feet and feature stainless steel appliances, wood-style flooring, individual washers and dryers, and private balconies or patios. Amenities include a pool, fitness center, outdoor …

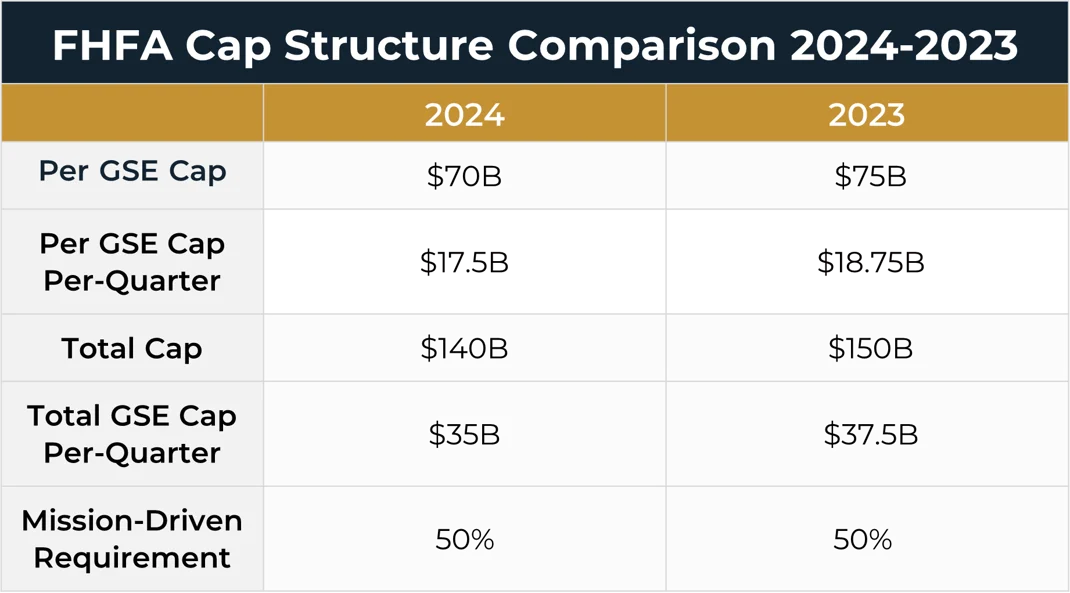

WASHINGTON, D.C. — The Federal Housing Finance Agency (FHFA) has announced that the multifamily loan purchase caps for Fannie Mae and Freddie Mac in 2024 will be $70 billion for each enterprise, for a combined total of $140 billion. FHFA’s 2023 volume cap is $75 billion for each agency. Additionally, at least 50 percent of each enterprise’s multifamily business is required to be mission-driven affordable housing, which is unchanged from this year. Only loans classified as supporting workforce housing properties in Appendix A of the Conservatorship Scorecard will be exempt from …

VANCOUVER, WASH. — Fourth Avenue Capital has purchased The Ridge, an 80-unit community in Vancouver. Built in 1987, The Ridge consists of 10 residential buildings on a 3.1-acre site. Units come in two- and three-bedroom floor plans. Units include private garage parking space and in-unit washers and dryers. The property also features a leasing office, playground and pool. Fourth Avenue Capital plans to renovate the asset with updates to unit interiors and amenity spaces.

FULLERTON AND BUENA PARK, CALIF. — CBRE has arranged the $7.6 million sale of two properties in northern Orange County, California. The properties, which total 24 units altogether, were sold to two separate buyers. In the first transaction, CBRE’s Dan Blackwell and Amanda Fielder represented the buyer in the acquisition of a property located at1801 and 1809 East Wilshire Avenue in Fullerton. The asset traded hands for $4.2 million. The asset was originally built in 1958 on a 0.4-acre site and offers 16 one-bedroom apartments. The buyer was based in …

MARION, OHIO — United Church Homes, a Marion-based non-profit organization that specializes in developing affordable and mixed-income communities, has secured $11.5 million to refinance four properties in Ohio, Indiana and Tennessee. Lument provided the financing. Lument’s Paul Weissman and Andy Nicoll led the transactions. The four refinanced loans were completed under the FHA Section 223(f) program and closed between May and September. The financing includes: $1.8 million for Pickfair Square, a 33-unit property in Pickerington, Ohio; $4.8 million for Salem Manor, an 84-unit complex in Fort Wayne, Indiana; $2.3 million …

JACKSONVILLE, FLA. — Lument has provided a $22.6 million Fannie Mae loan to refinance Pinebrook Apartments, a 208-unit property in Jacksonville. Tim Stevens of CREFCO brokered the transaction. The loan features a 10-year year term with seven years of interest only payments and a 30-year amortization schedule. The financing originated in June 2021 as a Lument proprietary bridge loan through Lument’s Real Estate Investment Strategy group. Originally built in 1974, Pinebrook Apartments consists of 16 buildings on an 11.1-acre site. The garden-style community offers amenities such as a pool, fitness center, clubhouse, …

CARMEL, IND. — CREC Real Estate has sold its stake in VER at Proscenium, a 196-unit community located at the intersection of Rangeline Road and West Carmel Drive in the Indianapolis suburb of Carmel. CREC Real Estate acquired the stake in 2019, prior to the project’s construction. VER at Proscenium was completed in 2021. The complex comprises four buildings and offers studio, one- and two-bedroom floor plans. Amenities include a fitness center, pool, putting green, multi-sport virtual simulator and club area with a beer tap. The property also includes commercial space, …

![20-REBO[5]](https://multifamilyaffordablehousing.com/wp-content/uploads/2023/11/20-REBO5.jpg)